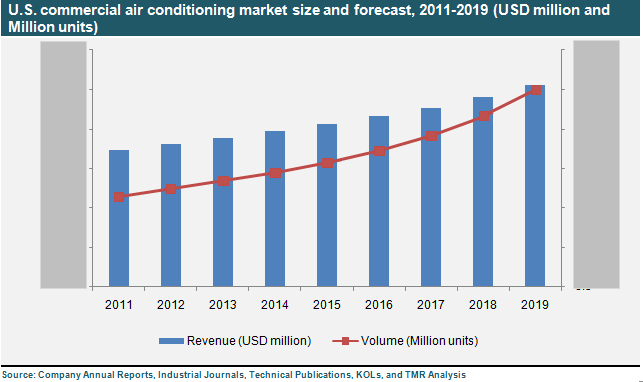

According to a recent publication by Transparency Market Research (TMR), “Commercial Air Conditioning Systems Market – U.S. Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 – 2019”, the U.S.commercial air conditioning market in the U.S. is projected to reach US$10,251.3 million by 2019, increasing from US$7,251.7 million in 2012. By revenue, the market will demonstrate a 5.2% CAGR from 2013 to 2019 and by volume, the market will grow at a 1.9% CAGR.TMR analysts state that worldwide, the commercial air conditioning systems market is experiencing substantial growth post the 2008 economic recession.

Further, late adoption of VRF in the U.S. has opened new opportunities for existing players, who have rapidly adapted to the demand for energy-efficient systems and are deploying VFR as an alternate solution, as stated by TMR analysts.The TMR study segments the U.S. commercial air conditioning market by product type into split systems, portable systems, window systems, single packaged systems, and other systems. Among all, split systems and single packaged systems are poised for healthy growth, with the two collectively accounting for 77.4% of the market in 2012. The main reason for growth of split systems is increasing usage of non-ducted systems owing to the flexibility, energy efficiency, and easy installation of the product type.

Request For Covid19 Impact Analysis Across Industries And Markets @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=2491

By technology, VRF systems are steadily establishing a foothold in the U.S. commercial air conditioning market. VRF systems offers the advantage of customizable temperature control for private, commercial, public, and industrial spaces for indoor environments, as pointed out in the research report.However, with the revival of the construction sector and standardization of VFR technology in the U.S., the adoption of the technology has eased in the commercial sector.Commercial air conditioning systems in U.S. find application in public, private, and industrial sectors. Amongst all, the private sector was the highest revenue generator in the market in 2012 on account of increased expenditure on energy-efficient systems in residential buildings and construction of new residential units.

Development in the construction sector positively impacts the commercial air conditioning systems market, with HVAC (heating, ventilation and air-conditioning) systems accounting for most of the revenue generated from new construction.Also included in the research report are profiles of key players in the U.S. commercial air conditioning market: Mitsubishi Electric Corporation, United Technologies Corporation, and Fujitsu General Pty Ltd., which collectively accounted for more than 50% of the market in 2012.