Manufacturers Cater to Unmet Demand for Gluten-free Bakery Products with Natural Hydrocolloids

Gluten-free products are increasingly gaining popularity in the precooked corn flour market. This trend has compelled market players to improve gluten-free bread and cake properties. As such, bakery products account for the highest volume among all applications in the precooked corn flour market, with an estimated production of ~418,700 metric tons by the end of 2027. Hence, manufacturers are using natural hydrocolloids to enhance the properties of gluten-free bread and cake products.

Growing prevalence of autoimmune digestive diseases due to the intake of gluten has prompted the demand for gluten-free products. In order to stay competitive, companies in the precooked corn flour market landscape are using gums as gluten substitutes to mimic the viscoelastic attributes of gluten. Manufacturers are pervasively using gums to enhance dough performance and alter cake characteristics. They are using xanthan and carboxy methyl cellulose gums in corn starch to produce low-phenylalanine bread for phenylketonuria patients. Apart from corn, companies in the precooked corn flour market are expanding their offerings of gluten-free breads made from rice and buckwheat.

Request a sample to get extensive insights into the Precooked Corn Flour Market

Convenience Food and Organic Food Grains Transform Business of Precooked Corn Flour Market

Convenience is an important aspect for target customers, especially the millennial population worldwide. Hence, the trend of ready-to-eat (RTE) products is gaining momentum in the precooked corn flour market space. This trend is further driven by the introduction of the food extrusion technology. Likewise, there is a growing demand for instant soup mixes to cater to the ‘on-the-go’ demand of customers.

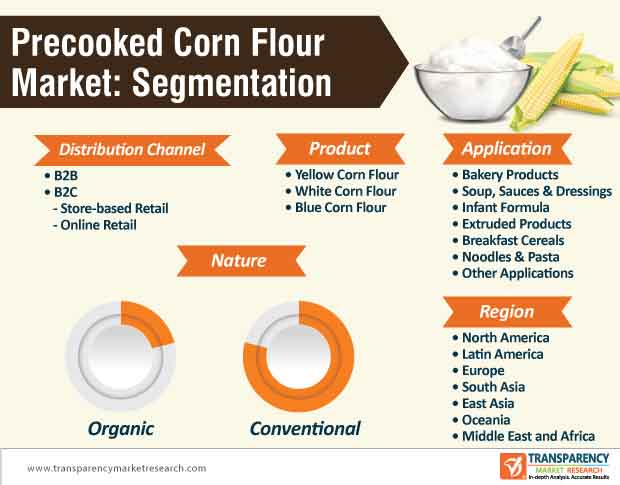

Although conventional precooked corn flour accounts for the highest value and volume in the market landscape, the demand for organic food grains is on the rise. The precooked corn flour market is anticipated to experience change with the introduction of gluten-free pasta made from white corn and sorghum. Thus, manufacturers in the precooked corn flour supply chain are gaining approvals and certifications for their products. For instance, Nutracentis – a Bergamo agricultural startup, is a supplier of 100% Italian organic certified pasta made with archaic Italian cereals.

Nixtamalization Bolsters Export and Fuels Demand for Mexican Food in European Countries

The precooked corn flour market is witnessing a shift in consumer preferences. Consumers are becoming health-conscious and demanding products made using the food extrusion technology, since the technology is popular for increasing the level of dietary fiber in glutinous and gluten-free RTE snacks produced from cereals and vegetable co-products.

To understand how our report can bring difference to your business strategy, Ask for a brochure

Therefore, the process of nixtamalization is being increasingly adopted in the precooked corn flour market landscape to increase the bioavailability of vitamins in grains and improve the flavor. This technique is being used to boost export and catalyze the demand for Mexican food in European countries, since corn is an essential ingredient in Mexican cuisines. Additionally, market leaders are buying ancestral criollo varieties in white, blue, and red corn from farmers due to shifting consumer preference for natural and organic food grains.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=74644

Food Extrusion Technology Aids in Development of Healthy Food Products

Food extrusion processes are being increasingly adopted by manufacturers to produce high-quality products in a single operation. The food extrusion technology helps to reduce operational costs. As such, the extruded products application segment is projected to reach ~407,000 metric tons by the end of 2027.

Consumer awareness about gluten-free products has triggered the demand for extruded products in the precooked corn flour value chain. However, high consumption of gluten-free products results in nutritional deficiencies. Hence, manufacturers in the precooked corn flour market are overcoming this issue with protein and fiber fortification in corn-based food formulations.

The growing demand for RTE products is creating incremental opportunities for manufacturers. Thus, companies are increasing their production capabilities to produce breakfast cereals to meet convenience requirements of consumers. RTE products are gaining popularity, owing to their convenience of preparation, appearance, and texture. In order to gain a competitive edge, manufacturers are expanding their product range in premium-quality RTE snacks at competitive prices.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Precooked Corn Flour Market

Analysts’ Viewpoint

Since Mexican farmers are unable to support themselves as corn-growers after NAFTA (North American Free Trade Agreement) came into effect, market leaders are extending their support to farmers to produce natural varieties of corn, as more and more consumers are demanding natural and organic varieties of corn. Companies in the precooked corn flour market are relaunching the cultivation of corn, and producing grains through biological and controlled chain of health foods.

Moreover, breakfast cereals application segment holds a significant share of the precooked corn flour market in terms of volume and value. However, processing parameters in the food extrusion technology increases the content of glycemic index in products. Hence, manufacturers should streamline their production processes to increase resistant starch and dietary fiber in RTE breakfast cereals.

Precooked Corn Flour Market: Overview

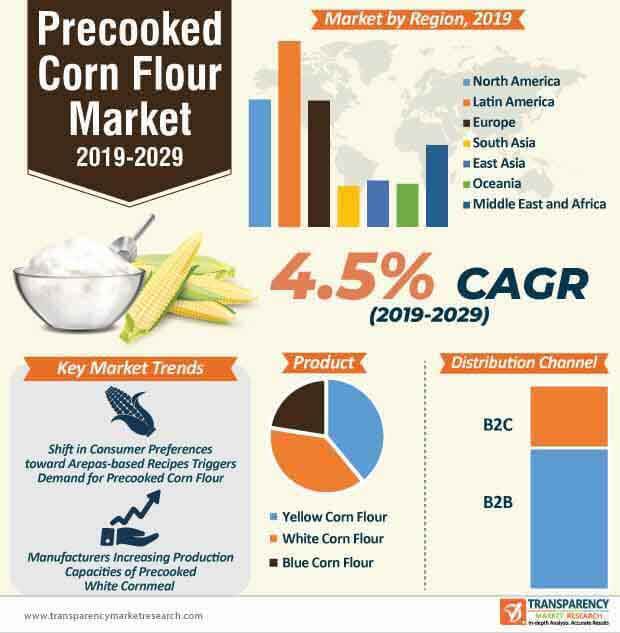

The global precooked corn flour market is projected to reach ~US$ 2 Bn by 2019. Transparency Market Research’s latest report studies the precooked corn flour market for the historical period of 2014–2018 and forecast period for 2019–2029. Globally, the precooked corn flour market is anticipated to expand at a CAGR of 4.5%, in terms of value, during the forecast period.

Steady Consumption of Traditional Food Products to Drive Precooked Corn Flour Market

- Precooked corn flour is widely used in traditional food products specifically in Latin/South America. Corn is a staple food as well as highly consumed grain across the world. Latin America is the largest consumer of precooked corn flour. Thus, the precooked corn flour market in the region is likely to expand at a significant rate.

- Major players in the global precooked corn flour market are expanding their distribution channels in Latin America. Despite changing taste as well as westernization, the demand for precooked corn flour has remained steady or has increased depending on the demand in the region. In other countries, traditional dishes have improved as per taste, resulting in an increase in demand for precooked corn flour, thus driving the precooked corn flour market.

Availability of Raw Material to Boost Profit Margins in Precooked Corn Flour Market

- Corn is easily available worldwide as its production has increased over time due to its rising demand. While most of the corn is used for feed and ethanol production, there is a high consumption of corn by humans. Easy availability of corn has resulted in an increase in the number of manufacturers in the precooked corn flour market.

- Dry milled corn products have a higher shelf life as compared to wet-milled products. There are possibilities of fluctuations in the supply of corn due to adverse climatic conditions. However, corn is produced in almost all parts of the globe. Thus, a negative impact on production in certain areas will not affect the precooked corn flour market.

Increase in Consumption of Mexican Food to Drive Precooked Corn Flour Market

- The impact of Mexican cuisine in North America is replicated in the consumption of foods, such as tortillas. According to a Statista report, compiled from the Simmons National Consumer Survey and the U.S. Census, in 2017, nearly 110.72 million North Americans consumed tortillas.

- Mexican dishes have become popular in North America. Moreover, an increasing number of traditional Mexican cuisines are becoming common in the U.S.

- Precooked corn flour does not require further processing and is easy to cook, making it an indispensable ingredient in Mexican food products. Due to the popularity of the Mexican food, the demand for precooked corn flour is increasing. Availability of precooked corn flour is also increasing in North America across hypermarkets, supermarkets, grocery stores, and online channels. This is expected to drive the precooked corn flour market in the region.

Demand for Organic Precooked Corn Flour to Increase

- Rise in the number of diseases has led to the adoption of healthy alternatives. Millennials constitute a large part of the global population and they have become conscious about the food they consume. Hence, they prefer food products that are healthy without compromising on the quality or taste.

- Although precooked corn flour has been popular for a very long time, there is an increase in demand for gluten-free and natural precooked corn flour. Organic precooked corn flour is more popular and is sold at a premium price. Despite its high price, there is a greater demand for such premium products among millennials. This is projected to fuel the growth of the precooked corn flour market during the forecast period.

Precooked Corn Flour Market: Competition Landscape

- In the precooked corn flour market, only a few key players hold a large share of the overall market. The precooked corn flour market association has put large-scale industries that control supply for a large part of the economy in an advantageous position.

- Tier-I players in the precooked corn flour market include Archer Daniels Midland Company, Cargill Inc., Gruma SAB de CV, and Bunge Ltd. These companies have a broad global presence and a wide range of offerings. These companies hold a large share of the market.

- Some of the mid-level players operating in the market are

- Empresas Polar

- The Quaker Oats Company

- Bob’s Red Mill Natural Foods, Inc.

- Goya Foods, Inc.

- Harinera Del Valle

- Groupe Limagrain.

- These companies are mainly aiming at the expansion of the global presence to expand consumer base.

Precooked Corn Flour Market: Key Developments

Some of the key developments witnessed in the precooked corn flour market over the past few years are as follows:

- In August 2018, P.A.N., a corn meal brand, launched its first food truck tour in North America to introduce Arepa to the U.S. consumers

- In April 2016, Bunge Ltd. launched non-GMO certified corn-based products at its corn mill of Nebraska and had set forth to scale up the production. Following this product launch, Bunge Ltd became the first grain supplier to deliver non-GMO corn-based ingredients on a large scale.