- Financial services CRM focuses on building and managing relationships through contact and account databases, organization tools, and automated workflows. Moreover, financial services CRM focuses on streamlining key financial workflows in order to provide closer integration with financial accounts that include investments, loans, and lines of credit.

- Financial services CRM includes two main systems: Industry-specific CRMs and multi-purpose CRMs. Industry-specific CRMs are geared toward investing, banking, insurance, or other investing firms to provide business intelligence modules or social integration. Multi-purpose CRMs are utilized to provide financial links and workflows with other back-end systems.

- The COVID-19 outbreak has been a primary catalyst for the expansion and rise in adoption of financial services CRM. Governments of various countries across the world have imposed lockdowns to curb the spread of the disease. This has prompted financial services CRM providers to provide banking related support with the use of digital tools and remote channels to their customers. This can be used to build new experiences to support their customers to manage debts and investments during this pandemic outbreak. This, in turn, is expected to boost the global financial services CRM market. Moreover, customers are choosing to manage their finances, insurance, and investment activities from home during the COVID-19 outbreak, which is expected to create significant opportunity for the global financial services CRM market.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=81590

Global Financial services CRM Market: Market Dynamics

- Rise in need for CRM solutions to manage financial services in the financial service industry and support customers in the field of banking, insurance, and mortgage lending is expected to boost the global financial services CRM market

- Increase in the penetration of insurance, investment, and credit management in developing countries, especially in rural areas, is expected to fuel the financial services CRM market

- Increase in need for financial services CRM to help financial companies boost their assets under management (AUM), in order to build strong relationships with all stakeholders, is projected to boost the financial services CRM market

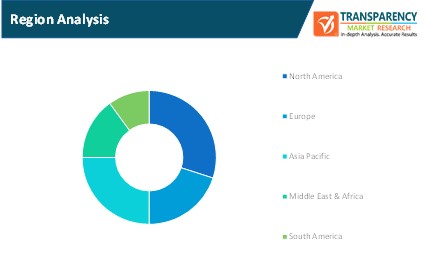

North America to Account for Major Share of Global Financial Services CRM Market

- In terms of region, the global financial services CRM market can be divided into North America, South America, Europe, Asia Pacific, and Middle East & Africa

- North America is expected to lead the global financial services CRM market during the forecast period, due to the presence of well-established players that offer integrated services, sales, and marketing solutions in the U.S. and Canada

- The financial services CRM market in Europe is anticipated to expand in the client information management system in near future, which empower business productivity while streamlining finance management in the region

- Asia Pacific is expected to hold a significant share of the global financial services CRM market in the near future due to expansion of generating personalized customer experience across all banking and investment departments, through all channels of communication in developing countries such as China and India. Additionally, governments of developing countries are collaborating with the banking industry to improve financial services for its customers. This is projected to fuel the financial services CRM market in Asia Pacific.

Ask for brochure:

Global Financial Services CRM Market: Competitive Landscape

Key Players Operating in Global Financial Services CRM Market

Companies operating in the global financial services CRM market are increasingly investing in research and development activities to develop new and innovative techniques to provide financial services CRM solutions. The global financial services CRM market is highly fragmented, with the presence of numerous manufacturers in developed and developing regions. Key players operating in the global financial services CRM market include:

- Backstop Solutions Group, LLC.

- Cetrix Cloud Services.

- Creatio.

- CRMNEXT,

- ELINEXT

- Microsoft Corporation

- Pegasystems Inc.

- Redtail Technology.

- Rolustech

- Sage Software Solutions Pvt Ltd.

- Salesforce.com, inc.

- ScienceSoft USA Corporation.

- SugarCRM Inc.

- Tenfold

- Total Expert Inc.

- Wealthbox

- Zoho Corporation Pvt. Ltd.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

Read Our Latest Press Release: