The packaging industry continues to tread steadily, however, it is the growing investment in, and adoption of, new materials and technologies that has created a buzz in this landscape.

Direct thermal ticket paper is one such development, partly brought about growing pressures to conform to regulatory norms and emphasis on enhanced functional properties. The features of direct thermal ticket paper, such as paper exhibiting durability, pre-printing sustainability, and utmost security have meant that demand has surged steadily in the recent past.

With the alarming rate of forgeries of tickets coming to light, the transportation industry has become an early adopter of direct thermal ticket paper. Gains have also been driven by broader developments in the e-commerce landscape, especially, in countries, where brick-and-mortar stores are being quickly replaced by the online shopping onslaught. Realizing the enormous growth potential of the direct thermal ticket paper market, Transparency Market Research (TMR), in its latest study, analyzes all aspects in detail, bringing to light critical insights that can be the differentiator in this fledgling marketplace.

Planning to lay down future strategy? Perfect your plan with our report brochure here

What’s on the Horizon for the Direct Thermal Ticket Paper Market?

Direct thermal ticket paper has been on the billing counter of retailers for quite a long time now, and the shifting paradigms from cash registers to automated POS terminals are likely to sustain its application during the forecast period. According to TMR’s report, the sales of direct thermal ticket paper crossed a value of US$ 420 Mn in 2018, this market is likely to register a CAGR exceeding 6% during 2019-2027.

As regulations regarding the use of BPA-containing paper become stringent in several countries, consumer perception takes a dramatic shift towards BPA-free direct thermal ticket paper. This has urged vendors to replace BPA-based epoxy coatings, and instead make use of urea urethane, Pergafast, and ascorbic acid to develop compliant direct thermal ticket paper.

Manufacturers who stay abreast with the policies and function towards fostering innovation in their products as per the demand ascending from end-use industries, will be able to safeguard their brand value and net sales. Since disruption awaits just below the surface for numerous manufacturers, the direct thermal ticket paper market is anticipated to gather vigor in the forthcoming years.

Stepping Stones for the Direct Thermal Ticket Paper Market

A major chunk of direct thermal ticket paper sales will remain driven by the transportation industry, where controlling ticket duplication and cost-bearing frauds become crucial. Since the success of the transportation business immensely relies on the reduction of overhead costs, barcode tag-based direct thermal ticket paper is emerging as a viable and valuable choice for ensuring security. Besides transportation, direct thermal ticket paper also finds wider application in the entertainment industry.

In recent times, the developed countries of North America, Europe, and GCC countries have witnessed a tremendous surge in the number of casinos. With the rise in lottery and betting activities, the demand for entrance tickets, cash coupons, and betting slips is showing greater ascendency. The sales of direct thermal ticket paper are outperforming their previous records, as ticketing applications broaden in parallel to transport and admission activities.

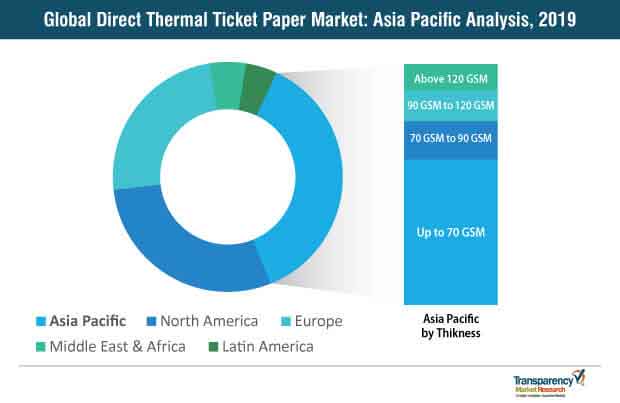

Direct thermal ticket paper with a thickness of 90 GSM remains preferable for transport, billing, barcode, and admission/event ticketing applications, and is set to drive the most sales, while thermal paper with a thickness of over 120 GSM is expected to remain a high-growth segment. While a cohort of drivers strive to push the growth bars of the direct thermal ticket paper market, unavoidable overhead costs could significantly impact the bottom lines of manufacturers.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

Since the manufacturing of direct thermal ticket paper is a systematic process, multiple stages ranging from designing to waste recovery use equipment for effective cooking, emission control, and pulp storage applications. This sums up the hefty installation, maintenance, and operation costs, which directly pass on to the price of direct thermal ticket paper. The volatile prices of raw materials, such as pulp, have yet another unprecedented impact on the cost of the finished product, which leads to frequent revisions. For example, Jujo Thermal Ltd. increased the price of its direct thermal ticket paper by 10-15% in March 2018.

With only ‘change in the price’ being constant in the landscape, end-user industries are embracing the novel trend of digitization, which is likely to deter the sales of direct thermal ticket paper.

Sustainability Implications for Direct Thermal Ticket Paper

In the direct thermal ticket paper market, where the intensity of competition levels up a notch every now and then, strategies related to product launches no longer satisfy the appetite of profit-seeking manufacturers.

A significant batch of manufacturers conceal the impact of forgeries to protect their brand impression; however, this can offer a lucrative opportunity to manufacturers to move a step beyond and develop direct thermal ticket paper with a combination of advanced security features. For instance, TELE-PAPER announced the launch of direct thermal ticket paper with advanced security features, such as an invisible photocopy mark, a UV invisible mark, micro coding, a 2D/3D barcode, and a security watermark.

Expansion of manufacturing facilities is becoming synonymous to the success mantra for direct thermal ticket paper manufacturers. For instance, in 2018, UPM-Kymmene Oyj announced the inauguration of a novel slitting and distribution facility in Santiago, Chile. As stringent laws govern the switch of end-user industries to BPA-free direct thermal ticket paper, leading players such as Appvion Operations, Inc. and Koehler Paper Group have already made a shift towards the development of environmental-friendly paper, while regional players are following suit to sustain their position in the market.

Competition Intensity: Highly Fragmented Market

The direct thermal ticket paper market remains fragmented, with numerous players employing organic and inorganic growth strategies to survive in this highly competitive landscape. Acquisitions and expansion are the core strategies of market goliaths, namely, Nippon Paper Industries Co., Ltd, UPM-Kymmene Oyj, Oji Holdings Corporation, Ricoh Company, Ltd, and Koehler Paper. In contrast to this, regional players in the direct thermal ticket paper market expend in research and development activities to cater to the exact requirements of end-users, and foster product innovation.

All-in-all, the competition landscape of the direct thermal ticket paper market will continue to intensify, wherein, innovation, customization, and security will govern the revenue size of companies.

Read Our Latest Press Release:

- https://www.prnewswire.com/news-releases/power-management-integrated-circuits-market-predicted-to-be-valued-at-us56-48-bn-by-2026–applications-in-highly-lucrative-automotive-consumer-electronics-sectors-evident-of-monumental-growth–tmr-301262055.html

- https://www.prnewswire.com/news-releases/rising-trend-of-remote-work-due-to-covid-19-pandemic-will-breathe-fresh-air-of-growth-across-the-endpoint-detection-and-response-edr-market-says-tmr-301266666.html