Key Highlights

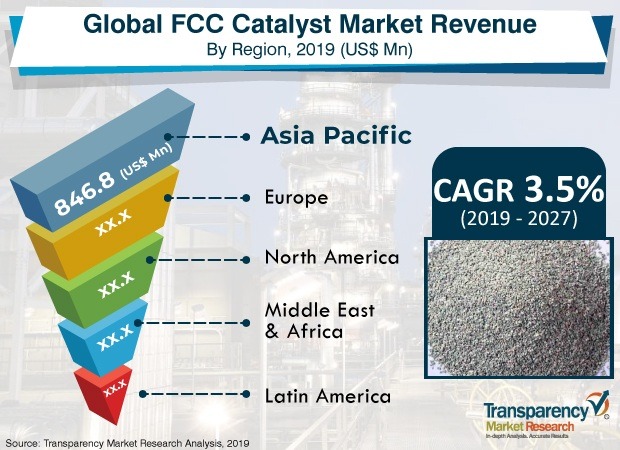

- The global FCC catalyst market was valued at US$ 2,445.3 Mn in 2018 and is anticipated to expand at a CAGR of 3.5% from 2019 to 2027

- In terms of process, maximum middle olefins conversion and gasoline sulfur reduction segments constituted major share of the global FCC catalyst market in 2018

- Based on application, the vacuum gas oil segment constituted more than 50% share of the global FCC catalyst market

- In terms of region, Asia Pacific constituted more than 30% share of the global FCC catalyst market in 2018

- Detailed list of raw material suppliers, product manufacturers, and key customers

- Historical Trend (2013 –2017)

- CAPEX Analysis: FCC Catalyst Plant

- Production Cost Analysis, FCC Catalyst Plant (2,000 Tons/year)

- Cost Sensitivity Analysis

Crude Refining Industries Drives FCC Catalyst Market

- Expansion of the FCC catalyst market depends on the growth of the crude refining industry

- More than 40% of FCC catalyst is employed for making maximum middle distillates

- Maximum bottoms conversion is extensively manufactured from FCC catalyst. Growth in synthetic zeolites manufacturing across the globe propels the demand for FCC catalyst.

Request A Sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=67520

Key Driver to Boost the Demand for FCC catalyst

- Growing demand for petrochemical products and synthetic zeolites to increase the demand for FCC catalyst

- Rising demand for petrochemicals is expected fuel consumption of FCC catalyst in the crude oil refineries

- Demand for crude blended products is estimated to increase in the next few years due to the rise in investment in industrialization

- Major oil refining companies such as Exxon Mobil and Royal Dutch Shell plan to invest in new petrochemical plants in the near future

- Expansion in refinery capacity may act as one of the major opportunities for the refinery catalysts, especially FCC catalyst, across the globe

- Synthetic zeolites are widely used as ion-exchange beds in domestic and commercial water purification, softening, and other applications

- Zeolites are used to separate molecules (only molecules of certain sizes and shapes can pass through), and as traps for molecules for analyzes

- Demand for synthetic zeolites is high in countries and sub-regions such as the U.S., China, Brazil, India, and Russia & CIS. Synthetic zeolites are used in applications such as insulated windows, automobile air-conditioning, refrigerators, air brakes on trucks, and laundry detergents.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/global-n-methyl-2-pyrrolidone-market-to-clock-nearly-6-cagr-during-20192027-to-touch-valuation-of-us2-bn-by-2027-transparency-market-research-300998383.html

Regulatory Framework and Environmental Regulations

- In April 2019, the ninth high-level meeting of the EU Refining Forum took place in Brussels. Stringent norms related to carbon emissions were laid for the EU refining industry, which are expected to drive the demand for refinery catalyst, especially for FCC catalyst.

- The Kyoto Protocol is a step toward formulation of regulations for reducing harmful chemical emissions such as sulfur gas emission globally. This is expected to drive the demand for FCC catalyst, especially those used in gasoline sulfur reduction.

- The Gulf Environmental Partnership and Action Program (GEPAP), a newly proposed initiative, aims to preserve and protect the Gulf waterway and promote its long-term sustainable development.

- Stringent environmental norms are imposed by the European Union on crude refining. A few countries in Europe require sulfur content in fuels less than 50 ppm especially in Russia & CIS. Therefore, demand for gasoline sulfur reduction is anticipated to rise in the Europe in the near future.

Enquiry Before Buying – https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=67520

China and India to Dominate FCC Catalyst Market in Asia Pacific

- In terms of value and volume, Asia Pacific dominated the FCC catalyst market in 2018.

- Rise in investments in crude refineries in Asia Pacific drives the market in the region. In terms of refinery capacity, India’s Reliance Industries constitutes a larger share of the market as compared to other refineries across the globe.

- India’s total refining capacity was 5,010 thousand barrels per day, which accounted for 15% of Asia Pacific’s total refining capacity in 2018

- The total crude refining capacity of China was 15,994 thousand barrels per day, which comprises 46% of Asia Pacific’s total refining capacity in 2018

Competition Landscape

- The global FCC catalyst market is highly competitive. WR Grace & Co-Conn, BASF SE, and China Petroleum & Chemical Corporation jointly constitute more than 50% of the market of the global FCC market.

- Other key players operating in the global FCC catalyst market include: Albemarle Corporation, Haldor Topsoe A/S, JGC Catalysts & Chemicals Co., Ltd., Clariant International Ltd., ReZel Catalysts, Anten Chemical Co., Ltd., SINOCATA, and Yueyang Sciensun Chemical Co., Ltd.

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=67520