Usage Based Insurance Market: Overview

A type of motor insurance that is designed to determine the premium of the vehicle by monitoring the driving behavior of the people is known as usage based insurance. In order to track the vehicle’s behavior, a wireless device is fitted in the vehicle that transmits the data to the insurance company whenever the premium is to be charged. Owing to rising vehicles and accidents that do a major damage to the vehicle usage based insurance, a dedicated market for the same exists from a global perspective. This market is experiencing a major boost recently owing to the factors such as real-time monitoring, and growing interest of people in connected vehicles. As a result of these and many other benefits, the global usage based insurance market is expected to witness a staggering growth of 30% CAGR and is projected to surpass US$200 bn by the end of forecast period.

However, the process of usage based insurance model is quite complex. It requires various industries such as insurance, IT and telecom, and hardware to function coherently. Due to this the global usage based insurance model faces several challenges such as legal hurdles and extensive development of IT infrastructure. Moreover, majority of the clients are ready to share their vehicle data with the insurance companies.

Get Sample Copy:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=52104

Pay-How-You-Drive (PHYD) to be the Dominant Segment

The segmentation of the global usage based insurance market is done on the basis of policy type, types of vehicles, and region. Depending upon the type of the policy, the market is further segmented into pay-how-you-drive (PHYD), pay-as-you-drive (PAYD), and manage-how-you-drive (MHYD). Out of these segments, pay-as-you-drive is expected to exhibit maximum potential in the global usage based insurance market.

The PAYD model is basically the policy where the value of premium is decided on the basis of the miles driven by the customer’s car. It is generally monitored by odometers installed in the car connected to wireless devices. Moreover, the PHYD or pay-how-you-drive segment is also expected to witness a robust growth in global usage based insurance market during the forecast period. Here the premium is evaluated on the basis or data collected by tracking the driving behavior of people. This includes parameters such as, acceleration, braking, and location, and time taken to drive.

Grab an exclusive PDF Brochure of this report:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=52104

On the basis of type of devices, the global usage based insurance market is categorized into OBD dongle, smartphones, and black box. The black box segment is likely to dominate the market in the forecast period. The segment is expected to be followed by OBD dongle segment. The growth of these segments is attributed to the properties such as accuracy and long term connectivity of the devices.

In terms of vehicle type, the global usage based insurance market is segmented into two categories, passenger vehicles and commercial vehicles. In this criteria, the passenger vehicle segment is expected to grow substantially in the forecast period as a result of increasing demand of lower operating cost of the vehicles.

Request For Customization:

https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=52104

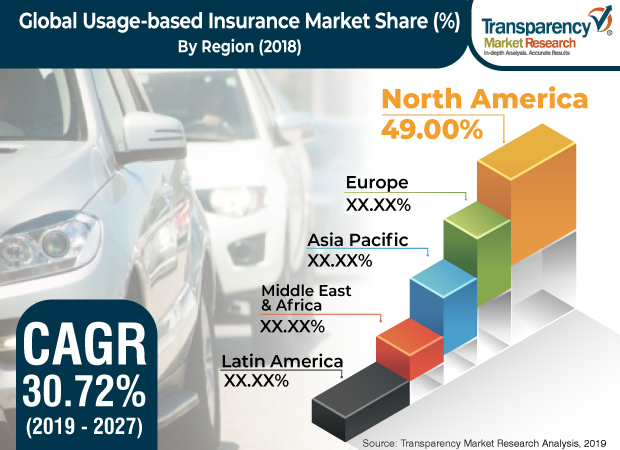

North America is expected to Show Maximum Potential

The market has its presence in regions such as Europe, North America, Asia Pacific, Latin America, and Middle East and Africa. North America is expected to show maximum potential in terms of revenue in the global usage based insurance market in the forecast period. The growth of the market is attributed to rising consumer confidence in adopting usage based insurance. The European region is expected to follow North America in terms of growth based on rising innovations in automotive industries in the forecast period.

Some of the major players of global usage based insurance market are Insure the Box, State Farm, AllState Insurance Company, Uniqa, Generalli, Groupama, Uniposai, and Liberty Mutual.

Read Our Latest Press Release:

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through ad-hoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

Contact

Transparency Market Research State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453