![Product Lifecycle Management [PLM] Market Research, Study Report, and In-depth Analysis 2030](https://knnit.com/wp-content/uploads/2022/08/product-lifecycle-management-plm-market-research-study-report-and-in-depth-analysis-2030_162206.jpg)

Online Events Educate Users about Remote Monitoring of Production Activities amidst COVID-19 Crisis

Digital transformation is the key to address challenges created by the COVID-19 (coronavirus) outbreak. Users in the manufacturing and retail sectors are participating in webinars to stay ahead in competition amidst the coronavirus era. For instance, Centric Software- a Silicon Valley-based software company conducted a seminar in March 2024 that shed light on how digitalization drives business growth with the help of the product lifecycle management software.

Companies in the Product Lifecycle Management (PLM) market should increase efforts to conduct online events that educate users on how they can deploy better collaborations and communication with the help of the PLM software. As such, decline in costs and streamlining of production processes are catalyzing the adoption of PLM. Remote monitoring of production activities is another advantage for users amidst the COVID-19 pandemic that will, in turn, drive the Product Lifecycle Management (PLM) market.

Request a sample to get extensive insights into the Product Lifecycle Management (PLM) Market?

Automated Management of Labels in F&B Bolsters Adoption of Product lifecycle Management

Product Lifecycle Management (PLM) is being adopted by F&B (Food & Beverage) manufacturers for product innovation and transparency in production practices. Stringent compliance pressures and the ever-increasing demand for quality products have catalyzed the adoption of PLM in F&B companies. F&B manufacturers are benefitting from PLM, since these software deliver important data about the likelihood of projects being successful. Product lifecycle management helps in regulatory compliance for labels and ingredients, which helps to increase product uptake.

Efficient information management has become instrumental to achieve transparency in internal and external processes. Hence, companies in the Product Lifecycle Management (PLM) market are innovating in software that effectively manage customer inquiries. Automated management of labels is another key driver that is bolstering growth for the Product Lifecycle Management (PLM) market, which is estimated to cross a value of US$ 91.9 Bn by the end of 2030.

Cloud PLM Deploys Low Cost Implementation as Compared to On-premises Solutions

Cloud product lifecycle management software are being highly publicized in various end markets. This explains why the product lifecycle management (PLM) market is estimated to advance at a favorable CAGR of ~5% during the assessment period. Easy to implement and real-time collaboration provided by cloud product lifecycle management software is generating value-grab opportunities for companies. As such, PLM helps internal teams and supply chain partners design, develop, and produce high-quality products for its target customers.

To understand how our report can bring difference to your business strategy, Ask for a brochure

Product lifecycle management supports new product development (NPD) and new product introduction (NPI) in a budget-friendly manner. Companies in the Product Lifecycle Management (PLM) market are capitalizing on the trend of real-time collaboration, which requires information sharing between internal and external teams. Cloud PLM is increasingly replacing on-premises solutions, owing to its advantages of low cost implementation and cheaper maintenance.

Need For Engagement with Extended Supply Chain Triggers PLM Adoption in Defense

Apart from consumer goods and the retail sector, vendors in the product lifecycle management (PLM) market are tapping into opportunities in the aerospace & defense sector. Since products used in the aerospace & defense industry are potentially complex and interdependent, end users are raising the demand for PLM software. In the face of constant innovation in the aerospace & defense sector, companies are making available advanced PLM systems that are capable of streamlining the flow of information. With the help of the product lifecycle management, users in the aerospace & defense sector can better engage with the extended supply chain and practice simultaneous development among cross-department teams.

Companies in the product lifecycle management market are innovating in software that help to improvise the performance in aircraft production and reduce costs. For instance, UEC Saturn— a Russian aircraft engine manufacturer is acquiring global recognition with its PLM software NPO Saturn by joining forces with the Siemens PLM Software technologies.

Flexible and Adaptable Software Solutions Win Over Rigid Software Structures

Most manufacturing organizations use the product lifecycle management software after some point in their company’s lifetime. However, several PLM software are rigid structures that lead to wasted time and costly workarounds. Hence, companies in the product lifecycle management market are increasing their R&D capabilities to develop flexible and adaptable software solutions that work efficiently. This can be attributed to the ever-evolving technology in PLM is constantly changing.

The next-gen product lifecycle management software is capable of deploying analytical and data-driven approaches in today’s fast-paced and customer-centric businesses. The Product Lifecycle Management (PLM) market is undergoing a sea change with the outside-in approach the vendors are adopting in order to ensure customer satisfaction. With the help of PLM, end users are able to calculate and anticipate changing demands of customers.

PLM versus PDM: Which is better?

PLM is primarily used to manage organizational workflows and deploy cross-department engagement. However, product data management (PDM) is a tool to manage product data and keep CAD (Computer-aided Design) files in organized and version-controlled manner. However, companies in the Product Lifecycle Management (PLM) market are increasing efforts to tackle the issue of incompatible formats such as CAD files in PLM, as users create and manage information in native CAD formats and other neutral file formats. In such cases, PDM helps to manage all formats of CAD files.

On the other hand, PDM and PLM are two sides of the same coin, as organizations who are using CAD software need to purchase a PDM system. Moreover, the momentum created by Industry 4.0 exposes the vulnerability of PLM. Hence, companies in the Product Lifecycle Management (PLM) market are suggesting users to make combined use of PDM and PLM to establish better efficiency in organizations.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Product Lifecycle Management (PLM) Market

Product Lifecycle Management (PLM) Market: Overview

- The growing need for product innovation, productivity enhancement, and decline in operational cost are key factors driving the growth of the Product Lifecycle Management (PLM) market. A PLM solution increases the productivity of a system substantially by providing various tools and methodologies to reduce redundancies.

- PLM vendors have also started offering various customized PLM solutions according to the needs of enterprises, further aiding the growth in demand. However, the Product Lifecycle Management (PLM) market faces some challenges such as low interoperability between different product versions, competitive products, data formats, and data models and databases.

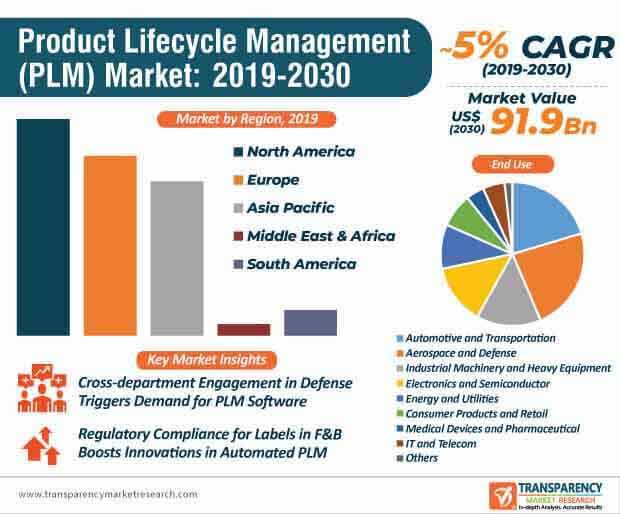

- The global Product Lifecycle Management (PLM) market generated revenue of US$ 52.4 Bn in 2019 and is projected to expand at a CAGR of ~5% during the forecast period (2020-2030) to reach a market size of US$ 91.9 Bn by 2030

- The PLM considered here includes both software and service components. PLM software can be segmented into on premise and cloud-based

- Different on premise and cloud-based PLM software types include CAD/CAM/CAE (CAx), numerical control (NC), simulation and analysis (S&A), architecture, engineering and construction (AEC), collaborative product definition management (CPDM), digital manufacturing, electronic design automation (EDA), and others

- In 2019, on premise PLM software occupied a major share of the Product Lifecycle Management (PLM) market. This was due to the large demand for on premise PLM solutions due to concerns related to security and accessibility in various end use sectors for cloud-based solutions. However, increasing security of cloud and access to increased features over cloud are driving the demand for cloud-based PLM software.

- Cloud-based PLM solutions are increasingly being deployed by enterprises across the globe. Cloud-based implementation models lower the cost by avoiding the need for infrastructure investments, along with the increase in scalability and accessibility to information, processes, and functions. SMEs are more likely to adopt cloud-based PLM solutions during the coming years due to its low cost.

Product Lifecycle Management (PLM): Market Segmentation

- The growth of the CAx segment is driven by the demand to lower time-to-market of products in enterprises. In the coming years, the market for both on premise and cloud-based CAx solutions is expected to be majorly driven by the demand from SMEs, as these enterprises have started investing in standalone software to have better visualization of the product as well as reduction in operational costs.

- Aerospace & defense was the largest end use segment of PLM in 2019. This segment has a significantly long product development cycle and in order to manage this, companies in this sector started adopting PLM solutions extensively.

- Increasing global competition, decline in budgets related to defense and aerospace, and a rising commercial aircraft backlog would significantly drive the demand for PLM in companies in the aerospace and defense sector. Non-traditional end use sectors such as consumer products and retail, and medical devices and pharmaceutical have also started using PLM solutions and services in order to increase their production efficiency.

- Thus, the growing demand from non-traditional end use sectors is also one of the major factors that drives the growth of the Product Lifecycle Management (PLM) market globally

Product Lifecycle Management (PLM) Market: Regional Segmentation

- In the coming years, Asia Pacific, South America, and Middle East & Africa (MEA) are expected to be key geographies driving the demand for PLM solutions

- The market for Product Lifecycle Market (PLM) is highly competitive with the presence of multiple global and local players

- Key PLM software vendors in 2019 included

- PTC, Inc.

- Siemens AG

- Dassault Systemes

- Autodesk, Inc.

- Further

- IBM Corporation

- Accenture PLC

- Hewlett-Packard

- Company are also key players in the Product Lifecycle Management (PLM) market

Read Our Latest Press Release:

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through ad-hoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

Contact

Transparency Market Research State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453