Investing money is an amazing way to make more money, and the proof of that is the large number of investors nowadays who enjoy the benefits of this practice. However, with the increase in the number of investors and the development of the modern age, the number of investment frauds has also increased. These actions refer to those taken by fraudsters to deceive investors and steal their money by giving them inaccurate and misleading information. The type of assets that are most often involved in these scams are currency, but also stocks, bonds, and in some cases even real estate. While all of this sounds pretty scary the truth is that there is no reason to worry. When you know what is happening, you can take all preventive measures in order not to become a victim of investment fraud. Below you can read about 4 most common types of investment fraud schemes you should look out for.

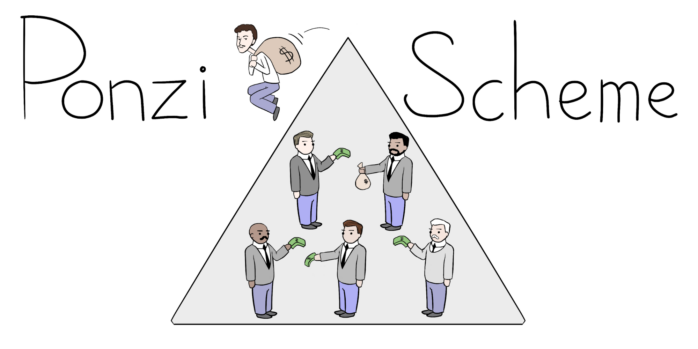

1. Pyramid and Ponzi schemes

Ponzi or pyramid schemes are types of investment scams that involve persuading investors to direct their money to a scheme that seems to bring in a large amount of money in a very short time. People often choose to get into this because it seems quite realistic to them, especially when someone they know and trust is inviting them to get involved. These calls usually come via email, sometimes through advertisements, and the biggest problem is that they look quite reliable. What Ponzi and pyramid schemes have in common is that both types of fraud require a constant inflow of cash to sustain themselves, which usually comes from young, new investors. This means that ‘older’ investors really get paid in the beginning, thanks to new people joining. In their eyes, these are interest checks, which were promised to them in the first place. However, after a while, the money runs out, and then investors become aware of it, when the whole system inevitably begins to collapse. Investors leave the system because they realize that something strange is happening, and in the end, there remain investors who did not leave the story believing that everything will eventually be fine. However, their money went together with the fraudsters who deceived them and will not return.

The Ponzi scheme was named after a 1920 fraudster, Charles Ponzi, who deceived a large number of investors by tricking them into investing their money in a scheme involving postage stamps, only to eventually steal the money and escape. Today, these complex schemes bear his name, and differ from pyramid schemes in that they require investors who have joined to recruit new members to enjoy additional benefits and make more profit.

2. Boiler room fraud

Another type of investment fraud is the so-called boiler room fraud, which involves deceiving investors into investing money in a company that does not actually exist, but seems so realistic that it is really difficult to say that it is a fraud. The point is that fraudsters in this case share information about their company and office on their website – address, phone number, email address. The website looks completely authentic and everything seems to be in perfect order, and it is supposed to be an investment company. However, the truth is that all information is false and that most often only the mailbox is behind the company’s address. If you invest money through these companies, you can expect them to steal it and you will never hear from them again, which is completely logical if you consider that no information you have about them is accurate.

We suggest that before you get into all of this, thoroughly check that the information is relevant and that the company is really legitimate, or someone is trying to take your money and run away without a trace.

In case you are a victim of investment fraud, it is a good idea to hire a litigation firm whose practice focuses on advocating for investors as well as elderly victims of securities fraud and investment fraud as soon as possible. One such company is MDF Law, which you can read more about at https://mdf-law.com/.

3. Advance fee scheme

The fourth type of investment fraud is the advance fee scheme, where the fraudster asks the investor to pay a certain fee in advance, in order to eventually make much more money. Yet, as you guessed, that doesn’t happen in the end. If you are wondering why someone would agree to pay money in advance, you should know who are the most common targets of fraudsters. Advance fee schemes most often involve deceiving disadvantaged investors who have previously experienced losses in high-risk investments. Such people are aware that they are in a difficult situation and are trying to find a way out, with which fraudsters are well aware. And they find a way to get in touch with them. In such situations, these investors get an offer to get paid a very high amount of money in exchange for worthless stocks. This sounds like a great opportunity for investors, so they pay this money in advance to accept the contract and achieve the desired benefits. However, they eventually figure out that it was a fraud, which means that these fraudsters took the money and ran away, leaving them in even greater trouble than they were before.

Conclusion: Investment scams are those in which investors are deceived and deceived by fraudsters who try to steal their money. These frauds can involve different assets, and what they have in common is that it is often really difficult to detect suspicious actions. Sometimes their actions look so authentic that it is almost impossible not to believe that it is a professional and reliable company, and sometimes the target investors are at a disadvantage looking for a way out of it. The four most common types of investment frauds are pyramid and Ponzi scheme, boiler room fraud and advance fee scheme. Once you are familiar with these scams you can more easily recognize them if you encounter them and prevent yourself from becoming a victim of one of them.