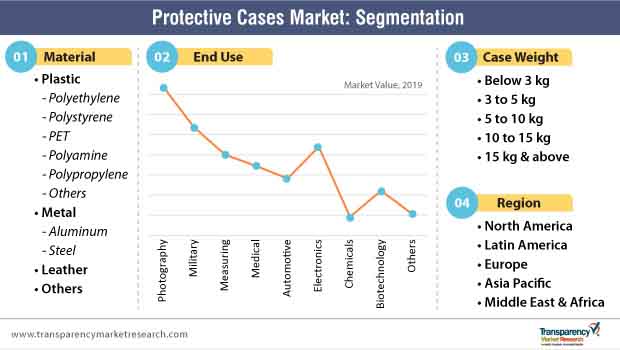

Protective Cases Market – Plastic’s Status as the ‘Material of Choice’ Intact

The packaging industry continues to flag the gravity of shipments during adverse weather conditions, given the recent proliferation in online shopping trends. Innovative efforts are underway in the landscape, as market goliaths such as Pelican Products Inc. and SKB Corporation, Inc. harness the prowess of technology – 3D printing – to bring value-added protective cases to the fore, and this interest has caught the attention of players from a wide array of end-use segments.

Seasoned analysts at Transparency Market Research (TMR) have been tracking such developments, besides market-weighted trends, and are of an opinion that, the sales of protective cases will rise from ~11 million units in 2019 to ~15 million units in 2027, representing a volume CAGR of ~4% during 2019-2027.

Research also portends the sustained popularity of plastic as a raw material over metal, despite tight environmental protocols, in light of its superior physical and chemical attributes. Players in the protective cases market, however, may encounter challenges pertaining to the rising proclivity for ‘custom-designed’ paper-based protective cases, with cost efficiency being their attractive proposition.

Planning to lay down future strategy? Perfect your plan with our report brochure here

Focus on Crucial Raw Materials

Opportunities are abound for manufacturers

to exploit, given the availability of a broad array of materials – plastic, leather, and metals, among others – to experiment with and foster innovation. In 2018, plastic-based protective cases recorded sales tantamount to ~US$ 1.1 Bn, thereby accounting for ~73% of the market share. This is on account of the surging demand for protective packaging cases, such as bubble wraps and air pillows, given the growth of the global e-Commerce industry. In addition, the ready adaptability of plastic materials for the development of protective cases of any shape or size, complemented by their lightweight and strength, are likely to remain a critical lever for the massive uptake in their adoption.

In contrast, with environment-sustainability concerns prevailing among consolidation-seeking manufacturers, the significance of metal for the development of protective cases will grow at an exponential rate. With such an improvement in their adoptability, the sales of metal-based protective cases are projected to arrive at a value of ~US$ 400 Mn in 2027.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

In Focus: Manufacturers Moving Past the ‘One-Size-Fits-All’ Concept

The packaging needs of various end-use segments differ significantly from each other, given the varying degrees of fragility, shapes, sizes, and quality of materials being used. As protective cases aid in the safe delivery of shipments, ranging from military equipment, electronics, automotive parts, medical & fire safety equipment, to measuring equipment, and others, manufacturers resort to the custom development process to target client-specific demands. Among the others, rotational molding and injection molding are the highly adopted custom-development processes by the protective cases market.

However, the threat of substitute prevailing from the very concept of ‘customization’ is high in the protective cases market. Though protective cases weigh better than paper-based protective cases on the scale of reusability, they underperform on the scale of pricing. Paper-based protective cases boast affordability, and with manufacturers arriving at the ‘custom development’ juncture, these cases are poised to compete strongly with plastic, metal, and leather-based protective cases, thereby impacting the steady growth of the market.

Looking for exclusive market insights from business experts? Request a Custom Report here

Surging Popularity of Protective Cases for Transit of Photography Equipment

In 2018, the sales of protective case for the packaging of photography equipment accounted for ~23% of the market share, and are projected to move at a CAGR of ~5% during the forecast period. The trend of owning a camera for personal and professional purposes, coupled with the ease of purchasing it from an online sales channel, has increased from the last decade. Since such equipment is cost-prohibitive and highly susceptible to damage whilst in the transit phase, protective cases have been witnessing a steady uptake in their sales.

However, the introduction of cushioned protective cases that ensure the safe shipment of fragile electronic products and consumer goods, such as smartphones, tablets, wristwatches, and kitchen appliances, among others, is gaining momentum at an exponential rate. The sales of protective cases for electronics equipment will rise from ~US$ 220 Mn in 2019 to ~US$ 340 Mn in 2027, demonstrating a CAGR of ~6% during 2019-2027.