Prebiotic Ingredients Market: Health & Wellness Spending Continues to Create Opportunities

Prebiotics, often overshadowed by the massive popularity garnered by probiotics, are finally getting their due – our new research finds demand for prebiotic ingredients has grown at nearly 6% annually since 2015, propelling global sales to the US$ 4.5 billion mark in 2018. As the global dietary supplements industry fights a ‘perception battle’, prebiotics are emerging as a bright spot. However, it is also pertinent to note that prebiotics still command a market value that pales in comparison to their popular counterparts, the probiotics; this continues to be a challenge for prebiotic ingredients suppliers.

Prebiotic Ingredients Market – Buoyed by Consumer Preference for ‘Less-Marketing, More Science’

The surge in demand for prebiotic ingredients—although a recent phenomenon—is paradoxical. Over the years, many dietary supplements have faced a legitimacy crisis, as lack of scientific literature on their actual health benefits hasn’t been really forthcoming. However, armed with humungous marketing budgets, the dietary supplements industry has prodded along. And, the status-quo hasn’t entirely changed; instead, it has witnessed an evolution which has created space for ‘less-marketing, more-science’ based products—a playing ground more level and conducive for prebiotic ingredients manufacturers.

While consumer awareness and inquisitiveness about the scientific literature has helped prebiotic ingredients suppliers, the trust factor consumers once placed in probiotics is now being challenged. Scientific research, most notably from University of Copenhagen, has ruled that there is “lack of evidence” surrounding the actual health benefits of probiotics. The prebiotics industry has used these findings to ‘educate’ consumers on the benefits of using a combination of probiotics and prebiotics instead.

Request for Report Sample @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=452

Scramble Toward Asia Pacific in Prebiotic Ingredients Market – The ‘Switch’ from ‘Pro’ to ‘Pre’

As these perception battles support the momentum in the prebiotic ingredients market, gains have also been driven by a range of macro-economic factors, ranging from growing urbanization, increasing disposable income, and resurgency in retail sales. The impact of these broader factors has been especially palpable in the emerging countries of Asia Pacific.

The functional food and dietary supplement industry remained concentrated in North America and Europe for a long time. However, in the last decade or so, a new demographic of consumers in Asia Pacific has induced a scramble among the world’s biggest food and beverage brands. Currently, dietary supplements is a multi-million dollar business in Asia Pacific, and probiotics are easily available in hypermarkets and retail stores.

The plethora of opportunities emerging in Asia Pacific are not lost on prebiotic ingredients industry. However, to succeed in the highly lucrative and fiercely-competitive markets of Asia Pacific, a holistic strategy to capture market share from probiotic industry is required. In a region as cost-sensitive as Asia Pacific, all consumer awareness initiatives and marketing strategies can boomerang if product pricing is out of sync with consumer expectations.

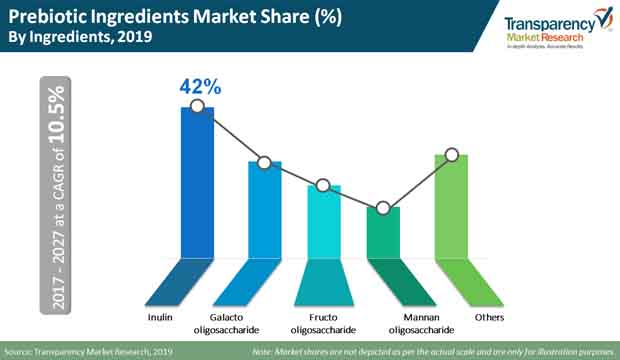

Asia Pacific also offers unique advantages in terms of sourcing prebiotic ingredients. Many countries in the region are agrarian, and the various prebiotic ingredients, including fructo-oligosaccharide, mannan-oligosaccharide, galacto-oligosaccharide, and inulin are easily available to prebiotic manufacturers. As is the case globally, inulin remains the ingredient of choice for prebiotic companies in Asia Pacific. Galacto-oligosaccharides and fructo-oligosaccharides follow suit, with mannan-oligosaccharides being the least preferred of all prebiotic ingredients.

Explore Transparency Market Research’S Award-Winning Coverage of the Global Food and Beverages Industry @ https://www.prnewswire.com/news-releases/ethylene-propylene-diene-monomer-epdm-market-to-reach-us-6-2-bn-by-2027-shift-towards-bio-based-materials-to-drive-market-growth-tmr-301001833.html

Prebiotic Ingredient Market – Consolidated Globally, Fragmented Locally

The prebiotic ingredients market shows varied a level of competitive landscape. On a global level, a handful of multinational companies account for a sizeable market share. However, regionally, and also on a country-wide level, smaller players hold sway. Prebiotic companies have to comply with a number of regulations, especially those outlining the marketing and advertising of the products. Guidelines on labelling are also present, which puts pressure on prebiotic ingredients suppliers to be transparent in how they source their products. The degree of competition is high in the prebiotics market, and considering the undercurrents impacting probiotics and dairy supplements, it is highly likely that the landscape will become more competitive during the course of the forecast period.

Request for Covid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=452

The companies profiled in this study on prebiotic ingredients market include Koninklijke FrieslandCampina N.V., Roquette Frères S.A., Kerry Group plc, Ingredion Incorporated, Cargill, Incorporated, Yakult Honsha Co.,Ltd., Cosucra Groupe Warcoing SA, BENEO GmbH, Fonterra Co-operative Group Limited, Sensus America, Inc., and Jarrow Formulas, Inc.