Spain Pharmaceutical Bottles Market: Snapshot

The market for pharmaceutical bottles in Spain is characterized by its access to multiple regions through its strategic location in the Iberian Peninsula. Thanks to the geographic proximity and long coastline of this country, stretching through the Atlantic Ocean and the Mediterranean Sea, it has an easy access to emerging markets in the Middle East and Africa as well as the developed markets in Europe.

The growth of the Spain market for pharmaceutical bottles has been directly influenced by the advancements in the drug delivery formats utilized for pharmaceutical products. In addition to this, the introduction of pharmaceutical bottles made up of plastic, on account of the abundant availability of relatively cheaper polymers, is expected to drive this market significantly over the forthcoming years. However, the emergence of eco-friendly biomaterials-based bottles as a substitute to the pharmaceutical ones and the increasing preference for flexible packaging formats, such as blisters, are anticipated to restrict the growth of this market to some extent in the years to come.

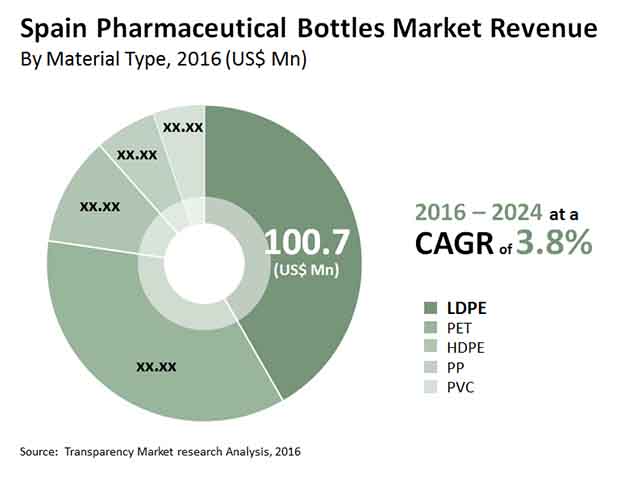

In 2016, the market for pharmaceutical bottles in Spain presented an opportunity worth US$241.4 mn. Progressing at a steady CAGR of 3.80% between 2016 and 2024, the market is estimated to reach US$235 mn by the end of 2024.

Planning to lay down future strategy? Perfect your plan with our report brochure here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=21206

Demand for Pharmaceutical Bottles to Remain High in Oral Care

Pharmaceutical bottles find widespread application in E-liquid, liquids, droppers, oral care, and topical medication in Spain. The demand for these bottles has been higher in the oral care segment than others. In 2016, this application segment held a share of nearly 36% in the overall market and is anticipated to exhibit extensive incremental performance in terms of both, market share and growth rate over the next few years. Topical medication, on the other hand, is likely to surface as the most lucrative application segment in the Spain pharmaceutical bottles market in the near future, thanks to the design capabilities offered by manufacturers concerning the dispensing of lotions and semi-solid contents.

The increasing demand for therapeutic medications related to eyes, ears, and nose, conventionally prescribed in dropper bottles, is likely to drive the dropper segment considerably in the years to come. The liquid segment is expected to gain from the augmenting demand for liquid medications as an efficient alternative to solid medicines from patients having swallowing issues. As E-liquid is in its budding stage, the segment is anticipated to exhibit moderate progress in the forthcoming years.

PET Pharmaceutical Bottles Segment to Retain Leadership

High-density polyethylene (HDPE), polyethylene terephthalate (PET), low-density polyethylene (LDPE), polyvinyl chloride (PVC), and polypropylene (PP) are key types of materials used in the manufacturing of pharmaceutical bottles in Spain. Among these, the PET segment is witnessing a higher growth and is projected to remain so in the years to come, thanks to the increased usage of PET to produce pharmaceutical bottles due to its atmosphere barrier properties. The durability and the rigid and stress-resisting characteristics of PET are also aiding the rise of this segment significantly.

Looking for exclusive market insights from business experts? Request a Custom Report here https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=21206

Pharmaceutical enterprises, chemical firms, healthcare centers, compounding pharmacies, and pharmaceutical packaging companies have emerged as the main end users of pharmaceutical bottles in this country.

Some of the leading manufacturers of pharmaceutical bottles in Spain are Pont Europe, Industrias Plasticas Puig SL, Maynard and Harris Plastics Ltd., Alcion Plasticos, Amcor Ltd., and Gerresheimer AG.