Global Automotive Sheet Metal Components Market: Snapshot

The transportation industry, one of the leading contributors of polluting agents to the environment due to the mounting numbers of vehicles across the globe, has been under the radar of environmentalists for a long while. To change the situation, the strict regulations imposed on vehicle-makers to bring to the market vehicles with higher rate of fuel efficiency are force-feeding the vehicle of development in the automotive industry. On the way to being more fuel efficient, engine downsizing and lighter vehicle parts are some of the most notable changes to have been observed in vehicles of late.

In order to make vehicles and their engines lighter, automobile manufacturers are demanding suppliers to provide lightweight sheet metal components to support the performance of lighter vehicle engines. Aluminum and steel sheet metals are being designed in much more refined and thinner forms as compared to old times in order to make them applicable for lighter automobile applications. These factors are expected to be the key factors to drive the global market for automotive sheet metal components market over the next few years.

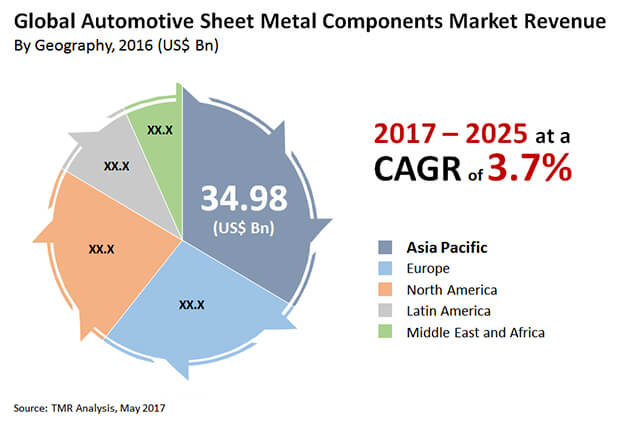

Transparency Market Research estimates that the global automotive sheet metal components market, which was valued at US$104.30 bn in 2016, will exhibit a CAGR of 3.7% from 2017 to 2025 to account for US$142.41 bn in 2025.

Planning to lay down future strategy? Perfect your plan with our report sample here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=21887

High-strength Steel to Continue to Witness Strong Demand

Steel sheet components are the most widely used material in the automotive sector. 60% of the total weight of a vehicles is made of steel components. Steel allows good corrosion resistance while maintaining weldability and formability. There are numerous grades of steel available in the market to best suit the specific requirements as per application.

Stringent emission norms and automobile standards has been emphasizing automakers to develop lightweight vehicles. Therefore, downsizing of engine in order to ensure fuel efficient and environment-friendly attribute in vehicles has been propelling the demand for high strength steel, which are more durable and lighter than standard steel. The usage of steel as an automotive sheet metal component is expected to remain strong over the report’s forecast period as well.

Asia Pacific to Continue to Lead with Healthy Future Growth Prospects

Asia Pacific contributed the dominant share of around 33% to the revenue of the global automotive sheet metal components market in 2016. China is the leading automotive sheet metal components market in Asia Pacific. The country has huge resource and technological capabilities in the automotive sector. Moreover, increasing demand for passenger vehicles in China and India is propelling the growth of automotive sheet metal components market in the Asia Pacific region.

Europe contributed more than 25% to the global automotive sheet metal components market in the said year, with Germany being the dominant market. The rising applications of sheet metal components in new segment of vehicles such as electric and hybrid cars are expected to bolster the growth of the market in Europe at a healthy rate over the forecast period. The automotive sheet metal components market in North America is projected to expand significantly during the forecast period. In terms of revenue, North America generated around 20% of the total revenues in the global automotive sheet metal components market in 2016, with the market in the U.S. holding the dominant share.

Looking for exclusive market insights from business experts? Request a Custom Report here https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=21887

Some of the leading companies operating in the global automotive sheet metal components market profiled in the report are Novelis Inc., Aleris International Inc., Mayville Engineering Company, Inc., O’Neal Manufacturing Services, General Stamping and Metal Works, Larsen Manufacturing, LLC, Amada Co. Ltd., Paul Craemer GmbH, Frank Dudley Ltd., and Omax Autos Ltd.