According to a new market report published by Transparency Market Research “Automotive Wiper Component Aftermarket – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2018 – 2026”, the global wiper system market for automotive is expected to expand at a CAGR of more than 5%, during the forecast period, to surpass US$ 15 Bn by 2026.

The global automotive wiper component aftermarket is projected to expand at a CAGR of more than 5% between 2018 and 2026, according to a new research report by Transparency Market Research (TMR). Increased usage of electronics and the demand for luxury have led to the development of driver assistance features such as rain sensing and is thus, driving the demand of rain sensors. Front wipers being mandatory, in order to maintain clear vision, account for a prominent share of the automotive wiper component aftermarket.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=44042

Wiper blades being a wear and tear part have a low shelf-life of six months to one year. The wiper blades erode due to their sustained usage and exposure to the environment. The wiper blade offers robust aftermarket potential as it is a serviceable part and requires periodic replacement. Rise in awareness among the consumers and the expansion of dealership and garages are driving the automotive wiper component aftermarket.

Increased preference for cross-overs and SUVs is boosting the market of wiper blades and wiper motor. The shift in consumer preference toward cross-overs and compacts from sedans, as they are cheaper than SUVs yet aesthetically impressing, is expected to drive the automotive wiper component aftermarket. SUVs, compacts, and cross-overs are adopting rear wipers and their increased adoption is projected to fuel the wiper motor and wiper blade segments of the automotive wiper component aftermarket. Adoption of rear wipers by luxury automakers such Porsche, BMW, and Mercedes is probably expected to further propel the rear wiper market .The used car industry is witnessing expansion due to gaining consumer confidence and increase in number of first-time buyers opting for used cars. Rise in number of used cars is boosting the automotive wiper component aftermarket, as they require frequent maintenance. The average age of vehicle is increasing, owing to the change in people’s preference to retain their vehicle and not scrap it. Increase in aged vehicle fleet on the road is a major driver for the automotive wiper component aftermarket.

Buy Now:

https://www.transparencymarketresearch.com/checkout.php?rep_id=44042<ype=S

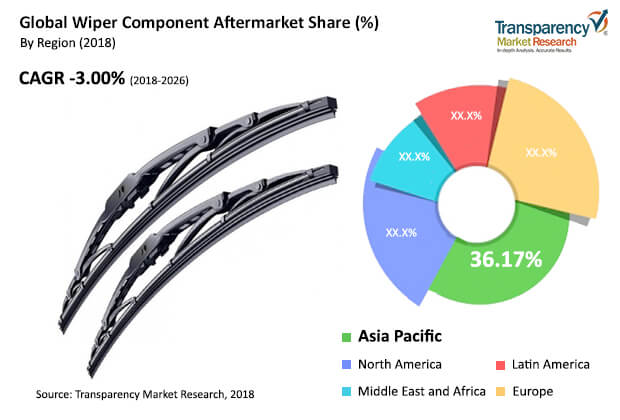

The aftermarket is projected to expand at a steady pace owing to the mandatory requirement of wipers and no feasible replacement solutions. The U.S. has more than 270 million vehicles on the road; and hence, is a highly attractive market for the automotive wiper component aftermarket. Increased sales of vehicles in Asia Pacific is likely to fuel the automotive wiper component aftermarket and surpass North America to emerge as the leading region by 2026. Cheaper production cost in China & India is likely to help improve wiper component exports and create competitive standard for other countries. Wipers play a major part in maintaining visibility in Asia Pacific, as the region experiences the monsoon season; and hence, is a prominent automotive wiper component aftermarket.

North America & Europe witness a higher penetration of luxury and premium cars and are thus, favorable markets for the rain sensor aftermarket. Demand for driver assisting features and high disposable income have fueled the development of rain sensing technology in North America & Europe. Increased vehicle sales in countries in Rest of Europe such as the Czech Republic and Slovakia is boosting the automotive wiper component aftermarket in Europe. The cold climate experienced in Europe and North America necessitates the usage of wipers for clearing snow. Wipers undergo considerable wear and tear when used to clear the snow and produce smearing on the windshield. Consequently, they require seasonal replacement, which in turn propels their demand.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=44042

Key players operating in the global automotive wiper components aftermarket include Robert Bosch GmbH, DENSO Corporation, Valeo S.A., Federal Mogul Motorparts LLC., HELLA GmbH & Co. KGaA, DOGA SA, Nippon Wiper Blade Co., Ltd., Pilot Automotive, Am Equipment, Mitsuba Corp., B. Hepworth and Company Limited, and Magneti Marelli S.p.A.

The global automotive wiper component aftermarket is segmented as follows:

- Global Automotive Wiper Component Aftermarket, by Component

- Wiper Blade

- Wiper Motor

- Rain Sensor

- Global Automotive Wiper Component Aftermarket, by Vehicle

- Passenger Vehicle

- Commercial Vehicle