As the offshore oil and gas industry and marine markets continue to evolve at a rapid pace, testing and demonstrating surveillance systems such as Permanent Reservoir Monitoring (PRM) systems bring more focus on the technologies required for such systems to perform with high reliability. Several underwater connectors – an important connectivity solution for most marine markets – have been developed over the years, making it easier to manage cable assemblies and conduct offshore testing.

Recent developments influencing subsea systems in general, and underwater connectors in particular, warrant an in-depth understanding and unbiased analysis. Transparency Market Research, in its new offering, draws attention to credible insights on the growth prospects of the underwater connectors market, which can assist stakeholders with value-creation and data-driven decision making.

Planning to lay down future strategy? Perfect your plan with our report brochure here

Past, Present, and Future Prospects of the Underwater Connectors Market

Underwater connectors have come a long way since their first use in the 1950s for connecting power cables to facilitate SONAR networks. Developments quickly moved ahead to ensure that underwater connection technologies were ready for the market, and patents began to appear. In 2018, the global sales of underwater connectors were valued at ~ US$ 1.8 Bn, and the establishment of technologically-advanced manufacturing facilities and distribution networks by key players continued to facilitate market growth.

Underwater connectors have enabled significant progress in the modularization of multiple systems in oil & gas, defense, and oceanographic industries. However, incorrect metal selection and installation could lead to connector corrosion, which continues to challenge manufacturers. Their capabilities have also been put to test, as certain limitations in the life cycle and design range of underwater connectors could result in operational challenges.

Trends Reforming the Underwater Connectors Landscape

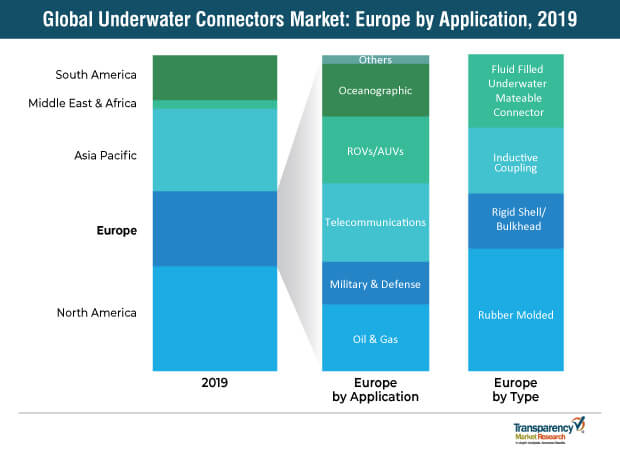

The demand for underwater connectors is based on the growing dependence of subsea equipment – ranging from simple sonar to wave energy converters – on connectors for use, deployment, and maintenance. While the industry-wide prevalence of rubber molded connectors continues to influence growth strategies, manufacturers are focusing on boosting the production of underwater connectors based on inductive coupling to capitalize on data transfer-based applications and telecommunication industry. In addition, product development and innovation strategies are highly influenced by specific requirements for military systems and equipment.

With fiber optic cables replacing copper cables in the transatlantic subsea transmission conduits, product penetration – as far as underwater or subsea optical fiber connections are concerned – is likely to grow. TMR’s study also finds that, increasing investments in deep submergence science and research projects to collect and comprehend critical information about the ocean ecology will create potential business opportunities for the manufacturers of underwater connectors.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

Product Innovation and Development – Key Strategies

As the demand for rubber molded underwater connectors persists across a wide range of industry verticals due to their cost-effectiveness, much focus is placed on their development and new launches. Suitable for underwater lights and cameras, ROV systems, diver communication, and towed-array cable systems, rubber molded connectors have also witnessed relatively high innovations and investments. These factors played an important role in SEACON’s decision to launch rubber-molded connectors that can be used for all types of underwater applications. Further, in May 2019, Hydro Group plc launched a new range of rubber-molded subsea connectors with five variants, which are suitable for a wide array of seawater as well as freshwater applications. Such strategic moves are likely to influence other stakeholders to follow suit and invest in product innovation.

Considering the increasing stringency of RoHS (Restriction of Hazardous Substances), which impacts electronic products and equipment, underwater connector manufacturers are focusing on manufacturing products that are lead-free and fully compliant with RoHS industry standards. For instance, in 2018, SEACON announced that all TE Connectivity MOG (Marine, Oil & Gas) Rubber Molded Series will be manufactured complying with RoHS guidelines and requirements.

Marine products that demonstrate high performance under extreme temperature and pressure have been observing significant demand. Therefore, a number of underwater connector manufacturers are launching new precision testing capabilities for deep submergence connectors and cable assemblies used in high-depth pressure. For example, BIRNS, Inc.’s new test system allows more than 48 hours continuous testing of cable assemblies and connectors at 6 km depth in a controlled environment.

The Competitive Landscape

The underwater connectors market shows a fair level of consolidation, with Eaton Corporation, LEMO, Souriau, Teledyne Marine, and SEACON operating as the leading players in this market space. It is also imperative to note that, the threat of new entrants and substitutes prevail in the underwater connectors market.

Read Our Latest Press Release: