Though COVID-19 (Coronavirus) cases have been rising in America, new-car and truck dealers have always been resilient in adverse situations such as recession, drastic fuel prices, and interest rate fluctuations. In such a scenario, digital retailing is gaining recognition, as truck dealers strive to meet customer demand. Digital retailing has provided clients with the flexibility to procure accurate trade appraisals and obtain bank approvals with precise payment information. This has eliminated the need to have in-person interaction with a dealership employees, which has become crucial, especially during the pandemic.

Analysts at the Transparency Market Research opine that truck dealers will continue to use digital retailing even after the COVID-19 pandemic subsides. Many dealers have already adopted and implemented 100% virtual and digital sales processes and are reaping its benefits amidst the COVID-19 era. These factors are likely to drive the truck-as-a-service market during the forecast period.

Request a sample to get extensive insights into the Truck-as-a-Service Market

Truck-as-a-Service Platforms Enhance Productivity Levels for Shippers and Carriers

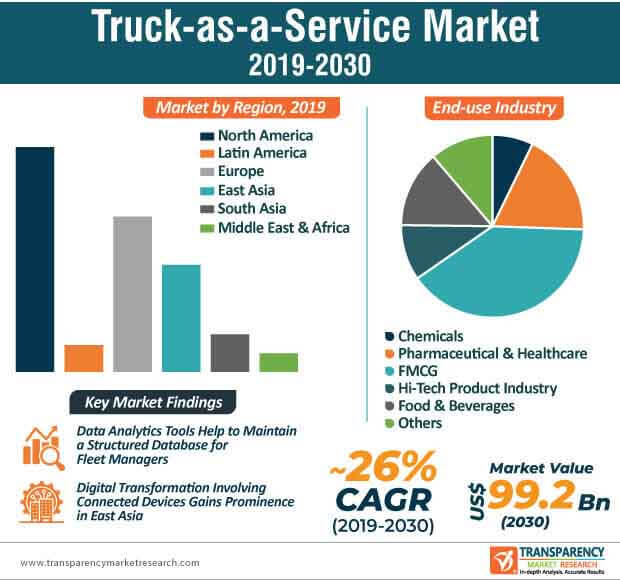

Artificial intelligence (AI) and Machine Learning (ML) is playing a crucial role in making predictions about supply and demand in the truck-as-a-service market. Several startups are exploring business opportunities in this innovative business model. This is explains why the market is predicted to grow at an explosive CAGR of ~26% during the assessment period. Centralizing procedures and processes with the help of an appropriate ecosystem has helped to increase the operational efficiency of truck drivers and shippers.

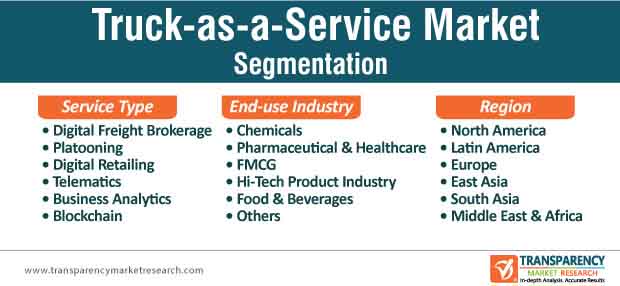

With the help of truck-as-a-service platforms, truck drivers and carriers can optimize their time by gaining access to channels to find shipping demand. As such, the revenue of digital freight brokerage is anticipated to be the highest in the truck-as-a-service market among all service types. Digital freight brokers are using their own truck equipment pools to accelerate the movement of cargo.

Advanced Data Analytics Tools Help Identify Vehicle and Uptime

Telematics has facilitated real-time communication, which is coupled with routing apps that help truck drivers to avoid delays and contributes toward fleet optimization. However, analyzing truck data to improve service operation can be challenging for fleet managers. Hence, companies in the truck-as-a-service market are developing smarter algorithms that overcome issues in data analysis.

To understand how our report can bring difference to your business strategy, Ask for a brochure

Trying to analyze telematics data without advanced tools can be potentially challenging for fleet operators. It is found that too many data points change at a high frequency for a fleet service location manager. Hence, companies in the truck-as-a-service market are developing advanced data analytics tools that deploy aggregation of individual data points in the most effective way. This helps to understand the vehicle health and its impact on the uptime of trucks. Proliferation of the Internet of Things (IoT) in truck-as-a-service platforms is another advantage, which has enabled accurate identification of vehicle health.

East Asia Set for Exponential Growth with Connected Devices and Smart Mobility

The trucking industry is witnessing a digital transformation, which has fueled the use of connected devices, thus deploying greater visibility and transparency across the supply chain. As such, the truck-as-a-service market is anticipated to surpass US$ 99.2 Bn mark by the end of 2030. On the other hand, the installation of telematics devices in trucks has jumped exponentially in North America. This is evident since currently, North America dictates the highest revenue among all regions in the truck-as-a-service market. However, East Asia is predicted to take the lead in terms of value by the end of 2030.

The era of increased smartphone usage, smart cities, and smart mobility is currently one of the prominent trends in North America. However, the connected environment is growing increasingly prominent in countries of East Asia. Such factors are boosting the adoption of digital freight brokerage solutions.

Electronic Logs and Safety Standards Help Reduce Operational Costs via Telematics

Mobile devices are becoming increasingly commonplace in vehicles. Smartphones and rugged tablets are leveraging the telematics technology in the truck-as-a-service market. Moreover, telematics has eliminated the need for spending several hours completing paper record of duty status logbooks. Thus, trucking fleet managers can easily do away with overspending and improve overall efficiency for stakeholders in the value chain. On the other hand, telematics has helped to improve safety as truck dealers can closely monitor behaviors of the driver and assess whether it aligns with the company and regulatory standards.

Increased job satisfaction and a decline in operating costs are bolstering the growth of the truck-as-a-service market. Since drivers have greater control over their electronic logs, it has become one of the top contributors to job satisfaction. Better fleet and driver utilization help in fuel savings.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

Incumbent Players versus Challengers: Who will dominate Truck-as-a-Service Market

The automation of truck brokerage is driving change in the truck-as-a-service market. As such, venture backed-digital freight brokers are posing as a tough competition to the incumbents of the market. For instance, Convoy— a provider of digital freight network has raised US$ 185 Mn at US$ 1 Bn valuations in September 2018 and is aiming for two times the valuation in the upcoming years. On the other hand, logistics technology startups are attracting capital investments. However, the incumbent market players also have advantages such as larger reach in terms of their business network and higher enterprise value.

In terms of revenue, incumbent market players hold a lion’s share as compared to the venture backed-digital freight challengers. Moreover, private companies do not publish their financial data, thus making it challenging for investors to take the decision.

Read Our Latest Press Release:

- https://www.prnewswire.com/news-releases/affordability-and-beneficial-properties-to-serve-as-vital-growth-factors-for-construction-tape-market-during-forecast-period-of-2020-2030-tmr-301221294.html

- https://www.prnewswire.com/news-releases/global-higher-education-solutions-market-to-thrive-on-growing-popularity-of-cloud-computing-and-high-consumption-of-digital-content-tmr-301219732.html