Brakeoil is a type of hydraulic fluid used in hydraulic brake and hydraulic clutch applications in automobiles, motorcycles, light trucks, and off-road vehicles. Brakeoil is renewed or changed every one to two years in off-road vehicles in order to improve the safety and durability of vehicles. Thus, the brakeoil aftermarket has been expanding across the globe. Newly developed state-of-the-art brakeoil offers better performance reliability with efficient results. Glycol fluids are the most commonly used in most motor vehicles in various grades. They are named by the Department of Transport (DOT) coding and are classified into DOT 3, DOT 4, DOT 5, and DOT 5.1.

Rise in investments in mining and construction industries across the globe

Rise in mining and construction activities is driving the off-highway brakeoil aftermarket. The frequency of oil change and other maintenance is expected to increase with the growth in age of off-highway vehicles such as heavy trucks and mining vehicles. Vehicles require brakeoil change to ensure safety of the passengers and maintenance of the vehicle for long life and high efficiency.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=41729

Volatility in crude oil prices coupled with increase in demand for electric vehicles is likely to hamper the demand for brake oil in the near future

Brake oil level may also be low because of a leak. This could result in a loss of hydraulic pressure. Consequently, this may lead to significant loss of braking ability. Modern vehicles have split hydraulic circuits to ensure against total hydraulic failure. Brakeoil has a limited life, not only because of water absorption but due to the depletion of corrosion inhibitors and stabilizers over time. Wear particles and rubber fragments also build up gradually. Rise in demand for e-vehicles is one of the restraints of the brakeoil aftermarket in Europe. The usage of electric vehicles for mining, agriculture, and construction is increasing at a rapid pace.

Year-on-year increase in demand for automotive, especially off-highway vehicles, provides lucrative opportunities for the off-highway brakeoil aftermarket

Brake oil plays an important role in the efficient operation of the braking system and in turn the safety of the vehicle. The U.S. continues to be the leading country in terms of consumption of brake oil due to the implementation of stringent government regulations on the servicing of vehicles in order to maintain safety and lower harmful emissions. India follows China in long-term growth of the brakeoil aftermarket due to its rapidly growing economy. Southeast Asia is also a key region of the off-highway brakeoil aftermarket due to the expansion in the automobile industry in the region. Key factors that promote the brake oil aftermarket are increasing due to stringent emission & fuel consumption norms imposed by several governments and more exacting OEM specifications. Opportunities in the development of next generation brakeoil with better efficiency and advanced technology are under process. Companies such as Bosch and Exxon are engaged in developing brake oil with advanced technologies.

Developments & innovations in terms of product and technology in brakeoil aftermarket services

In January 2018, Lukoil signed a contract with Elabuga car plant (ELAZ), Turkey, wherein the former will supply first fill lubricants for ELAZ-BL backhoe loaders. The company will also supply a wide spectrum of hydraulic, motor, transmission, and universal tractor oils. In October 2017, Lukoil entered into a strategic partnership with the Russian Export Center. The partnership aims to provide full scale support to Lukoil in promoting its high-end lubricants and oil manufacturing technology in foreign markets. This is expected to expand Lukoil’s business across the globe. In 2016, LUKOIL launched the construction of a lubricants plant in Kazakhstan the capacity of 100 thousand tons per year to be engaged in blended lubricant production. The plant is scheduled for commissioning in 2018. This is estimated to expand the company’s business in Europe. In 2017, Phillips 66 launched T5X® off-road mobile high-performance hydraulic fluid, which is likely to be beneficial in the hydraulic systems of Caterpillar and other off-highway mobile equipment. Recently, Royal Dutch Shell launched its Rimula’s adaptive technology, which provides outstanding wear protection with reduced viscosity for improved fuel efficiency for off-road heavy vehicles.

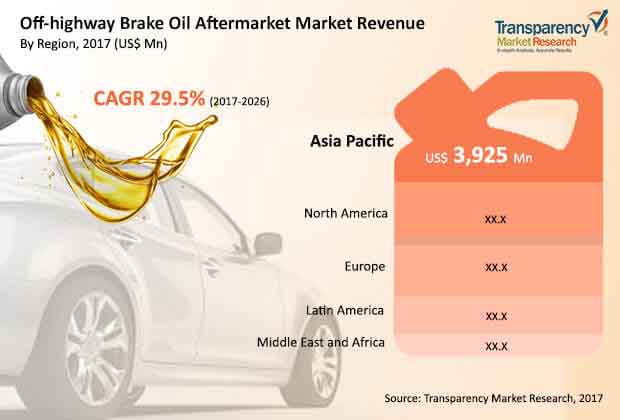

Asia Pacific to remain dominant region in terms of demand for brakeoil aftermarket services

In terms of revenue and volume, Asia Pacific held large share of more than 30% of the global off-highway brakeoil aftermarket in 2016. Countries such as China, India, Vietnam, and Indonesia are experiencing major economic and infrastructure development. This can be ascribed to the rapid industrialization in the region. India, China, and Australia are dominant countries in the mining of minerals, metals, non-metals, and ores. Globally, Australia is ranked second in terms of year-on-year mining of gold. Furthermore, these countries employ majority of off-highway mining vehicles. This is anticipated to boost the market in the near future.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=41729

Highly competitive market with domination of top players

The global off-highway brakeoil aftermarket is a highly competitive. The leading players dominate the market. Key players in the off-highway brakeoil aftermarket are BRB International BV, Halron Lubricants Inc., Lukoil Lubricants Company, Phillips 66 Lubricants, Royal Dutch Shell plc., Indian Oil Corporation Limited, Castrol Limited, Chevron Corporation, BP plc., Total S.A., ExxonMobil Corporation, Fuchs Petrolub SE, and Topaz Energy Group Ltd.

Read Our Latest Press Release: