Accurate invoicing is a crucial bookkeeping component for every independent contractor or small business owner. Whether you work at a fixed rate or charge by the hour, having an easy-to-read, clear invoice can help you look professional and be paid on time.

Being a small business owner or a self-employed contractor is not simple. You are in charge of managing every aspect of the company’s operations, including bookkeeping. And you undoubtedly have questions about time management. Well, one approach is by effectively producing estimates and bills.

That’s harder to say than it is to do. Due to costs, notoriously slow payments, and the general nature of a credit-heavy corporation, it is simple to get yourself into trouble. You’ll get paid more quickly and avoid the worst-case situation of running out of money if you provide accurate and on-time invoices.

There are several ways to invoice, but no matter which method you choose, you should always give your clients a reliable, polished contractor invoice.

What information must be included on an invoice, and what should be displayed on a limited company contractor’s invoice? This is something to take into account if you work for yourself. The key is understanding proper customer billing procedures and how to establish accurate invoice information upfront.

It would be best if you prepared invoices for the services you perform for your client or customer, whether you are a lone proprietor or a business owner who operates under your name. So, each time before your client or clients may make a payment. You will be able to create your independent contractor invoice.

What Needs To Be Included in the Invoice

1. Personal Details

Including your personal information on a contractor invoice may seem obvious, but remember that your client often receives several monthly bills. They will stay more structured if you put your complete name or company name directly at the top. Include your mailing address, phone number, and email address with your contact details. You can also include your personal website and company logo to maintain brand consistency if you have one.

2. Client Information

The client information you include next should be used to identify the invoice recipient. Make sure to include your client’s name, address, and phone number.

Including the client’s information is crucial after you have added your information to the header. Contact the client in advance to obtain the client’s contact information to ensure that all the information on the invoice is accurate.

When working with large clients or companies, they frequently have a distinct billing department with contact information different from the standard corporate contact information.

It is essential to record all pertinent client information accurately. You don’t want all your effort in preparing an invoice to go in vain just because you provided the incorrect client contact information. Your small business’s reputation as an independent contractor will suffer from this appearance of unprofessionalism.

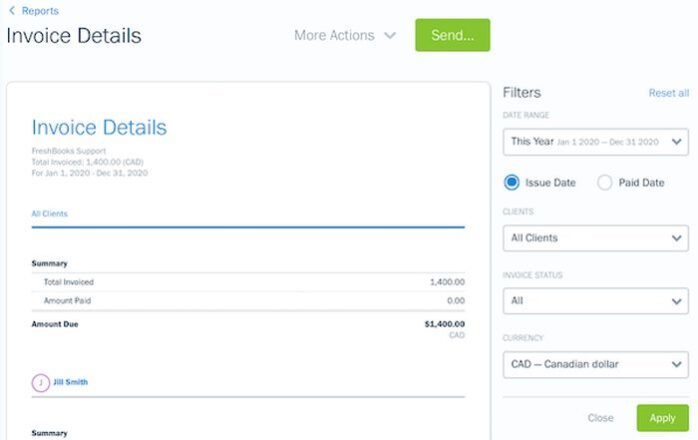

3. Invoice Details

Include the date you submit the invoice and an invoice number near the top of the contractor invoice. To keep track of the bills, you submit, use an invoice number.

You must give a unique invoice number to every invoice you produce. This is more significant than one might think. As it is simpler to refer to them, assigning invoice numbers might also assist you and your client in record keeping. Assigning a number is a terrific approach to organizing your past invoices if you wish to review any particular one.

Independent contractors can quickly find the invoice with these allocated numbers using current accounting software. The simplest way to give your invoices a number is to start at 1, as in #001, #002, and so forth.

4. Breakdown of Services

The services you provided will be described in full in the body of your contractor invoice. Here, being prepared for your client’s queries and giving them the information they need upfront can be helpful. Include a list of all the services or deliverables you completed, along with information on the quantity, rate, additional fees incurred, subtotal, total, and dates or hours spent. Ensure that this section is simple to read and comprehend. Always double-check your spelling, grammar, and math, and make sure the services you list are consistent with the initial terms you and your client agreed to.

Find a customizable standard contractor invoice template online if you don’t want to start from scratch. Choosing the best contractor invoice app will save you a lot of time.

5. Payment Details

A section with payment information serves as a handy reminder to your client of how and when to make payment. Include the terms and conditions, a due date, and information on how they can pay you. Once more, confirm that this information complies with the first contract you discussed and agreed upon.

Whenever You Recharge Your Expenses

Expenses you and your client or customer agreed to in advance may be reimbursable. If so, you must include these in your invoices to your client or customer at the seventh stage mentioned.

Before you recharge them, you’ll also need to “net down” the expenses. Please refer to our other article for information on recharging costs. This clarifies how the process of “netting down” operates. You will determine the total amount payable once the expenses have been accurately netted down and the VAT has been recovered.

Invoice payment – Image from pixabay by kreatkar

7. Notes

Think about adding a notes section. Although it could be simple to ignore, this aspect is essential. You might add a brief note here thanking them for their business or something more intimate. This space is available for your client to respond to further queries or remarks.

Tips for Faster Payment

1. Understand The Distinction Between Due And Owed

In the construction sector, lengthy billing and payment cycles are typical. A month later is usually the earliest that payments must be made. However, that does not exclude you from expecting that money sooner. In any case, you are billing for it because you deserve it. So it makes perfect sense to try to collect as soon as possible.

Due also implies due, according to this. Net 30 does not imply that the customer has 30 days to hold onto the invoice before reviewing it. It implies that after 31 days, it is past due. You have every right to demand that money when that day arrives, and you should fully anticipate it being in your account.

2. Use Discounts As Incentives

Successful contractors, however, have discovered that including discounts in their payment conditions can ensure that fewer invoices go unpaid. Once given up and recorded as “bad debt,” it is a 100% discount. Avoiding the expenditure and lost time associated with pursuing customers many months past due can be worth offering a little discount for early payment. A smaller cheque “in the mail” isn’t worth as much as one in your grasp.

3. Demoralize Late Payments

You are already falling short if you must exert pressure once invoices are past due. Instead, contractors might take the initiative and include late-payment fines in their contracts. These might include a portion of accruing interest on past-due sums. Additionally, it could outline your right to be reimbursed for the expenses incurred in pursuing unpaid debts.

4. Track Your Receivables Using Tools

They use spreadsheets to track who owes you what and when is challenging. It’s nearly impossible when using paper invoices. However, contractors can be sure that their work cost accounting software is always up to date with the most recent invoices and cash transactions when they can run aging reports directly from it.

By looking at these time intervals, you may better predict upcoming obligations and areas where uncollected receivables may restrict your cash flow. Additionally, having a single point of reference will provide your construction company with a single source of reality. That keeps everyone informed about the status of projects and which clients have already received invoices.

5. Implement Proactive Procedures

When no one is accountable for being aggressive with collections, it frequently leads to severe flaws in contractor cash flows. In practice, there is frequently no procedure at all. Project managers can think accounting will follow up. Accounting might believe the PM is in charge. A customer’s invoice is outstanding because no one has spoken to him in the past two months, and it is sitting on his desk.

Each construction business can choose what works best for its procedures, but the most excellent solutions are frequently the most straightforward. How long should it take, for instance, for customers to receive a 30-second courteous call? How many days should pass before a client receives an official email or letter? When will there be another follow-up? Customers frequently only need a polite reminder. They only need to be informed that someone is missing the check before they’ll be willing to send one over.

Conclusion

You might be able to create your invoices directly on the website if your business uses an online record-keeping system. Additionally, the system will provide all the accurate invoice facts for your small business if it happens. It will perform all the computations on your behalf. In addition to working out the VAT for you, this will include your chargeable time and the expenses you are recharging.