Manufacturers Work at Breakneck Speeds amidst COVID-19 to Avoid Business Loss

The coronavirus (COVID-19) pandemic has virtually altered the global society and economy, and its repercussions are being felt in the welding industry as well. Companies in the welding torch and wear parts market are managing the short-term effects and preparing for potential adjustments in the long run.

A significant drop in COVID-19 cases is predicted to relax production, trade, and travel restrictions. In order to avoid losing out on business, OEMs in the welding torch and wear parts market are manufacturing products at breakneck speeds. They have been establishing work environments deemed safe for the return of their employees.

Request a sample to get extensive insights into the Welding Torch and Wear Parts Market https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=74337

Demand Shortage and Difficulty in Staff Maintenance Inhibit Market Growth

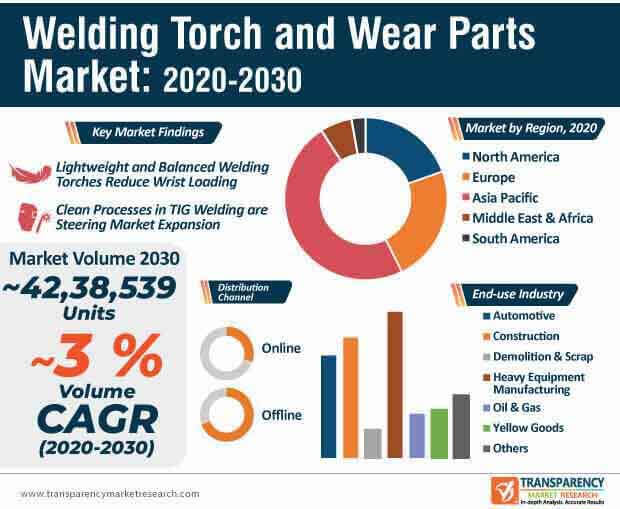

The welding torch and wear parts market is estimated to surge at a sluggish CAGR of ~3% during the assessment period, as fragmented nature of the market has intensified the competition. The increased supply of welding torch and wear parts has led to a demand shortage. Challenges such as lack of skilled workers and difficulties in staff maintenance are also important factors for low demand. Thus, OEMs (Original Equipment Manufacturers) are offsetting these disadvantages by diversifying their supply for atomic hydrogen welding, TIG (Tungsten Inert Gas) welding, and other applications.

OEMs in the welding torch and wear parts market are increasing their production capabilities of accelerator pedals and introducing fingertip control on the torch to simplify TIG welding.

Improved Ergonomics in Welding Torches Facilitate Everyday Safety and Comfort

The welding torch and wear parts market is expected to surpass the revenue of US$ 7.4 Bn by 2030. Manufacturers are innovating in guns and torches to facilitate efficient welding. For instance, Kemppi— a Finnish family owned welding company, is boosting its output capacities for Flexlite series of TIG and MIG (Metal Inert Gas) torches with improved ergonomics to enhance everyday welding comfort and efficiency.

Companies in the welding torch and wear parts market are increasing the availability of gas and water-cooled versions of TIG and MIG welding that facilitate alternative power classes, lengths, and values. They are introducing lightweight torches that are balanced and reduce wrist loading. Innovative materials such as silicon rubber are being used to adhere to welding safety standards.

Growing Availability of Purpose-built Plasma Equipment Drives Global Market

Apart from MIG and TIG equipment, OEMs in the welding torch and wear parts market are tapping into incremental opportunities with plasma welding torches. For instance, EWM AG— a specialist in welding technology, is increasing its product portfolio in plasma torch series to meet requirements of its end users. These torches are being preferred for delicate welding tasks on thin metal sheets. Plasma torches are even used for thick metal sheets to enable safe and stable welding.

Microplasma, medium current plasma, and keyhole plasma are different operating modes that are gaining importance in the welding torch and wear parts market. The increasing availability of purpose-built plasma equipment is acting as a key driver for the market.

Robust MAG Torches Deploy Premium Performance and Quality Welds in Automotive Industry

Unmatched ergonomics and lightweight attributes are being preferred in MAG (Metal Active Gas) welding torches. Durable and high quality MIG/MAG and TIG torches are the latest addition to voestalpine AG’s product portfolio that are easy to handle and deploy precision welding. In order to gain a competitive edge over other OEMs, manufacturers in the welding torch and wear parts market should increase their research expenditure and collaborate with think tanks and engineers to innovate in robust and durable welding torches.

Premium performance and high quality welds with the help of improved MAG welding torches are being made commonplace for use in demanding applications in ever-growing industries such as automotive, construction, and heavy equipment manufacturing.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Welding Torch and Wear Parts Market https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=74337

Welding Torch and Wear Parts Market: Overview

- According to Transparency Market Research’s latest research report on the global welding torch and wear parts market for the historical period 2018–2019 and the forecast period 2020–2030, rising demand from the automotive industry is expected to boost the global welding torch and wear parts market during the forecast period

- In terms of revenue, the global welding torch and wear parts market is projected to exceed value of US$ 7.4 Bn by 2030, expanding at a CAGR of ~4% during the forecast period