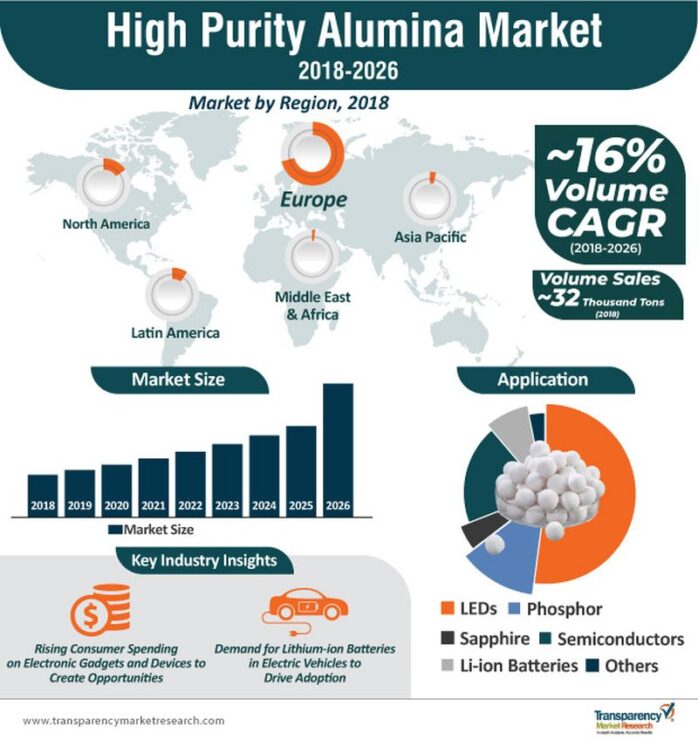

The Global High Purity Alumina (HPA) Market is forecast to reach USD 11.32 billion by 2027. The major factors contributing to this growth is the increase in its usage in applications like LED lighting, semiconductors, lithium-ion batteries, photovoltaic cells, phosphor, optical lenses, biomedical device, and others. The increase in the production of electric vehicles is also driving the industry.

HPA is used for producing sapphire ingots that are used in products like LED lights or semiconductors. Governments around the world are trying to promote energy-efficient lighting systems, and this is providing a huge boost to the LED segment. The increasing adoption of LED lights is having a positive impact on the market under study. The growing popularity of electric vehicles is forcing automobile manufacturers to focus on the manufacturing of electric as well as hybrid vehicles. Electric Vehicles have lithium-ion batteries that contain high purity alumina, and thus, the growth of the electric vehicle segment is predicted to drive the industry’s growth further. HPA also finds high usage in the semiconductor industry as it is used in the fabrication of semiconductor devices.

The production of HPA involves a lot of costs, which is somewhat restraining the industry’s growth. For this reason, major players of the industry are trying to come up with innovative solutions in order to make the production process as cost-effective as possible.

Reasons for Buying this Report:

- The report focuses on market share, market size, revenue share, industry growth rate, regional bifurcation, and overall industry outlook.

- The study provides pin-point analysis for changing competitive dynamics.

- The report helps readers in understanding the product segments and their future growth.

- Analysts in this research report can quickly expand their business by focusing on various business and market strategies.

- It helps in making informed business decisions by having complete insights of market and by making in-depth analysis of market segments.

- PEST analysis of the market in the five major regions.

Further key findings from the report suggest

- The 5N type of HPA has a purity level of 99.99%. It possesses properties like scratch resistance, chemical stability and strength, which makes it suitable for the production of sapphire. Polar Sapphire is a major manufacturer of this variant of HPA.

- Over the years, the semiconductors application segment is continuing to have the second largest market share. It is forecasted to witness a steady growth during 2024-27. Plasma display panels consists of phosphor coatings which is also driving the segment’s growth.

- In the HCL Leaching process, hydrochloric acid is used instead of caustic soda in order to extract alumina from clay. The product is extracted by acid-leaching using HCL at high temperature and then applying pressure. This process does not find much use in manufacturing processes of different companies but have very good future prospects.

- North America is expected to witness a considerable amount of growth during the forecast period. Increasing demand of LED lighting systems and the adoption of electric vehicles to a large extent is boosting the industry’s growth in this region. In 2016, Orbite Technologies announced the construction of a new HPA plant in Canada which would cost around USD 122 million.

- There have been a number of new product launches in the market amongst which 4N HPA Powder of Sapphire grade by Altech Chemicals Limited and Milled Alpha Powder, Spray Dried Alpha Powder, Compressed Pucks, High Purity Alumina Beads by Polar Sapphire Limited require special mention.

- There have been a number of M&A in the industry in 2019 like PARTNER Capital Group acquiring Aviles and La Coruna plants from Alcoa Corporation, Altech Chemicals Ltd acquiring 29% stakes of Youbisheng Green Paper AG, Baikowski acquiring Mathym SAS and Norsk Hydro ASA acquiring Technal Middle East.

For the purpose of this report, Reports and Data have segmented into the global High Purity Alumina market on the basis of type, application, manufacturing process and region:

Regional Outlook (Revenue, USD Billion; 2024-2027) (Kilo Tons)

- North America

- Europe

- Asia Pacific

- MEA

- Latin America

Type Outlook (Revenue, USD Billion; 2024-2027) (Kilo Tons)

- 4N

- 5N

- 6N

Application Outlook (Revenue, USD Billion; 2024-2027) (Kilo Tons)

- LED Bulbs

- Semiconductors

- Lithium-Ion Batteries

- Optical Lenses

- Bio Medical Devices

- Others

Manufacturing Process Outlook (Revenue, USD Billion; 2024-2027) (Kilo Tons)

- Hydrolysis

- HCL Leaching

- Thermal Decomposition

- Vapor-Phase Oxidation

- Others