Income splitting is a standard tax planning tool in Canada. It involves redirecting income from one family member to another so that both can enjoy certain tax benefits. But, this strategy must be done within the boundaries the Canadian government sets.

If you’re a Canadian resident looking for ways to save tax dollars, here are some of the tax rules and regulations governing income splitting in Canada.

What Is Income Splitting?

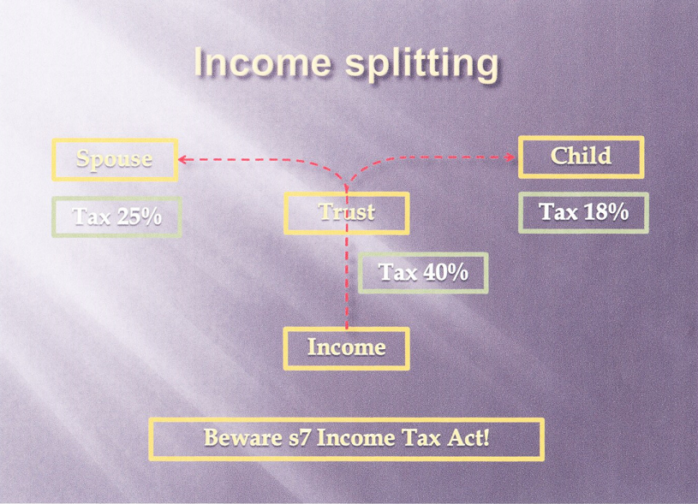

Income splitting is a technique that can be used to reduce the overall tax burden on a household. The household can take advantage of lower tax rates and save money by transferring income from a high-earning spouse or partner to a lower-earning one.

What Are the Rules for Income Splitting in Canada?

There are a few income splitting rules that come into play in Canada.

The first rule is that only married couples or common-law partners can split their incomes. This means that if you’re not married or in a common-law relationship, you won’t be able to take advantage of income splitting.

The second rule is that you can only split up to 50% of your total income. So, if you and your spouse both earn $50,000 per year, you can only split up to $25,000 of that income.

The third and final rule is that the person receiving the split income must be in a lower tax bracket than the person who is splitting their income. For example, if you earn $100,000 per year and your spouse earns $40,000 per year, you can split your income with them because they are in a lower tax bracket. However, if your spouse also earned $100,000 per year, you wouldn’t be able to split your incomes because they would then be in the same tax bracket as you.

These are just some of the general rules around income splitting in Canada. For more specific information on how these rules might apply to your situation, it’s always best to speak with a professional accountant or tax specialist.

The Different Types of Income Splitting

There are three different types of income splitting in Canada: spousal splitting, pension splitting, and split-income.

- Spousal Splitting: Spousal splitting allows a husband and wife to split their incomes for tax purposes. This means that each spouse can claim half of the income on their tax return. This can help to reduce the overall tax bill for the family.

- Pension Splitting: Pension splitting allows a couple to split their pension income between them. This can help to reduce the overall tax bill for the family.

- Split-Income: Split-income allows a person to split their income with another person. This can be used to help reduce the overall tax bill for the family.

Final Thoughts

While there are some limitations to how much income can be split under these rules, they offer significant tax savings for households with high incomes. If you’re looking for different ways to reduce your taxes, Income splitting is an effective strategy worth considering.

The bottom line is that there are many different ways to split income, but each situation is unique. You’ll need to work with a financial planner or accountant to figure out what method makes the most logical sense for you and your family.