Free Data Capture Systems and eCRFs Support COVID-19 Research Projects

Vendors in the clinical trial data management software market have taken a step forward to join the fight against coronavirus (COVID-19). For instance, Castor EDC— a provider of CTMS tools on the centralized platform, announced to make its research data capture system available for free to meet the needs of users conducting COVID-19 research projects. Several companies in the clinical trial data management software market are continuing to deliver their services without any interruptions by adopting work from home and telecommunication policies.

The demand for clinical trial data management software is anticipated to surge, as research studies on COVID-19 are estimated to grow in number. Unprecedented demand for vaccines and coronavirus-fighting drugs is another key driver that is predicted to generate incremental opportunities for companies in the market landscape. Vendors are increasing the availability of eCRFs (Case Report Form) that help researchers start their study and registry in less than an hour.

Request a sample to get extensive insights into the Clinical Trial Data Management Software Market https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77267

SaaS CTMS Deploys Operational Efficiency for Pharmaceutical and Biotech Companies

Software as a Service (SaaS) is emerging as a profitable investment option for pharmaceutical and biotech companies in the field of clinical trial data management software. For instance, leading information technology (IT) consulting TATA Consultancy Services is increasing awareness about its innovative SaaS platform, the TCS Connected Clinical TrialsTM that helps pharmaceutical companies in personalized patient engagement. The demand for high-quality data capture is rising in the clinical trial data management software market.

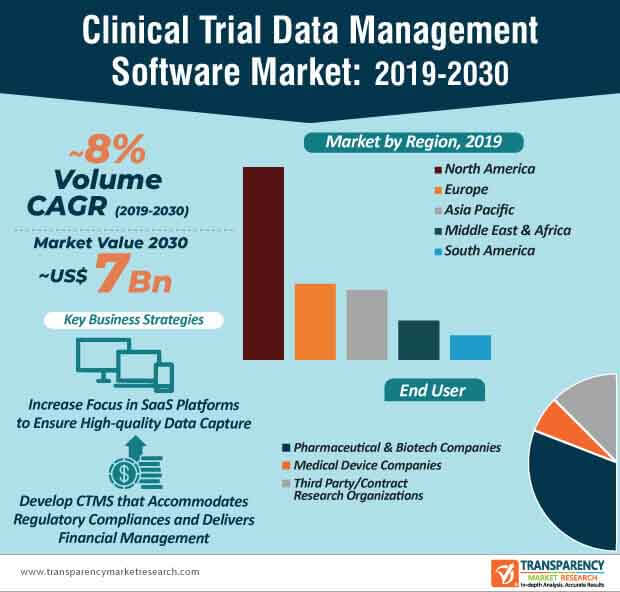

SaaS-inspired clinical trial data management software are becoming increasingly mainstream in pharmaceutical and biotech companies. This is evident since pharmaceutical and biotech companies are estimated to generate the highest revenue among all end users in the clinical trial data management software market, where the market is estimated to reach a value of ~US$ 7 Bn by the end of 2030. Clinical trial management software (CTMS) is being highly publicized for improving operational efficiency and compliance, while conducting clinical trials.

Cloud-based Data Management Software Helps in EDC and Supports Complex Trials

Companies in the clinical trial data management software market are increasing their focus to meet the needs of third party end users and contract research organizations (CROs). For instance, Veeva Systems— a leading U.S. cloud-computing company is serving the need of CROs by offering their Veeva Vault Clinical Data Management Suite (CDMS) that deploys greater visibility and control over data. As such, the revenue of third party/CRO end users is projected for exponential growth in the clinical trial data management software market, where the market is estimated to advance at a healthy CAGR of ~8% throughout the forecast period.

There is a growing demand for clinical trial data management software that eliminates manual processes and accelerates data processing capabilities. Next-gen interfaces in CDMS solutions are helping clinical research associates (CRA) to accurately review data and eliminates the need to page through forms. Vendors are increasing efforts to deliver better electronic data capture (EDC) with the help of clinical trial data management software in complex and multi-arm adaptive trials.

EDC v/s Excel & other Data Capture Tools: Which is better?

Most researchers are familiar with Excel, Google Forms, SPSS (Statistical Package for the Social Sciences), and the likes for data capture in the clinical trial data management software market. However, these tools are cumbersome and cannot be efficiently deployed for medical data capture. Hence, vendors are increasing awareness about clinical trial data management software to meet the needs of medical device companies. However, loss of productivity levels due to the fresh adoption of software is a shortcoming that vendors need to tackle. Hence, companies are innovating in EDC platforms that are specially meant for medical device and other healthcare companies.

Companies in the market for clinical trial data management software are gaining efficacy in developing multi-purpose tools for EDC. EDC tools are gaining increased popularity in the clinical trial data management software market, since they eliminate the need to have programming knowledge, thus boosting its adoption among small-scale medical research companies.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Clinical Trial Data Management Software Market https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=77267

Clinical Trial Data Management Software Market: Overview

- The global clinical trial data management software market is expected to reach ~US$ 7 Bn by 2030 from ~US$ 3 Bn in 2020, expanding at a CAGR of ~8% from 2020 to 2030

- The global clinical trial data management software market is currently driven by growing demand from pharmaceutical & biomedical companies to reduce operational costs and failures of clinical trials

- The clinical trial data management software market in Asia Pacific is projected to expand at a high CAGR during the forecast period. Adoption of cloud-based clinical trial data management software by end users has propelled the demand for clinical trial data management software in the region.

- China is the most attractive market in Asia Pacific. The incremental opportunity is significantly high for China, as it accounts for a dominant share of the clinical trial data management software market in the region.

- The clinical trial data management software market report provides analysis of the global clinical trial data management software market for the period 2018 – 2030, wherein 2019 is the base year, 2020 is the estimated year, and 2021 to 2030 is the forecast period. Data for 2018 has been included as historical information.