Chloromethane Market: Business Diversification and Strategic Expansion – Key Market Strategies

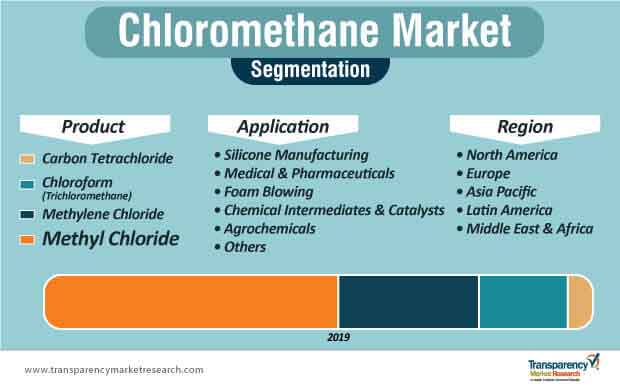

Chloromethanes are being increasingly used for end-to-end applications in the pharmaceutical industry, and also for water treatment. Likewise, chloromethane molecules such as methyl chloride are being extensively used to produce construction material and agricultural products. The growing demand for methyl chloride is well justified, as the product is estimated for a revenue of ~US$ 2.4 billion by 2027; highest revenue in the chloromethane market.

Since most countries in Asia Pacific are developing economies, manufacturers should scale up their businesses in this region. Thus, market growth is catalyzed by the increasing number of water treatment plants in these developing economies. Due to population growth and the growing demand for clean water, manufacturers in the chloromethane market are producing methyl chloride polymers that are universally and categorically used in water treatment plants.

Manufacturers in the chloromethane market are devising strategic expansions in Europe. For instance, in April 2019, Nouryon – a producer of specialty chemicals, announced that the company is planning to start work on chloromethanes in Germany. Thus, manufacturers are executing plans to boost their production by introducing new equipment and upgrades that help to significantly increase the capacity of molecules for the development of high-quality products.

To gauge the scope of customization in our reports Ask for a Sample

Maintenance of Steady Supply Chain Results in Long-term Returns

Established companies in the chloromethane market are scaling the extra mile to gain a competitive edge over each other. These efforts include expanding their manufacturing plants in high-growth regions, while continuing to work in existing installations to maintain a steady supply chain to various end markets. Manufacturers in the chloromethane market can ensure long-term and profitable returns by working closely with stakeholders in the healthcare ecosystem. This is because they can provide their products to pharmaceutical customers through a special pipeline process.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=52272

Manufacturers in the chloromethane landscape are investing in automated processes to enhance their production capabilities. By eliminating the manual intervention of pumps and valves, manufacturers are aiming to make production a safe process, and take this opportunity to customize their process according to the varying demands in the market.

Get an idea about the offerings of our report from Report Brochure

Chloromethane Manufacturers Expand Business in Silicone Manufacturing

The chloromethane market is highly fragmented. This is evident because in 2018, the chloromethane market was dominated by emerging players holding a ~71% market share, whereas, ~29% of the holdings were accounted for by major players in the landscape.

Since the chloromethane market is relatively easy to enter for emerging market players, manufacturers are expanding their business by teaming up with stakeholders in the silicone manufacturing space. Silicone manufacturing accounts for the highest production in the chloromethane market, with an estimated output of ~3,151,000 tons by the year 2027. Thus, major credit for the market’s expansion in the coming years can be credited to the high use of silicone in biocompatible and medical applications.

However, manufacturers in the chloromethane landscape find it challenging to obtain good quality elemental silicon that is used as a synthetic substance in microfluidics, breast implants, contact lenses, and the like. Hence, they are improving their production processes to efficiently execute synthesizing and distilling silane intermediaries to develop high-quality products.

Looking for Regional Analysis or Competitive Landscape in Chloromethane Market, ask for a customized report?

Analysts’ Viewpoint on Chloromethane Market

Since countries are rapidly transforming their healthcare infrastructure, the market will experience an increasing demand for chloroform (trichloromethane) in anesthetic and other medical applications. Manufacturers can gain novelty by increasing the production of carbon tetrachloride, since it is one of the main molecules used for the chemical synthesis of agrochemicals and solvents for special industrial synthesis.

However, the purification of silane intermediaries from a huge mixture of different reaction products is a challenge for manufacturers. Hence, they are acquiring advanced chemistry knowledge to gain expertise in the hydrolysis and polymerization processes to deliver superior-quality products.

Manufacturers can tap into opportunities such as increasing the availability of chloromethane for the decaffeination of coffee, which can serve as a profitable source for business income. They should focus on expanding their business in growing applications such as refrigerants, antibiotics, and agricultural products.

Chloromethane Market: Product Introduction

- Chloromethane possesses flammable characteristics. It is one of the major types of haloalkane in the chemical industry, owing to its key derivatives such as methyl chloride, methylene chloride, chloroform, and carbon tetrachloride. Chloromethane also is known by its derivatives such as methylene chloride, chloroform, and carbon tetrachloride.

- Chloromethane is prepared by the reaction between methanol and chlorine that forms methyl chloride. This methyl chloride is used to react with chlorine to further produce its derivatives, such as methylene chloride, chloroform, and carbon tetrachloride. Chloromethane products are used in key applications in several end-use industries such as silicone manufacturing, pharmaceuticals & medical, agrochemicals, chemical solvents, and rubber. Rapid industrialization in emerging economies is expected to boost the chloromethane market in the near future.

Global Chloromethane Market: Highlights

- In terms of value, the global chloromethane market is estimated to expand at a CAGR of ~4%, to reach ~US$ 3 Bn at the end of the forecast period. Asia Pacific was the leading region of the chloromethane market in Asia Pacific in 2018, owing to the high demand for chloromethane in the region. The market in Asia Pacific is anticipated to expand at a significant CAGR of 4.5% from 2019 to 2027.

- Increase in the consumption of chloromethane in silicone, medical & pharmaceutical, and agrochemicals industries is projected to boost the chloromethane market in the near future. China is one of the prominent manufacturers and exporters of chloromethane across the globe, due to the presence of key manufacturers in the country, large production capacity, and established supply chain in other countries. China is also one of the major consumers of chloromethane, due to the high demand for chloromethane in end-use industries in the country.

- On April 05, 2019, Nouryon, a Germany-based subsidiary of Akzo Nobel N.V., announced plans to construct a new manufacturing facility to increase the production of chloromethane in Frankfurt, Germany. This strategic implementation of capacity expansion is likely to help meet the demand for chloromethane in various end-use industries.

- In 2017, Nouryon expanded the production capacity of chloromethane and its derivatives by 30% in Germany. This move is expected to help meet the demand for chloromethane in several end-use industries in the country.

Methyl Chloride to Offer Attractive Opportunities for Chloromethane Market

- Based on product, the methyl chloride segment constituted a major share of the global chloromethane market in 2018. The segment is estimated to maintain its dominance during the forecast period. Mono-chloromethane, also known as methyl chloride, is employed in key applications as a raw material to produce methylate silicone and other silicones around the globe. Increase in the consumption of silicones in various products such as adhesives, sealants, resins, and elastomers is projected to boost the demand for chloromethane during the forecast period.

- Based on product, chloroform was a highly lucrative segment in 2018. It is estimated to maintain its lucrativeness during the forecast period. Chloroform, or trichloromethane, is extensively used in the medical industry as a strong anesthetic compound across the world. Trichloromethane is used in various important applications in medical and pharmaceutical products. It is primarily employed in various chemical reactions and laboratory processes to prepare medicines and drugs. This factor is projected to boost the chloromethane market in the next few years.

High Demand for Chloromethane in Silicone Manufacturing Application to Boost Growth

- Based on application, silicone manufacturing was a highly lucrative segment of the global chloromethane market in 2018. High consumption of chloromethane was majorly driven by silicone manufacturing to produce methylate silicones. Increase in the demand for chloromethane in silicone manufacturing is anticipated to boost the chloromethane market during the forecast period.

- The medical & pharmaceuticals segment is likely to expand significantly during the forecast period, owing to the rise in the demand for generic medicines that are prescribed as over-the-counter medications. Increase in the demand for chloromethane in applications such as chemical solvents, analytical processes, and laboratory chemicals is expected to augment the global chloromethane market during the forecast period.

Chloromethane Market: Key Regional Highlights

- In terms of value and volume, Asia Pacific accounted for a prominent share of the global chloromethane market in 2018. Major countries in the region, such as China, Japan, and India, gained key share of the market in 2018.

- China is anticipated to maintain its leading position, owing to the increase in the demand for silicone, medical & pharmaceutical, and agrochemical applications in the next few years. China has become a top chloromethane manufacturing country in the world, due to the rise in domestic consumption of chloromethane in end-use industries. The chloromethane market in Asia Pacific is projected to expand at a rapid pace during the forecast period.

- North America also has an important share of the global chloromethane market in 2018. The market in the region is estimated to expand at a sluggish pace, owing to the presence of stringent government regulations in chloromethane applications. The U.S. held a prominent share of the chloromethane market in North America in 2018, due to the vast production, supply, and import-export of chloromethane across the country. Rise in the consumption of chloromethane for usage in laboratory and medical applications in the country is projected to drive the chloromethane market during the forecast period.

- After Asia Pacific, Europe held a key share of the global chloromethane market in 2018. Europe witnesses a strong presence of the Montreal Protocol and stringent regulatory norms for chlorinated products. This is expected to drive the chloromethane market in Europe at a sluggish pace during the forecast period.

Global Chloromethane Market: Competition Landscape

- The global chloromethane market is fragmented due to the presence of regional and local players. Major manufacturers are focusing on expansion of their production capacities to suffice the demand for chloromethane in end-user industries across the globe.

- Key players operating in the global chloromethane market include –

- Dow Chemical Company

- AGC Chemicals

- Gujarat Fluorochemicals Limited

- The Sanmar Group

- Nouryon

- Occidental Petroleum Corporation

- KEM ONE

- Shin-Etsu Chemical Co., Ltd.

- Other major vendors are

- Gujarat Alkalies and Chemical Limited

- Spectrum Chemical Manufacturing Corp.

- Krunal Acid Agency

- Mitsubishi Australia Ltd.

- Tokuyama Corporation

- SRF Limited

- Benzer Multi Tech India Private Limited.