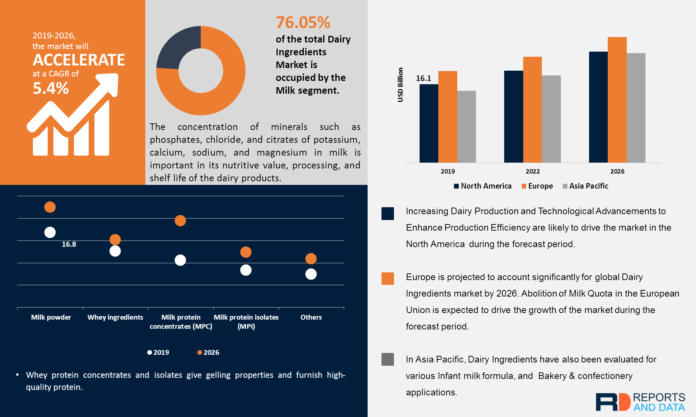

According to the current analysis of Reports and Data, the global Dairy Ingredients Market was valued at USD 52.6 billion in 2018 and is expected to reach USD 80.1 billion by the year 2026, at a CAGR of 5.4%. Dairy ingredients are derived from fluid milk in the form of cream, butter, condensed milk, dry milk, cheese, and whey products. The use of such constituents in formulated foods enhance consumer appeal, improves the nutritional value, and supplies functionality features. Modified ingredients, when designed to meet specific functional requirements of the food manufacturer, could supply not only the inherent benefits of the dairy raw materials but also improve economy and convenience. Introduction of these functionally designed, and industrially oriented, new ingredients into international trade would tend to reduce the economic pressures of overproduction in dairy production areas and be of benefit to the food industries in the non-dairying countries as well.

Consumer trends, especially in functional foods as well as fast and convenient foods, are shaping the development of new products in the marketplace. More recently, market opportunities have been leveraged in nutraceutical beverages for use as tools for weight management, meal replacement, and geriatric nutritional needs using fluid skim milk, nonfat dry milk, milk protein concentrate, and whey protein concentrate. In addition, coffee-based drinks have provided the consumer with a variety of nutritional and functional drinks.

Asia-Pacific is one of the largest segments in the dairy ingredients market, followed by North America and Europe. The markets in the latter regions are also projected to witness significant growth during the forecast period. High-concentrate ingredients, such as milk protein isolates and whey proteins, are majorly used in developed nations, such as the U.S., France, and Germany. Contrarily, low-concentrate ingredients are prevalent in developing countries. An increase in disposable incomes, along with a constant increase in the toddler and infant population in the Asia-Pacific region, is anticipated to benefit the global dairy ingredients market.

Get a sample of the report @ https://www.reportsanddata.com/sample-enquiry-form/2639

Further key findings from the report suggest

- The global butter exports expanded by about 7.5% to 917,920 tonnes in 2018, primarily contributed by New Zealand, the U.S., and India, whereas those of the European Union declined. Global butter markets were did not have much growth in the first half of 2018 owing to reduced export availabilities on strong internal demand in North America and Europe, coinciding with limited supplies from the Oceaniac region. However, markets began easing since June, as the export availabilities improved due to increased output and export availabilities from New Zealand in the 2018-19 production cycle.

- Increasing consumption of dairy and other livestock products is bringing significant nutritional benefits to large segments of the population of developing countries, although many millions of people in developing countries are still not able to afford better-quality diets owing to the higher cost. However, the rapid growth in production and consumption of livestock products also presents risks to human and animal health, the environment and the economic viability of many poor smallholders but may also offer opportunities for small- and medium-scale industries.

- The increasing prominence of nutritional enrichment in foods & beverages due to increased awareness towards maintaining a healthy lifestyle among individuals is anticipated to have a positive impact on the dairy ingredients market. This market is also being driven by the regulatory support from the U.S. FDA and U.K. government, which is intended to incorporate proteins in food and drinks. The rise in the disposable income of the customers, coupled with increased inclination to pay a premium price for food products with various health benefits, is a key driver in this market.

- In the Asia Pacific, milk output increased to about 346.9 million tonnes in 2018, up 3.9% from 2017, as outputs rose in India. In India, the production of milk increased by 5.6% in 2018, driven by an expanded dairy herd and incremental improvements to milk collection systems and higher productivity. However, milk output in China in 2018 is estimated to have declined by 1.1%. Recently published census data for China indicated that milk output during 2015-2017 had been one average 15% WMP and SMP prices.

- Key participants include FrieslandCampina (Netherlands), Fonterra Co-operative Group Limited (New Zealand), Dairy Farmers of America (U.S.), Arla Foods (Denmark), and Glanbia plc (Germany). Other players include Devondale Murray Goulburn (Australia), Groupe Lactalis (Germany), and Volac International Limited (U.K.). Current food and beverage companies are shifting to protect and improve their positions in the market, both through internally driven product development and invention and inorganic development through the procurement of the new disruptor brands and products.

Request a customization of the report @ https://www.reportsanddata.com/request-customization-form/2639

For the purpose of this report, Reports and Data has segmented the Dairy ingredients market on the basis of type, source, nature, application, and region:

Type (Revenue, USD Million; 2016–2026, Volume, Kilo Tons; 2016-2026)

- Milk powder

- Whey ingredients

- Milk protein concentrates (MPC)

- Milk protein isolates (MPI)

- Lactose and its derivatives

- Casein & caseinates

- Milk protein hydrolysates

- Other dairy ingredients

Source (Revenue, USD Million; 2016–2026, Volume, Kilo Tons; 2016-2026)

- Milk

- Whey

Nature (Revenue, USD Million; 2016–2026, Volume, Kilo Tons; 2016-2026)

- Traditional dairy ingredients

- Non-traditional dairy ingredients

Application (Revenue, USD Million; 2016–2026, Volume, Kilo Tons; 2016-2026)

- Bakery & confectionery

- Dairy products

- Convenience food

- Infant milk formula

- Sports & clinical nutrition

- Other food products

Regional Outlook (Revenue, USD Million; 2016–2026, Volume, Kilo Tons; 2016-2026)

- North America

- U.S

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of the Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia-Pacific

- Middle East & Africa

- Latin America

- Brazil

To know more about the report @ https://www.reportsanddata.com/report-detail/dairy-ingredients-market

Thank you for reading our report. To inquire about customization or any query about the report, please get in touch with us. Our team will make sure the report is best suited to your needs.

Explore Our Related Reports :

Spices and Seasonings Market Size, Share & Analysis, By Type (Salts & Salt Substitutes, Hot Spices, Aromatic Spices, Others), By End-User (Food Processing, Catering, Households, Others), And By Region, Forecast To 2027

Pork Meat Market Size, Share & Analysis, By Type (Chilled, Frozen, Others), By Application (Household, Commercial), And By Region, Forecast To 2027

Processed Potatoes Market Size, Share & Analysis, By Type (Frozen, Chips & Snack Pellets, Dehydrated, Others), By Application (Snacks, Ready-To-Cook & Prepared Meals, Others), By Distribution Channel (Foodservice, Retail, Others), And By Region, Forecast To 2027

Cappuccino Foaming Coffee Creamer Market Size, Share & Analysis, By Type (Coconut Based Products, Palm Based Products), By Application (Coffee, Chocolate Drinks, Milk Tea, Others), And By Region, Forecast To 2027

Barley Market Share and Overview, Outlook by Nature (Organic, Inorganic), by Type (Hulless, Covered Size,, Six-row barley, Two-row barley), by Grade (Food grade, Malt grade, Feed grade), by Application (Animal feed, Food & Beverages, Seed Industry, Nutraceuticals, Others), by Region, Competitive Strategies and Segment Forecasts, 2016-2026

Jewelry Market @ https://www.reportsanddata.com/report-detail/jewelry-market

Check our upcoming research reports @ https://www.reportsanddata.com/upcoming-reports

Visit our blog for more industry updates @ https://reportsanddata.com/blog/top-8-food-industry-trends

Contact Us:

John W

Head of Business Development

Direct Line: +1-212-710-1370

E-mail: sales@reportsanddata.com

Reports and Data | Web: www.reportsanddata.com

News: www.reportsanddata.com/market-news