The packaging industry continues to flag the gravity of shipments during adverse weather conditions, given the recent proliferation in online shopping trends. Innovative efforts are underway in the landscape, as market goliaths such as Pelican Products Inc. and SKB Corporation, Inc. harness the prowess of technology – 3D printing – to bring value-added protective cases to the fore, and this interest has caught the attention of players from a wide array of end-use segments.

Seasoned analysts at Transparency Market Research (TMR) have been tracking such developments, besides market-weighted trends, and are of an opinion that, the sales of protective cases will rise from ~11 million units in 2019 to ~15 million units in 2027, representing a volume CAGR of ~4% during 2019-2027.

Research also portends the sustained popularity of plastic as a raw material over metal, despite tight environmental protocols, in light of its superior physical and chemical attributes. Players in the protective cases market, however, may encounter challenges pertaining to the rising proclivity for ‘custom-designed’ paper-based protective cases, with cost efficiency being their attractive proposition.

Planning to lay down future strategy? Perfect your plan with our report brochure here

Focus on Crucial Raw Materials

Opportunities are abound for manufacturers

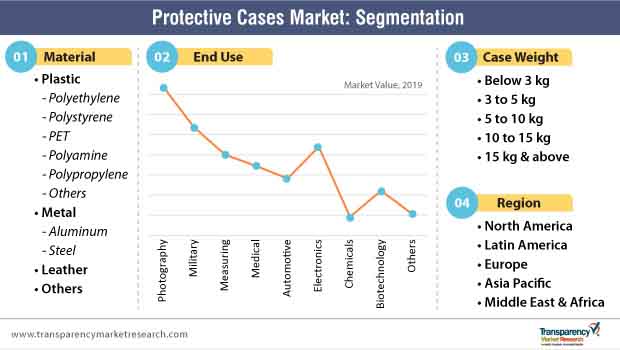

to exploit, given the availability of a broad array of materials – plastic, leather, and metals, among others – to experiment with and foster innovation. In 2018, plastic-based protective cases recorded sales tantamount to ~US$ 1.1 Bn, thereby accounting for ~73% of the market share. This is on account of the surging demand for protective packaging cases, such as bubble wraps and air pillows, given the growth of the global e-Commerce industry. In addition, the ready adaptability of plastic materials for the development of protective cases of any shape or size, complemented by their lightweight and strength, are likely to remain a critical lever for the massive uptake in their adoption.

In contrast, with environment-sustainability concerns prevailing among consolidation-seeking manufacturers, the significance of metal for the development of protective cases will grow at an exponential rate. With such an improvement in their adoptability, the sales of metal-based protective cases are projected to arrive at a value of ~US$ 400 Mn in 2027.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

In Focus: Manufacturers Moving Past the ‘One-Size-Fits-All’ Concept

The packaging needs of various end-use segments differ significantly from each other, given the varying degrees of fragility, shapes, sizes, and quality of materials being used. As protective cases aid in the safe delivery of shipments, ranging from military equipment, electronics, automotive parts, medical & fire safety equipment, to measuring equipment, and others, manufacturers resort to the custom development process to target client-specific demands. Among the others, rotational molding and injection molding are the highly adopted custom-development processes by the protective cases market.

However, the threat of substitute prevailing from the very concept of ‘customization’ is high in the protective cases market. Though protective cases weigh better than paper-based protective cases on the scale of reusability, they underperform on the scale of pricing. Paper-based protective cases boast affordability, and with manufacturers arriving at the ‘custom development’ juncture, these cases are poised to compete strongly with plastic, metal, and leather-based protective cases, thereby impacting the steady growth of the market.

Looking for exclusive market insights from business experts? Request a Custom Report here

Surging Popularity of Protective Cases for Transit of Photography Equipment

In 2018, the sales of protective case for the packaging of photography equipment accounted for ~23% of the market share, and are projected to move at a CAGR of ~5% during the forecast period. The trend of owning a camera for personal and professional purposes, coupled with the ease of purchasing it from an online sales channel, has increased from the last decade. Since such equipment is cost-prohibitive and highly susceptible to damage whilst in the transit phase, protective cases have been witnessing a steady uptake in their sales.

However, the introduction of cushioned protective cases that ensure the safe shipment of fragile electronic products and consumer goods, such as smartphones, tablets, wristwatches, and kitchen appliances, among others, is gaining momentum at an exponential rate. The sales of protective cases for electronics equipment will rise from ~US$ 220 Mn in 2019 to ~US$ 340 Mn in 2027, demonstrating a CAGR of ~6% during 2019-2027.

3D Printing Technology Poised to be the New Default in the Manufacturing Process

Recent developments in protective cases, built with a novel approach, use 3D printing technology, as manufacturers seek improvement in the time-to-market of their products. For the packaging industry, 3D printing technology empowers manufacturers to take charge of designs and manufacturing processes, and converge innovation with customization.

With the ‘reduced time’ and ‘high efficiency’ attributes of 3D printing technology, protective cases with utmost precision and superior surface finish than those manufactured using conventional manufacturing processes are witnessing better marketability in reduced turnaround time. Players following this shift in the manufacturing process can swiftly meet the rising demand for protective cases with their enhanced production competency.

How Should Players Position Themselves in the Protective Cases Market?

The success of market players hinges on their adaptability to the evolving nature of the protective cases market. Manufacturers need to move past their conventional manufacturing competency to realize the latent potential of custom development, thereby safeguarding the loyalty of their clients.

Since the shopping preferences of consumers have move to digital channels, opportunities are abound in the e-Commerce industry, which need to be addressed by increasing production competency. Manufacturers can integrate 3D printing technology in their production processes to match supply with the demand.

In this consolidated landscape, wherein, there are a few, yet well-established market leaders, expansion of value-added product portfolio can bring in better exposure opportunities for market participants. An example of this organic growth strategy can be learnt the Pelican Products, Inc. way. This U.S.-based manufacturer of protective cases averred the launch of Voyager cases for iPad Pro tablets, in October 2018, to ensure safe transit across the globe.

Beside organic, the inorganic growth strategy, such as acquisitions to mark geographical presence and collaborations to gain reciprocal advantage, can be employed by manufacturers. As the North America market looks at steady growth with an anticipated CAGR of ~4%, and the Asia Pacific market moves exponentially at a CAGR of ~6% during 2019-2027, owing to attractive sales opportunities available in the electronics and consumer goods industries, investments in developing regions can turn out fructuous in the long run.

- According to Transparency Market Research’s latest market report on the protective cases market for the historical period of 2014-2018 and forecast period of 2019-2027, the demand for safe and secure packaging is likely to trigger the growth of the protective cases market.

- Globally, total revenue generated by the protective cases market is estimated to reach ~1.6 billion in 2019, and is expected to expand at a CAGR of ~5% in terms of value throughout the forecast period.

Customized Product Offering: Brand Owner’s Choice

-

Material Preference: Polypropylene

- Manufacturers prefer plastic for protective cases. It initiates polypropylene to lead the market in terms of market share during the forecast period. These cases are used to prevent damages to components and consumer products, which include various electronic components, military products, and delicate products that require to be protected from environmental changes. High thermal coefficient of polypropylene along-with its high impact resistance adds significant value to the characteristics of protective cases. In the case of metal protective cases, leading players are choosing aluminum over steel, which is expected to increase during the forecast period at a noticeable growth rate.

-

Technology Preference: Injection Molding & Rotational Molding

- Some manufacturers in the protective cases market are offering customized solutions and expanding their product portfolio by collaborating with leading companies in the industry.

- Pelican Products Inc., a leading manufacturer of plastic injection-molded protective cases, acquired Hardigg Industries Inc., a manufacturer of rotational-molded protective cases. This acquisition nearly doubled the size of its operations overnight, making it one of the largest manufacturers of equipment protection cases in the world.

- End Users: The photography and music equipment segment is expected to hold maximum value share in the protective cases market, owing to increasing safety concerns and demand for protective packaging in the industry. Packaging requires high strength, along with the ability to withstand temperature variations. Consequently, the protective cases market in electronics & electricals is expected to expand at a high growth rate among other end-use industries.

Protective Cases Market Volume to Expand 1.4X by 2027

- The protective cases market is expected to register noticeable growth during the period of 2019-2027, driven by the demand for secure & protective packaging and safe transport.

- The technology used to manufacture protective cases depends upon the size of the case to be designed. Manufacturers prefer injection molding in case of small protective cases, whereas, the rotational molding technique is used to manufacture large, hollow, one-piece protective cases. The demand for protective cases may witness an increase, as manufacturers of plastic processing machinery are focusing on providing automated solutions. The production of protective cases is expected to increase in correlation with the prices of polymer resins.

Lightweight & Compact Transit Cases to Protect Against Severe Environmental Conditions

- Transit cases require high strength as they need to protect contents in extreme temperature conditions. Therefore, brand owners are looking forward to investing in co-polymer-based protective cases, which is expected to create demand for bespoke protective cases. Customized protective cases are the preference of brand owners, commonly in end-user industries such as military equipment, measuring communication, electronics & semiconductors, and biotechnology, among others.

- Compact protective cases are used as they require less storage space, as well as offer cost-effectiveness in terms of shipping and transportation.

Protective Cases Market to Witness Higher Growth Rate in 2024-2024

The protective cases market is expected to expand at a CAGR of ~5%, which is likely to boost the logistics & transportation industry output. The market scenario and key development study shows that, acquisition and frequent product launches are the crucial factors to maintain a foothold in the coming years in the protective cases market. Increment in manufacturing sector output is expected to increase the growth of the protective cases market in the near future. The outlook for the protective cases market is expected to be positive during the forecast period.

Protective Cases Market: Competition Landscape

Some of the key players in the global protective cases market included in the report are

- Pelican Products, Inc.

- SKB Corporation, Inc.

- PARAT Beteiligungs GmbH

- C.H. Ellis Company, Inc.

- GT Line S.r.l.

- ZARGES GmbH

- GMOHLING Transportgeräte GmbH

- Gemstar Manufacturing Inc.

- Nefab Group

- Gemstar Manufacturing Inc.

- Suprobox.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

Protective Cases Market: Key Developments

Key manufacturers in the protective cases market are focusing on product portfolio expansion through frequent product launches as well as acquisition strategies for their growth in the packaging industry.

- In 2018, SKB introduced three new case sizes into its line of premium quality, affordable, and ultra-versatile iSeries Injection molded mil-standard waterproof utility cases.

- In 2018, PARAT Beteiligungs GmbH introduced a new generation of handles in many types of cases and bags.

- In 2018, C.H. Ellis Company acquired Howe Industries, a leading player in the protective cases market.

Read Our Latest Press Release:

- https://www.prnewswire.com/news-releases/affordability-and-beneficial-properties-to-serve-as-vital-growth-factors-for-construction-tape-market-during-forecast-period-of-2020-2030-tmr-301221294.html

- https://www.prnewswire.com/news-releases/global-higher-education-solutions-market-to-thrive-on-growing-popularity-of-cloud-computing-and-high-consumption-of-digital-content-tmr-301219732.html

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through ad-hoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

Contact

Transparency Market Research State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453