Understanding credit scores can be confusing, but they are incredibly important. Knowing the basics of how credit scores work and what impacts them is key to managing your finances wisely.

This article will demystify credit scores and look at why they matter in today’s world. Well, explore how creditors use this tool to decide whether or not you’re a good candidate for loans, as well as other factors that might influence your score.

By the end of this article, you should have a better understanding of what makes up a good credit score and why it matters so much in our lives today.

What is a Credit Score?

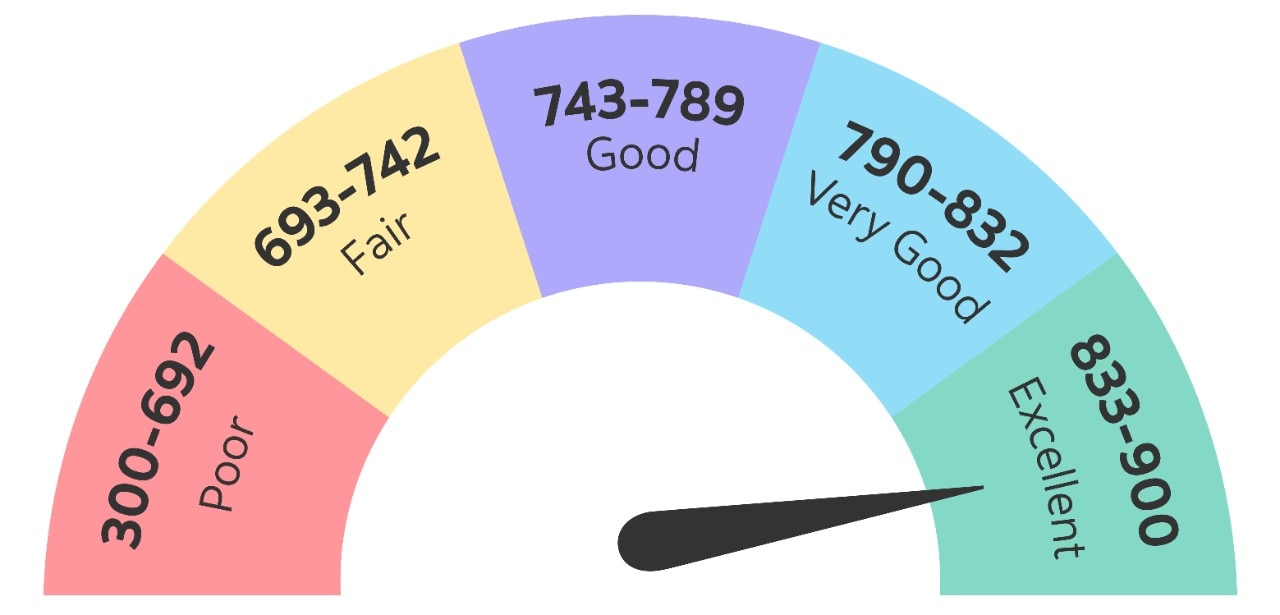

A credit score is a three-digit number that summarizes the information in a person’s credit report. It is used to evaluate an individual’s ability and willingness to repay debt, and lenders use it to determine an individual’s eligibility for loans, credit cards, mortgages, and other financial products.

Credit scores are based on five main components: payment history; amount owed; length of credit history; new accounts; and types of accounts held. A good credit score can help individuals save money by qualifying them for lower interest rates on loan products such as car loans or mortgages, while those with poor scores might not be eligible for certain types of financing at all.

Knowing one’s score can provide insight into how creditors view a potential borrower and make it easier to spot mistakes or inaccuracies in one’s report.

The Components of a Credit Score

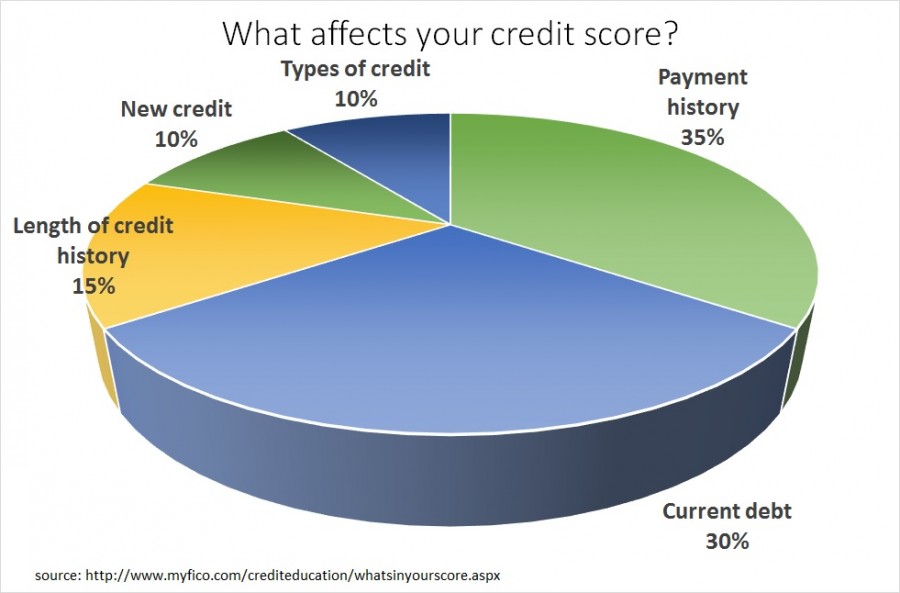

Understanding the components of a credit score is key to deciphering why it matters so much. Your credit score is made up of several different elements, including your payment history, amounts owed, and length of credit history.

Your payment history accounts for 35% – the largest factor – of your overall score. This includes whether you pay bills on time miss payments or have accounts sent to collections.

It’s important to be aware that even one late payment can cause your score to drop significantly and take years for it to bounce back again. The second most influential element in determining your overall credit rating is how much debt you carry compared with total available lines of credit; this makes up 30%.

Lower balances are better than higher ones when it comes to maintaining a good score – make sure not to max out any line of credit as this will negatively affect your rating. Length of Credit History determines 15% and includes how long each account has been open, as well as the average age for all accounts combined.

Newer accounts may lower an older person’s overall scores since they often don’t have enough data points yet while older consumers benefit from having more established histories behind them.

The Benefits of Having a Good Credit Score

Having a good credit score has multiple benefits. The first and most obvious is that it allows you to be approved for loans or other forms of borrowing at competitive rates.

Having a favorable credit score can also provide better terms on mortgages, auto loans, personal lines of credit, and other types of financing products. It may even increase the chances of being offered more favorable insurance premiums when shopping around for coverage.

On top of this, having a healthy credit rating could make it easier to find employment – employers often check an applicant’s financial history as part of their hiring process. Finally, having a good score reflects well on your overall financial responsibility; proving to lenders that you are reliable in managing your money responsibly.