COVID-19 Pandemic Stalls FCC Summit Focused on Cost-effective Deployment of vRAN

The cancellation and postponement of events have been a recurring phenomenon in the virtualized RAN (vRAN) market due to the coronavirus (COVID-19) outbreak. For instance, the FCC (Federal Communications Commission) Summit, which was originally scheduled for March 26, 2024, was focused on 5G and the vRAN technology, and has been stalled due to the COVID-19 pandemic. Analysts at the Transparency Market Research (TMR) opine that companies in the virtualized RAN (vRAN) market and the FCC should make collaborative efforts to conduct online summits to discuss important aspects of 5G and the vRAN technology.

vRAN vendors are exploring incremental opportunities in the U.S. by addressing issues related to the cost-effective deployment of secure and interoperable 5G network components. As such, the FCC is increasing efforts to ensure the safety and health of its staff and the public to contain the spread of coronavirus.

Purchase our Premium Research Report At:https://www.transparencymarketresearch.com/checkout.php?rep_id=58146<ype=S

Single vRAN Hardware Platforms Help Reduce Operations and Maintenance Costs

Software architectures are penetrating in almost all markets, be it telecommunication, government, or defense sectors. However, significant challenges such as processing and timing requirements are very crucial for the deployment of vRAN. Processing and timing requirements are the deciding factors for RAN capacity and coverage. Thus, the advantages of vRAN such as the deployment of the single uniform hardware platform across the core network, potentially offsets the disadvantages of vRAN. Singular hardware platforms help to simplify the management of the overall network whilst reducing operations and maintenance costs.

In order to help end users save on network maintenance costs, companies in the virtualized RAN (vRAN) market are innovating in platforms that separate the network functions from the processing hardware. This helps multiple vendors to simultaneously run their RAN network functions through a single hardware.

Get More Press Releases by TMR: https://www.prnewswire.com/news-releases/long-term-health-hazards-loss-of-natural-habitat-of-terrestrial-aquatic-animals-due-to-rise-in-air-pollution-levels-drives-growth-in-air-quality-monitoring-equipment-market-valuation-projected-to-surpass-us-4-7-bn-by-2031–opi-301284496.html

Edge Computing Deploys 5G Networks for Wireless Data Transmission and Network Standardization

5G networks are accelerating investments in the virtualized RAN (vRAN) market. As such, edge computing is a hot technology buzzword among communication service providers (CSPs) and enterprises in order to develop and execute strategies that involve huge volumes of data. This is why Intel-a U.S. multinational corporation and technology company, is increasing efforts to look beyond the conventional open systems interconnection (OSI) model to innovate in virtualized RAN. In order to achieve this, companies in the virtualized RAN (vRAN) market are delivering multi-vendor virtualization so that protocols and software can be standardized across the industry.

Companies are looking into reference architectures that help them to innovate in software-based radio base stations. 5G networks are becoming popular for wireless data transmission such as LTE (Long Term Evolution) and also aids in workload acceleration. Leading companies are entering into partnerships to support diverse enterprises and cater various network end-use cases.

Virtualized RAN Helps Execute Mission-critical Tasks through Mobile Phone Devices

The virtualized RAN (vRAN) market is estimated to surpass the US$ 6.4 Bn mark by the end of 2030. This is evident since 4G and 5G networks are deploying innovations in cutting-edge virtualized RAN (vRAN) platforms. Global data networks innovator Sterlite Technologies Limited (STL) has announced to acquire stake in ASOCS-a provider of virtualized RAN solutions, which will help to address the rollout of 5G networks in telcos and other enterprises. Commercial off-the-shelf IT hardware and open standards complaint radios are paving the way for further investments in the virtualized RAN (vRAN) market.

The 5G network aids in the execution of mission-critical tasks and help deliver liability in localized private networks. Artificial intelligence (AI) and analytics are growing prominent in virtualized RAN platforms that derive benefits for mobile use cases.

Next-gen 5G Networks Hold Promising Potentials in Delivery of Multiple Input/Output Capacities

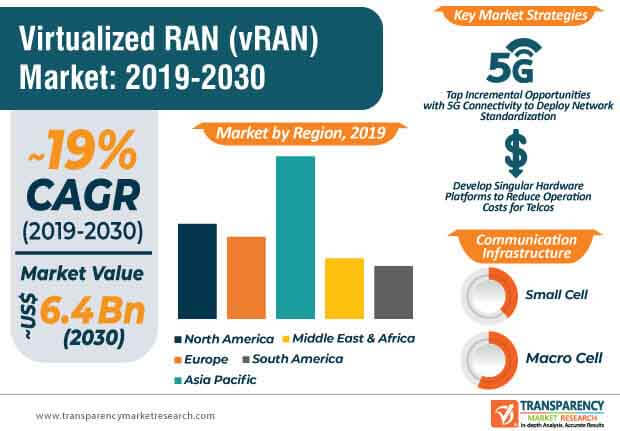

5G is being publicized as the next-gen mobile technology that helps CSPs to accommodate heavy traffic loads. This explains why the virtualized RAN (vRAN) market is projected to register an explosive CAGR of ~19% during the assessment period. 5G is being looked as the engine that enables CSPs to achieve cost reduction in terms of managing dynamic networks and services. Key success drivers such as enhanced mobile broadband (eMBB) and massive machine type communications (mMTC) are creating value-grab opportunities for companies in the virtualized RAN (vRAN) market.

Analysts of TMR are anticipating quick response times and fast network speeds with the deployment of 5G in virtualized RAN platforms. vRAN is acquiring popularity for its contribution toward high spectral efficiency that supports multiple input and output capacities in devices. It also holds promising potentials in supporting multiple use cases that demand diverse performance requirements.

Cloud-native Microservice-based Architecture Improves Economics of 5G RANs for MNOs

The cloud-native 5G RAN software is being upgraded to offer efficient network scalability. For instance, in February 2024, Altiostar-a provider of 4G and 5G virtualized RAN software solutions, announced the launch of first-of-its-kind container-based open 5G vRAN software, which is fast to deploy in end-use cases and deploys scalability for mobile network operators (MNOs). As such, mobile companies are collaborating with vendors in the virtualized RAN (vRAN) market to deploy virtualized mobile networks using cloud-based RAN platforms. Likewise, mobile companies are focusing on launching 5G networks to leverage cloud infrastructures.

Containerized applications using virtualized RAN software have helped to develop 5G services that are more responsive toward consumer needs. Virtualized RAN solution providers are collaborating with world leaders in the IT industry to innovate in the cloud-native containerized radio access technology. A cloud-native microservice-based architecture improves economics and scalability of 5G RANs for MNOs.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Virtualized Radio Access Network (vRAN) Market

Virtualized RAN (vRAN) Market: Overview

- The virtualized RAN (vRAN) market is expected to register a CAGR of ~19% between 2020 and 2030. The market is projected to be driven by the deployment of 5G network services across the globe.

- The global virtualized RAN (vRAN) market is expected to reach US$ 6.4 Bn by 2030 from US$ 1.1 Bn in 2020. Increasing adoption of digitized technology and IoT connected devices, and increasing data traffic is expected to drive the growth of the market.

- The virtualized RAN (vRAN) market in Asia Pacific and Europe is anticipated to expand at a rapid pace during the forecast period, followed by North America and Middle East & Africa

- Asia Pacific remained the dominant leader in the global virtualized RAN (vRAN) market in year 2019, primarily due to rapid adoption of the 5G technology in South Korea, China, and Japan

- North America is projected to witness significant growth in the global virtualized RAN (vRAN) market during the forecast period. Increased Internet and data traffic is expected to drive the consistent growth of the North America virtualized RAN (vRAN) market.

Key Growth Drivers of Virtualized RAN (vRAN) Market

- Rising Investments in 5G – In this technological era, wireless networking is gaining major importance across all industries in order to fulfill the challenges of the future. Faster networking data rates, lower latencies, and higher bandwidth are major requirements across industries in order to expand business operations. Private LTE and 5G networking are supporting these requirements. The investment on 5G infrastructure is expected to have a positive impact by increasing R&D activities and product innovation. Following are the companies that are building the value chain of 5G networking and can help in pioneering the 5G market:

- OEMs for edge computing and data centers: Huawei Technologies, Dell EMC, Cisco Systems, Hewlett Packard Enterprise, IBM, Lenovo, Pure Storage

- Suppliers of edge compute components and datacenters: Broadcom, NVIDIA, Qualcomm, Advanced Micro Devices, Intel, Samsung Electronics, Xilinx

- Providers of network transformation: Nokia, Ericsson, Huawei Technologies, Intel, National Instruments, Samsung Electronics, ZTE

- Suppliers of IP and modems: Ericsson, Nokia, Intel, Huawei, Qualcomm, Samsung Electronics

Contact us:

Transparency Market Research

State Tower,

90 State Street, Suite 700,

Albany NY – 12207,

United States

Tel: +1-518-618-1030 Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

https://todaysmarkettrends.wordpress.com