It is commonly stated that the IT sector is among the key beneficiaries of the pandemic: without a physical contact digital excellence is your last opportunity to keep a business alive. An obvious example is the US stock market (and especially NASDAQ), dominated by IT companies in 2024.

Having said that, let us point out that the picture is different for various niches within the IT — the industry incorporates plenty of them.

Depending on the company’s position in the supply chain (developer, buyer, agency) and the average project size, the COVID impact is quite different.

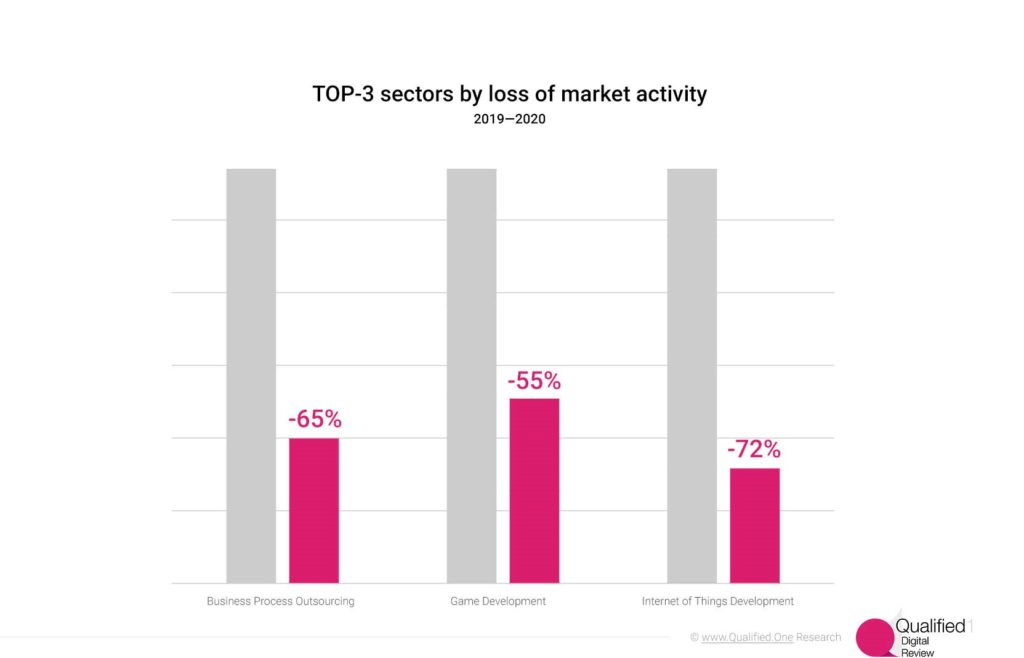

TOP-3 losers

Our data show a dramatic decrease of reported deals in Game Dev, business process outsourcing (BPO) and IoT development.

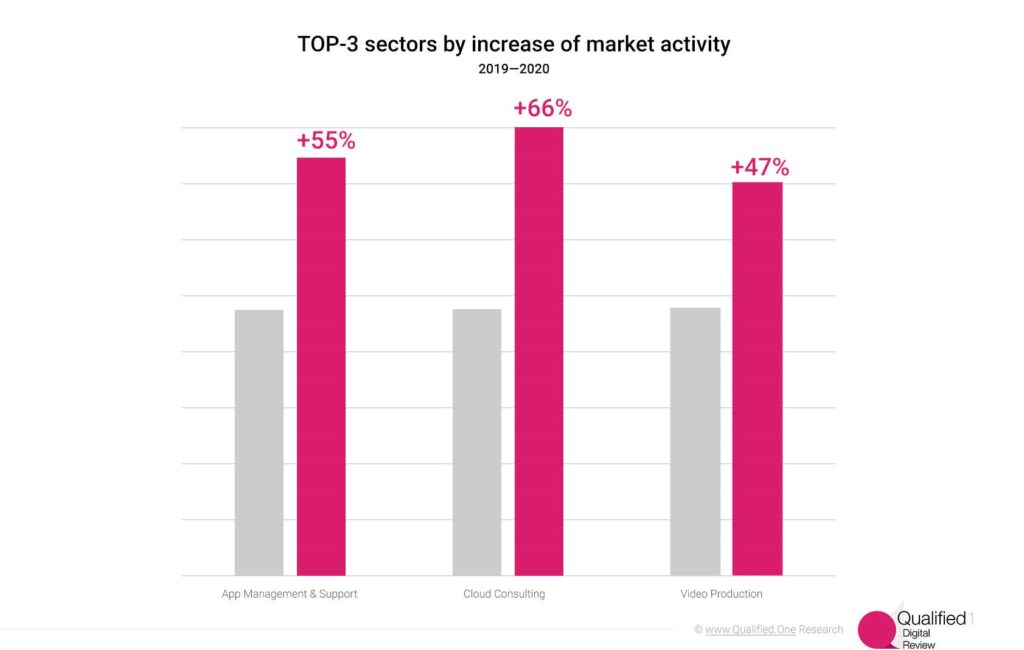

TOP-3 winners

On the other hand, there are certain services that experienced an explosive growth of demand. Secure and stable remote work requires cloud technologies to be implemented; high-quality video content is crucial for sales and marketing to perform well. For those companies that already had their own mobile applications, the need in support increased rapidly – for both maintenance and improvement.

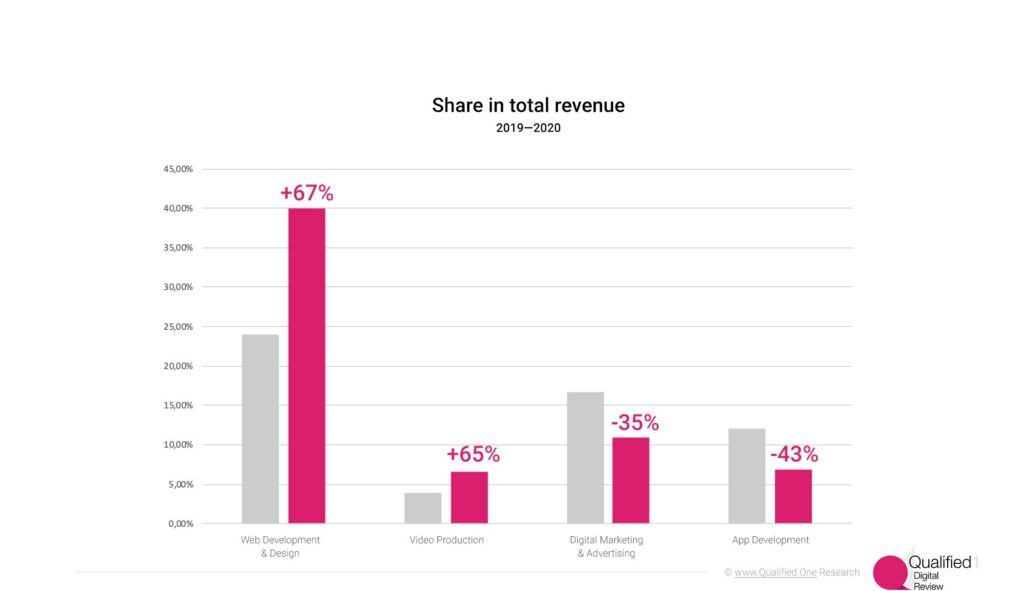

Revenue dynamics

Another point of interest is the variation of cash flow in different sectors. Whilst the above pictures represent the change in the number of deals, the amount of spending is even more illustrative. We focused on Web Design & Development, Video Production, Digital Marketing and Application Development services.

Despite the 10% yearly growth of Paid Search spending reported by Google, the corresponding digital marketing services experienced a 35% decrease. This is aligned with Deloitte predictions as of March 2024.

We provide a detailed analysis in the full report. The results are to be refined after the processing of the Q3-Q4 data.

Summary

We observe a distinct growth of market activity for the services with (almost) immediate and crucial effect: Cloud Technologies, App Support, Video Production. At the same time, long-term investments in App Development, Game Development and Internet of Things seem to have been postponed or cut off entirely.

Statistics on Digital Marketing and BPO show that many companies probably decided to maintain the advertising budgets, but cut the costs on external outsourcing providers.