N-Methyl-2-Pyrrolidone Market Holds Multichannel Revenue Opportunities

The sales of consumer electronics are showing no signs of slowing down, implying that, manufacturers of electronic devices are investing toward the development of smart-sized products with better functionalities, which manages to attract the attention of consumers.

Investments made in the consumer electronics market, are, in turn, creating opportunities for the N-methyl-2-pyrrolidone market, given the rising demand for lithium batteries. According to stats published in a recent Transparency Market Research (TMR) report, ~74 thousand tons of the total N-methyl-2-pyrrolidone sold in 2018 was used for lithium battery manufacturing, which is projected to increase to ~23% by 2027.

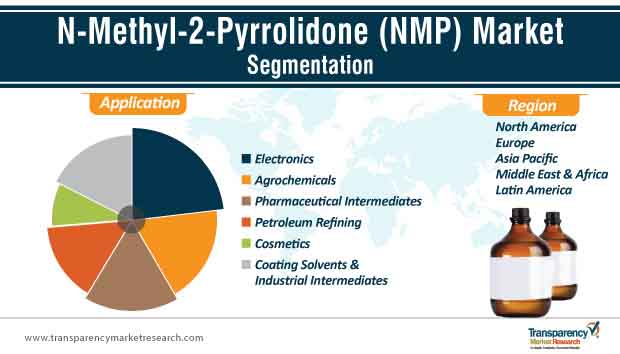

The agrochemical industry will also hold profitable opportunities for players in the NMP market. As concerns regarding the use of toxic pesticides are surfacing, agrochemical players are rethinking about their products in terms of inactive chemicals, which has been adding sheen to the popularity of N-methyl-2-pyrroline for the formulation of herbicides and pesticides. To add to that, the distinguished properties of NMP are also found to resonate well with pharmaceutical, cosmetic, coating and solvent, and petrochemicals industries, which portends multichannel revenue prospects for the N-methyl-2-pyrrolidone market during the period of 2019-2027.

Get an idea about the offerings of our report from Report Brochure

Key Growth Challenges for N-Methyl-2-Pyrrolidone Market

Despite the above-average growth trajectory that the N-methyl-2-pyrroline market has been tracing, threat from the possible substitute – Dimethyl Sulfoxide (DMSO) – could scale down the size of its potential revenue. Though N-methyl-2-pyrroline has crucial applications in the aforementioned industries, DMSO, with the same properties, is reported to outscore in safety regards, whereas, NMP has attracted regulatory mandates.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=2405

In the State of California, as per Proposition 65, products containing NMP must be labeled as a developmental toxin. In contrast, DMSO has not been ‘Prop 65’ listed. The regulatory pressure for mandatory NMP level labelling is also mounting in Europe and the U.S., which could possibly create opportunities for DMSO.

To gauge the scope of customization in our reports Ask for a Sample

Invest in Recycling Systems – A Smart Cost-cutting Strategy for Producers

With massive uptake in the sales of NMP for manufacturing electronic devices, tons of waste is generated, which is recklessly disposed. However, the introduction of recycling systems is likely to have a profound reduction in the production cost. Several manufacturers, such as Clean Planet, offer solvent recyclers that ensure optimum recovery of the material with the highest possible quality.

The penetration of such efficient systems is likely to bring down the cost expended towards the purchase of raw materials. Taking a cue from the profit-making opportunity, several players in the N-methyl-2-pyrrolidone market are incorporating NMP recyclers to achieve ~99% recovery of the chemical and reduce harmful emissions from unorganized disposals.

Analyzing Investment Opportunities in Key Regions

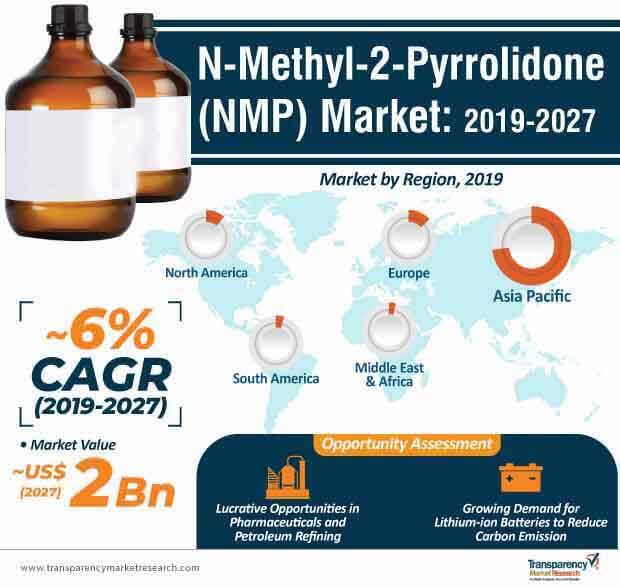

While the EU recommends limited use of NMP in cosmetic products, gains for the N-methyl-2-pyrrolidone market in Europe will arrive from the semiconductor industry. An underway shift from fossil fuel-based vehicles toward hybrid and electric vehicles in the region is also likely to create opportunities for market players. However, in terms of lithium battery production, Asia Pacific holds prodigious opportunities, considering the global influence of the Chinese consumer electronics market, coupled with the emission control projects taken up by the governments of numerous countries in this region.

Despite the stringency in emission regulations, marked market growth is also projected in North America, with the pharmaceutical industry being the leading NMP consumer. In Latin America, market players need to focus on the agrochemical industry for creating sales prospects, since high soil acidity leading to poor soil fertility has been challenging the efficiency of conventional fertilizers, which could indirectly draw significant revenue from the tropical agriculture sector.

In the MEA market, government initiatives extended towards encouraging consumers to purchase zero-carbon electric vehicles through green bank loans and green insurance plans are likely to upkeep the rising demand for lithium batteries, in particular, and N-methyl-2-pyrrolidone, in general.

Looking for Regional Analysis or Competitive Landscape in N-Methyl-2-Pyrrolidone Market, ask for a customized report

Analysts’ Take

Authors of the report estimate that, the N-methyl-2-pyrrolidone market will expand at a healthy CAGR of ~6% during the forecast period of 2019-2027. Asia Pacific remains a fragmented, yet attractive market, with the concentration of ~65% of the total producers in China, India, Japan, ASEAN countries, and other parts of the region. While market players will face limited threats from new market entrants, given high CAPEX and OPEX requirements, the threat of substitutes will continue to be of high concern.

Expansion of production facility, innovation in production process, and development of different grades of NMP have been the key strategies devised by players in the N-methyl-2-pyrrolidone market. In contrast to this, examples of inorganic growth in the NMP market through acquisitions and mergers are limited.

N-Methyl-2-Pyrrolidone (NMP) Market Description

- N-methyl-2-pyrrolidone is used in petrochemical and plastic industries as a solvent, owing to its properties such as no volatility and ability to dissolve in any kind of fluid.

- N-methyl-2-pyrrolidone is a polar organic solvent that is primarily used to enhance a chemical reaction with the help of its high solvency and low volatility characteristics. Prominent applications of N-methyl-2-pyrrolidone include electronics, agrochemicals, pharmaceutical intermediates, petroleum refining, cosmetics, and coating solvents & industrial intermediates.

- The global N-methyl-2-pyrrolidone market was valued at ~US$ 1.1 Bn in the year 2018.

- Increasing at a CAGR of ~6%, the global N-methyl-2-pyrrolidone market is projected to reach a value of ~US$ 2 Bn by the end of 2027.

Key Growth Drivers of N-Methyl-2-Pyrrolidone Market

- The global NMP market is anticipated to expand at a significant pace during the forecast period, as the governments of various countries have imposed regulations on CO2 emissions. Regulations coupled with increase in initiatives are boosting the sales of electric vehicles. This is anticipated to fuel the demand for lithium-ion batteries in the near future.

- N-methyl-2-pyrrolidone is used in the manufacturing of lithium-ion batteries, as it acts as a solvent for electrode binders between a metal foil, and also as an active material for positive/negative electrode agents. Stringent solvation is required for the manufacturing of lithium-ion batteries in a dry atmospheric environment. Thus, the rise in the manufacturing of lithium-ion batteries will propel demand in the N-methyl-2-pyrrolidone market space.

Key Growth Challenges for N-Methyl-2-Pyrrolidone Market

- Regulations on the usage of N-methyl-2-pyrrolidone is expected to restrain its market. NMP can cause health and reproductive problems, which is likely to hamper its usage in the near future. This factor has also led to a ban in the European Union (EU) for its usage in new processes. Currently, regulations on the use of N-methyl-2-pyrrolidone have been imposed in Europe, North America, and Australia; however, no such regulations have been laid down in Asia Pacific.

- The health risks associated with the manufacturing of N-methyl-2-pyrrolidone include the risk of stillbirth and stunted growth of the fetus in pregnant workers, and respiratory issues. Additionally, N-methyl-2-pyrrolidone has been classified as a skin, eye, and possible respiratory irritant and repro-toxic under the category 1B (defined as substances presumed to be toxic for human reproduction). Hence, the health hazards associated with its usage are expected to restrain the growth of the N-methyl-2-pyrrolidone market.

Lucrative Opportunities in Global N-Methyl-2-Pyrrolidone Market

- Increase in the demand for N-methyl-2-pyrrolidone from the pharmaceutical, petrochemical, and agrochemical sectors is providing lucrative opportunities for the N-methyl-2-pyrrolidone market. NMP acts as a strong solubilizing agent and an excipient in the pharmaceutical sector. It is primarily used in parenteral and oral medications. It is mainly used in the extraction, purification, and crystallization of drugs, owing its higher solvency.

- N-methyl-2-pyrrolidone is also used as a penetration enhancer in human and animal parenteral dosage. It is used as a medium for extraction in industrial processes, which includes butadiene recovery and BTX extraction, and lube oil purification in the petrochemical sector due to its affinity for unsaturated hydrocarbons and aromatics. N-methyl-2-pyrrolidone is used as co-formulant in herbicide, pesticide, and fungicide formulations in the agrochemical industry. As such, the global N-methyl-2-pyrrolidone market is projected to increase at a decent pace over the forecast period.

Asia Pacific to Dominate N-Methyl-2-Pyrrolidone Market

- In terms of volume as well as value, Asia Pacific accounted for a significant share of the global N-methyl-2-pyrrolidone market in 2018. Expansion of electronics and semiconductor industries is expected to offer lucrative opportunities to the NMP market during the forecast period.

- The production of lithium-ion batteries and semiconductors is increasing in China, Japan, India, and South Korea. This is expected to fuel the consumption of N-methyl-2-pyrrolidone in the region. In terms of production, China and Japan accounted for a major share of the N-methyl-2-pyrrolidone market in Asia Pacific. Counties such as Taiwan and South Korea, are expected to drive the consumption of N-methyl-2-pyrrolidone in Asia Pacific.

Electric Vehicles Offer Growth Opportunities for N-Methyl-2-Pyrrolidone Market

- LyondellBasell Industries N.V. uses propylene oxide as a raw material to produce butanediol, which is further used to manufacture N-methyl-2-pyrolidone. On August 22, 2018, the company announced its plans to open a new manufacturing plant for propylene oxide (PO) and tertiary butyl alcohol (TBA). This new facility is estimated to cost US$ 2.4 Bn, and is likely to manufacture 1 billion pounds (470,000 metric tons) of propylene oxide (PO) and 2.2 billion pounds (1 million metric tons) of tertiary butyl alcohol (TBA) every year. The plant is likely to become operational by 2021 at the Texplast facility in Wolfen.

- In 2017, SK Innovation Co. Ltd. invested US$ 919.12 Mn toward the expansion of its electric vehicle (EV) battery and lithium-ion battery separator (LiBS) sectors. The company is expected to invest US$ 183.82 Mn to expand its LiBS production facilities at the information electronic material plant in Jeungpyeong County, North Chungcheong Province, and its EV battery plant in Seosan, South Chungcheong Province of South Korea.

- In January 2016, BASF SE and Xinjiang Markor Chemical Industry Co., Ltd. (Markor) opened a new butanediol (BDO) production plant in Korla, China. This plant has an annual production capacity of 100,000 tons of butanediol. It is operated by a joint venture between Markor and BASF, which is registered as Markor Meiou Chemical (Xinjiang) Co., Ltd.

Leading Players in Global NMP Market

Key players operating in the global N-methyl-2-pyrrolidone market are

- LyondellBasell Industries N.V.

- BASF SE

- Mitsubishi Chemical Holdings Corporation

- Ashland Global Holdings Inc.

- Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd.

- He Fei Teng Chao Chemical Material Co., Ltd.

- Puyang Guangming Chemicals Co., Ltd.

- BALAJI AMINES LTD.

- Eastman Chemical Company

- Jiaozuo Zhongwei Special Products Pharmaceutical Co., Ltd.

- Shandong Zejiada Environmental Protection Technology Co., Ltd.