Algorithmic Trading Market – Snapshot

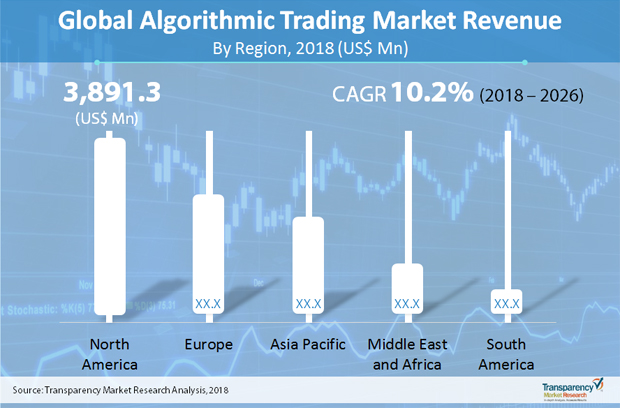

Algorithmic trading is a process of using an automated computer programed to follow a defined set of trading instructions for placing a trade, accounting for factors such as time, price, and volume. Algorithmic trading or algo trading is a technology platform providing advantage of both artificial intelligence and human intelligence. Algorithmic trading helps in reducing transaction costs, allowing investment managers to take control of their own trading procedures. The main objective of such software is not just to maximize profits but also to control market risk and execution costs. The market for algorithmic trading is forecasted to grow to US$ 21,807.6Mn by 2026, recording a CAGR of 10.2%.

Get Sample Copy:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=50109

The algorithm trading market has experienced substantial growth due to large number of financial firms opting for increasing automation in trading processes. Integrated financial markets or an open market economy such as the European Union helps local vendors in buying foreign assets with reduced risks. Contribution of several international markets has aided developing countries in generating opportunities for portfolio diversification, global distribution of savings, and also risk sharing.

The algorithmic trading market is driven by the emergence of AI and algorithms in the financial service sector. This in turn is boosting the algorithmic trading sector globally. Furthermore, increasing adoption of non-equity trading algorithms by institutional asset managers is enhancing the use of artificial intelligence in the financial services sector. The global algorithmic trading market is anticipated to grow significantly during the forecast period, attributed to rapidly growing demand for market surveillance. By using market surveillance technology, traders are able to keep track of their trading activities and investment pattern.The rising need to build an economy with global as well as regional interdependencies force key vendors to formulate effective marketing strategies and develop new solutions for market surveillance. In addition, many companies are inclined toward the use of algorithmic trading in order to reduce market risks and transaction cost.

Grab an exclusive PDF Brochure of this report:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=50109

However, stringent regulatory guidelines are affecting the large-scale use of algorithmic trading. To conduct algorithmic trading and high frequency trading (HFT), all trading companies should inform the national regulatory authority and submit an application for approval from the regulatory authority.The regulatory environment for algorithmic trading and HFT practices are not favorable in some of the major countries such as China. There are barriers to the widespread application of automated trading, specifically for high frequency trading in financial markets across the country. This is consequently restricting the growth of the algorithmic trading market across the Asia Pacific region, as China is one of the major markets for the stock exchange.

A key trend boosting market growth is the growing adoption of cloud based solutions. The technology is gaining popularity in capital markets due to its flexibility, scalability, cost-effectiveness, and massive processing power. Presently, capital markets and financial institutions are unceasingly adopting cloud-based applications in order to enhance their efficiency and productivity as well as providing better custom applications and security to their customers.

Buy Complete Report@:

https://www.transparencymarketresearch.com/checkout.php?rep_id=50109<ype=S

The algorithmic trading market is segmented on the basis of components and trading type. Based on components, the market is segmented into software (on premise, cloud (private and public cloud) hybrid) and services (managed services, professional services (maintenance, integration and consulting). Based on trading type, the market is segmented into forex, stock markets, commodities, bonds, and cryptocurrency.

From a geographical standpoint, North America is expected to hold a major share in the algorithmic trading market.Growth in this region is attributed to strong adoption and penetration of algorithmic trading platform, software and services, as well as considerable application of algorithm trading in different end-user segments across the region. Developed markets and emerging markets have embraced this technology in the securities market. Asia Pacific region is expected to witness lucrative growth due to rising adoption of such software from countries such as India, Japan, Philippines, and Singapore. Furthermore, the markets in Middle East and Africa (MEA) and South America regions are also expected to grow significantly during the forecast period.

Growing awareness and adoption of algorithmic trading across Asia Pacific and South America is offering new opportunities for key players operating in the global algorithmic trading market. The algorithmic commodity market in India is expected to expand at a faster pace during the forecast period, owing to SEBI’s efforts to ease algo trade rules in the commodity market. In April 2018, SEBI raised the limit of orders that can be processed per second by a user from 20 orders per second to 100 orders per second.

Attracted by this fast expanding market, underlying technological advancements, and rising trend of algorithmic trading, many players are driven to develop comprehensive suites of software and services for all trading types. Existing software providers are rapidly expanding their distribution network in order to reach the most distant customers.Some of the key players profiled in the algorithmic trading market report include Trading Technologies International, Inc., Argo Software Engineering, Inc., Automated Trading SoftTech Pvt. Ltd., InfoReach, Inc., Kuberre Systems, MetaQuotes Software Corp., Software AG, Thomson Reuters Corporation, uTrade, and Vela Trading Systems LLC (OptionsCity Software, Inc.).

Read Our Latest Press Release: