Global Ferroalloys Market: Snapshot

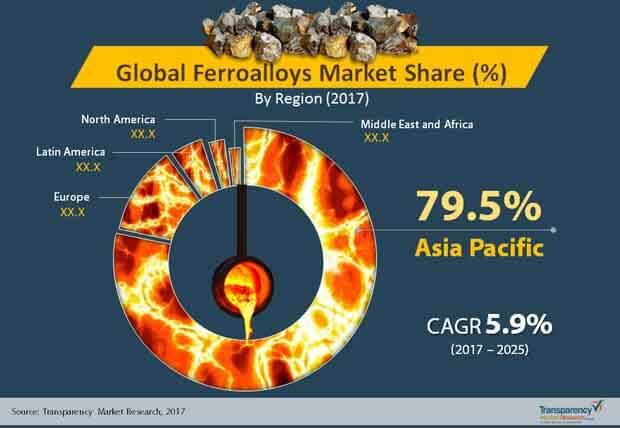

Owing to the lack of a viable alternative that can meet the diverse applications, the future of the global ferroalloys market is healthy, expanding at an estimated CAGR of 5.9% during the forecast period of 2017 to 2025. The prosperity of the building and construction industry in a number of emerging economies is another key driver of the global ferroalloys market, wherein the development of lightweight and high strength steel grades is expected to open new opportunities. On the other hand, stringent governmental regulations pertaining to the environment and high operational costs are two glaring restraints over the global ferroalloys market. The market for ferroalloys, worldwide, is projected to reach a valuation of US$188.7 bn by the end of 2025, significantly up from its evaluated worth of US$112.8 bn in 2016.

Bulk Ferroalloys Emerge as Major Product Type Segment

Based on type, the global ferroalloys market has been segmented into two major categories, viz. bulk ferroalloys and noble ferroalloys. Bulk ferroalloys is further sub-segmented into ferrosilicon, ferromanganese, ferrochromium, ferro-silico-manganese, and ferro-silico-chromium. Manganese plays an essential part in the production of most varieties of steels and it is also one of the most important element in the production of cast iron. Most of the noble ferroalloys are made from rare earth minerals and are expensive to produce as compared to bulk ferroalloys. Most of the noble alloys are made from adding chromium, tungsten, nickel, boron, vanadium, niobium, titanium, cobalt, copper, molybdenum, phosphorus, and zirconium. These rare earth metals helps in contributing special properties and character to the various alloy steels and cast irons.

More Trending Reports by TMR:

Steel Production Identified as Primary Application

The production of stainless steel and steel production are two primary applications of ferroalloys, whereas wire production, welding electrodes and superalloys and alloys are other application categories. Most of the bulk ferro alloys and noble alloys are used in enhancing the properties of steel according to different end users. Nearly 80% of the all ferroalloys are utilized for the production bulk ferroalloys and used in the production of the steel because of the low prices of the bulk ferroalloys and high production around the major producing regions. Noble alloys are produced from rare earth elements and also uses expensive energy consuming industrial processes which increases their production cost. Noble ferroalloys are expensive as compared to bulk ferroalloys. Consumption of noble ferroalloys is considerably less than bulk ferroalloys but revenue generated by noble ferroalloys is significantly more.

REQUEST FOR COVID19 IMPACT ANALYSIS:

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=2847

Asia Pacific to offer Lucrative Prospects for Growth

In 2017, Asia Pacific accounted for 79.5% of the overall demand in the global ferroalloys market, and is expected to exhibit the best CAGR among all regions throughout the forecast period. Europe was the second most profitable region in 2017, but the demand is expected to decrease in the near future, owing to slowing economy and global recession in the region. Recovering economy in North America, economic growth in Asia Pacific, and increased production of ferroalloys in the countries of Africa have driven the market for ferroalloys around the globe. Emerging technologies for the production of ferroalloys and increased consumption and exports from China, Japan, and India would drive the market for ferroalloys around the globe.

Some of the key companies in the global ferroalloys market are ArcelorMittal, Tata Steel, Sakura Ferroalloys, BAFA Bahrain, OM Holdings LTD, Pertama Ferroalloys, NikoPol Ferroalloy Plant, Gulf Ferroalloys Company, Brahm Group, Ferroalloy Corporation Limited, MORTEX Group, China Minmetals Corporation, Shanghai Shenjia Ferroalloys Co. Ltd., Vale S.A., Georgian American Alloys, SAIL, and OFZ S.A.