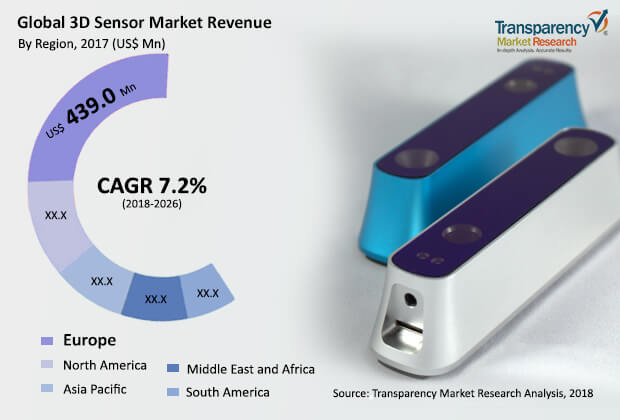

The sensor industry is witnessing substantial technological advancements across IT & telecommunication and electronics industry. Developments in electronics industry that saw the introduction of an upgraded 3D sensor has changed the way services are being delivered in the sensor business. Rise in demand for smartphones and increased requirement for improving performance of electronic devices is driving the growth of the 3D sensor market. Such sensors find a number of applications in different industry verticals such as consumer electronics, healthcare, industrial robotics, automotive, and security and surveillance. The market for 3D sensors is forecast to reach US$ 2,556.6 Mn by 2026 from US$ 1,292.2 Mn in 2016, recording a CAGR of 7.2%.

The 3D sensor market has seen demand traction due to rising demand for smartphones, with consumer electronics holding the largest share. One of the most important features in mobile communications is to unlock the mobile by 3D face recognition as a replacement of fingerprint or PIN. Making authentication more convenient and more secure, it may soon become indispensable for mobile payment applications and mobile ID. Healthcare, automotive, and aerospace & defense are the leading verticals in terms of adopting 3D imaging which provides a number of advantages for inspection applications. These are some drivers that are expected to drive the 3D sensor market during the forecast period.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38018

Further, 3D imaging has seen quick and extensive adoption in the industrial sector. Smart image sensors and other industrial developments continue to expand the abilities of 3D imaging for industrial applications. With the growing demand for gesture exploration application, 3D sensors play an significant role in improving the performance and effectiveness of a huge complex system in sectors such as electronics and automotive. From robotic navigation to building automation and gesture recognition, 3D sensors allow for determined elasticity to customize every feature of a camera’s design to make the most appropriate product.

However, 3D sensors face a challenge due to higher cost of installation. 3D imaging systems certainly provide more information than 2D systems, but they are a lot more complicated in nature. The main problem with 3D essentially is calibration and getting measurements to some calibrated standard that generally requires much more information than a planar calibration. The generation of 3D data with 2D cameras usually involves combining several 2D cameras for creating a single 3D image and this requires more precise illumination when compared to taking a single 2D image. Moreover, the cost of 3D imaging systems is another barrier and these systems do not cater to the price-sensitive markets. Thus, the technical difficulties and high cost involved while producing 3D images are the major impediments to the widespread adoption of these systems.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=38018

Attracted by this expanding market and underlying demand, several players are expanding their business through strategic mergers & acquisitions and partnerships with several industries. Apple announced 3D sensing equipment in iPhone X, and the company paid about US$ 390 million to Finisar, its VCSEL supplier. Some of the prominent players identified in the 3D sensor market includes – Infineon Technologies, Omnivision Technologies, Occipital, Inc., PMD Technologies AG, Microchip Technology, Cognex Corporation, Intel Corporation, Ifm electronic GMBH, LMI Technology, and Texas Instruments. Companies are focusing on expanding their business through strategic acquisitions and partnerships with several end-use industries.

Read Our Latest Press Release: