Specialty Carbon Black Manufacturers Eye Opportunities in Wide-ranging Industries

Right from the automotive industry to the printing industry, carbon black has become ubiquitous across various industrial verticals. However, the constantly growing need for highly-advanced products is triggering innovation in the carbon black industry. The demand for specialty and high-value carbon black is on the rise, as the preference of end-users continues to evolve.

Specialty carbon black’s highly-touted properties, including ultraviolet (UV) protection, conductivity in plastics, and its ability to enhance the aesthetic appeal of various products are boosting its adoption. Transparency Market Research (TMR), in its latest offering, thoroughly analyzes the specialty carbon black market, and offers credible and incisive insights that can arm stakeholders with the arsenal to succeed.

Are you a start-up willing to make it big in the business? Grab an exclusive PDF sample of this report here

Market to Evolve through Environmental Regulations and Price Volatility

The specialty carbon black landscape has witnessed healthy growth in the past few years, recording global sales of ~ 1,000 kilo tons, worth ~ US$ 2 billion in 2018. With a mounting number of manufacturers in this market space, including Himadri Specialty Chemical Ltd, Orion Engineered Carbons and Cabot Corporation, expanding their production facilities, the specialty carbon black market is expected to witness significant developments in the coming years. Himadri Specialty Chemical has announced the setting up new carbon black production lines at its existing integrated plant at Mahistikry in West Bengal, India, for the production of specialty carbon black.

On the other hand, Orion Engineered Carbons has announced the expansion of the production capacity at its manufacturing facility in Ravenna, Italy, Europe, owing to the growing applications of specialty carbon black in the coatings, polymers, and printing markets. Also, Cabot Corporation is investing ~ US$ 50 million in 18 of its carbon black facilities to cater to the increasing demand from its customers in the specialty carbon black market, through debottlenecking projects and operational improvements.

Though the demand for specialty carbon black is surging, the environmental impact of its manufacturing continues to be a concern. Complying with stringent regulations can add to the overall cost for specialty carbon black manufacturers, while delaying the product’s time to market. Thus, the expansion ambitions of manufacturers can be stymied due to the complexities and investments involved in meeting environment regulations.

Many manufacturers, in a bid to recover regulation costs, have introduced an environmental compliance surcharge to prices of carbon black. For instance, Tokai, a carbon black manufacturer, is adding a ‘3 cents per pound’ environmental compliance surcharge to their prices. Another carbon black leader, Orion Engineered Carbons, has announced an environmental compliance surcharge of 1.5 cents per pound. This surcharge has been implemented to address the initial estimated cost of compliance to reinforce materials for customers, and will influence the pricing of specialty carbon black in the coming years.

Is something restraining your company’s growth in the “Specialty Carbon Black” market? Ask for the report brochure here

Applications in Plastics Grow Strong; Battery Industry to Create New Sales Opportunities

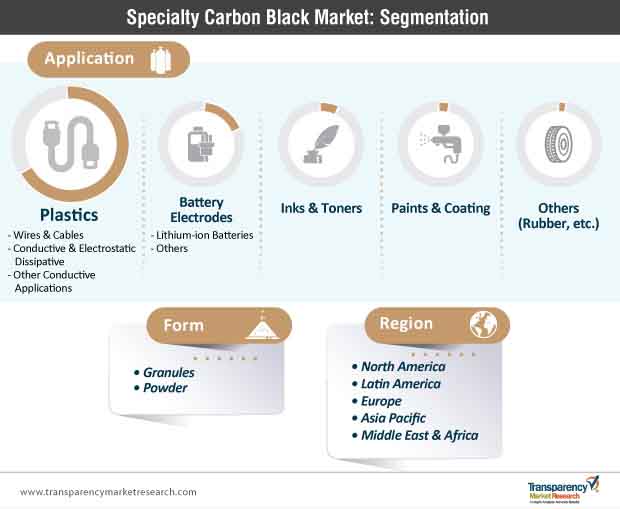

The specialty carbon black landscape is expanding rapidly, as applications in a wide range of industrial segments create new opportunities for stakeholders. While the increasing growth of the paints and coatings, and inks & toners industries continues to foster growth, lucrative opportunities in the rapidly-growing plastics industry will support manufacturers in strengthening their sales performance in the specialty carbon black landscape.

In 2018, applications of specialty carbon black in the plastics industry, such as wires & cables, and conductive and Electrostatic Discharge (ESD) plastics, held ~ 68% revenue share of the global specialty carbon black market. Since specialty carbon black meets rigorous specifications and delivers important functionality performance, it provides high value to the end users in the plastics industry. This trend is expected to prevail in the coming decade, boosting the sales of specialty carbon black in the plastics industry.

Another trend that is influencing the market dynamics of the specialty carbon black landscape is the rise in the adoption of lithium-ion technology in electric and hybrid electric vehicles. The demand for new batteries is surging worldwide, and increasing applications of high-performance carbon additives in battery electrodes are opening new avenues of growth for specialty carbon black in the lithium-ion battery industry. Stakeholders are likely to concentrate on entering new industrial areas, such as the battery industry, to create new revenue streams and boost sales in the coming years.

Stuck in a neck-to-neck competition with other brands? Request a custom report on competition on “Specialty Carbon Black Market” here

Focus on Boosting Volume Growth by Enhancing Performance Properties: A Key to Win

Leading players in the specialty carbon black market have increased focus on revising their capability to produce more technologically-superior products. This has ensued manufacturers to expand their production in terms of volume, to offer a broad and unique range of product offerings, instead of maximizing product value in terms of revenue.

Subsequently, producers are likely to invest in rigorous R&D (research & development) for fulfilling the specific demands of various end-use industries. For example, Orion Engineered Carbons recently announced that it will launch its new range of products – conductive Specialty Carbon Black XPB 633 BEADS, with conductivity and anti-static properties, specially developed for their application in thermoplastics.

In addition, the omnipresent hallmark of specialty carbon black is proven to be advantageous at all stages of the commodity value chain. Eventually, manufacturers are likely to rely on the delivery of uniform product quality and consistent value-added services on a global level for target customers.

Market Leaders Increase Investments in Asia Pacific to Gain a Competitive Edge

The competitive landscape of the specialty carbon black market is largely dominated by global, multi-national, and single-country-based producers. This is a consolidated market, spearhead by key players such as Cabot Corporation, Birla Carbon, and Orion Engineered Carbons, that own production plants across key locations around the world. Cumulatively, these three suppliers hold ~ 58% share of the global market, with Orion Engineered Carbons accounting for the highest global market share of ~ 23%.

Apart from catering to the demand for specialty carbon black in plastics and battery electrodes, companies are also focusing on the growing demand from the paints & coatings industry. With the increasing demand for specialty carbon black in plastics and battery industries, manufacturers and suppliers, including Cabot Corporation, Birla Carbon, and Phillips Carbon Black Limited, are likely to increase focus on expanding their production bases, especially in low-cost countries in Asia Pacific, to cater to the burgeoning demand.

Frontrunners, including Cabot Corporation, Birla Carbon, Phillips Carbon Black Limited, and Himadri Speciality Chemical Ltd., recently made announcements of business expansions in the specialty carbon black landscape. The rising demand for batteries, mainly lithium-ion batteries, for consumer electronics as well as electric vehicles, is expected to trigger market players to concentrate on the volume growth of their businesses, in the coming years.

Analysts’ Viewpoint

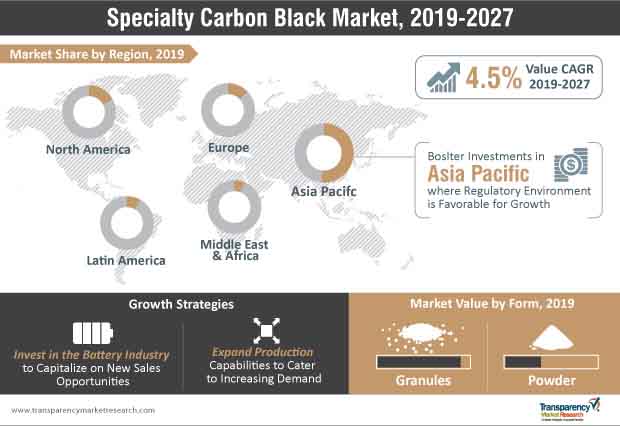

The specialty carbon black market is expected to rise in terms of volume at a CAGR of 4.5% over the forecast period of 2019-2027. This will reflect in the growing demand for specialty carbon black in diverse industrial applications such as plastics and lithium-ion batteries.

On a global level, Asia Pacific is projected to represent a substantial market for specialty carbon black, with a global value share of ~ 53%, while North America and Europe, collectively, are expected to account for one-third revenue share of the specialty carbon black market, throughout the forecast period. Increasing industrial growth and improved sales potential for specialty carbon black in Asia Pacific’s battery industry will continue to create a favorable business environment for market players in the region.

Specialty Carbon Black: A High-value Grade Carbon Black

- Specialty carbon black is the purest grade of carbon black with the finest particle size. It is a non-rubber grade of carbon black, which is employed in several industries.

- Specialty carbon black has specific characteristics such as viscosity control, high-quality pigmentation, UV protection, dispersion, and electric conductivity. Owing to these, it is employed in applications in industries such as paints, coatings, plastics, fiber, printing, paper, and construction.

- The global carbon black industry is anticipated to expand at a CAGR of 3.5% during the forecast period. Among the grades of carbon black, the rubber grade is the most widely used. It is primarily used in tires as a reinforcing material. Non-rubber applications of carbon black account for around 7% share of the total consumption of carbon black. However, the specialty carbon black segment of the global carbon black industry holds around 12% share of the industry, in terms of value, due to high prices.

- Manufacturers of specialty carbon black are focusing on the research and development of specialty carbon black suitable for use in a variety of applications. They are also expanding their current production capacities for specialty carbon black.

Global Specialty Carbon Black Market: Highlights

- In terms of value, the global specialty carbon black market is anticipated to expand at a CAGR of 4.5% during the forecast period, and reach a value of US$ 3.0 Bn by 2027.

- The plastics segment accounts for a key share of the global specialty carbon black market, owing to the high consumption of plastics in various applications such as wires and cables, coupled with advancements in the construction and industrial manufacturing sectors across the globe.

- Asia Pacific was the leading region of the global specialty carbon black market in 2018. The market in the region is expected to register a significant CAGR between 2019 and 2027.

- However, the production process of specialty carbon black causes hazards to the environment, as emissions from the process include pollutants such as particulate matter, carbon monoxide (CO), nitrogen oxides, sulfur compounds, polycyclic organic matter (POM), and trace elements. Thus, emissions from carbon black production plants are strictly regulated, especially in the U.S. and Europe. Thus, environment-related concerns pertaining to the production of carbon black are estimated to hamper the global specialty carbon black market during the forecast period.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/increasing-rubber-recycling-rate-to-create-opportunities-in-industrial-rubber-products-market-from-2019-to-2027-tmr-study-301123822.html

Demand for Specialty Carbon Black for Use in Battery Electrode Applications Likely to Increase

- Rise in the demand for lithium-ion batteries led by the increase in the demand for consumer electronics products and electric vehicles has fueled the demand for battery materials.

- Furthermore, the increasing popularity of electric vehicles, mostly in developed countries, is estimated to boost the consumption of lithium-ion batteries during the forecast period. The global demand for lithium-ion batteries is estimated to rise from around 62,500 MWh in 2015 to approximately 220,000 MWh by 2025.

- Specialty carbon has excellent properties that are helpful in filling free spaces within the active material of cathodes, which leads to enhanced cathode cyclablity. Thus, the increasing requirement for battery material additives for better performance, in terms of battery capacity, is estimated to fuel the demand for specialty carbon black during the forecast period.

Granule Form Segment to Dominate the Specialty Carbon Black Market

- Among the forms, the granule segment held a prominent share of the global specialty carbon black market, in terms of value, in 2018. Granule is a highly cost-effective form of specialty carbon black.

- The granule form of specialty carbon black is popular in developing countries, owing to its low price and ease of transportation. Furthermore, manufacturers prefer to purchase specialty carbon black in the granule form in bulk at a low cost, and to convert it into the powder form as per requirement.

- Thus, the granule segment holds a key share of the global specialty carbon black market.

Asia Pacific Estimated to Remain a Dominating Region

- In terms of value and volume, Asia Pacific constituted a prominent share of the global specialty carbon black market in 2018. The key share of this region can be ascribed to the low production cost of specialty carbon black and increase in large-volume exports of specialty carbon black by China.

- Growth of end-use industries, such as paints & coating, in Asia Pacific can be ascribed to the rise in population and increase in disposable income, primarily in developing economies such as China, India, and Indonesia. Furthermore, increase in the manufacture of lithium-ion batteries in countries such as China, Taiwan, and Japan is fueling the demand for efficient battery materials to meet the risen demand from electric vehicle batteries. This, in turn, is augmenting the demand for specialty carbon black in Asia Pacific.

- The market in Asia Pacific is projected to expand at a rapid pace during the forecast period. North America and Europe also held a considerable share of the global specialty carbon black market in 2018. The market in these regions is estimated to expand at a moderate pace during the forecast period.

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=60855

Global Specialty Carbon Black Market: Competition Landscape

- The report comprises detailed profiles of the major players operating in the global specialty carbon black market. The report also consists of a comparison matrix of top the four players operating in the global market, along with their market share analysis and application mapping for 2018.

- Prominent players operating in the global specialty carbon black market are

- Cabot Corporation

- Imerys

- Mitsubishi Chemical Corporation

- Denka Company Limited

- Phillips Carbon Black Limited

- Tokai Carbon Co., Ltd.

- Lion Specialty Chemicals Co., Ltd.

- Birla Carbon

- Ampacet Corporation

- Himadri Specialty Chemical Ltd.

- Continental Carbon

- Orion Engineered Carbons

- Asbury Carbons

- Pyrolex AG

- Black Bear Carbon B.V.

- The global specialty carbon black market is highly consolidated among key market players. The top three players account for ~ 55% share of the global market.