Power system analysis software facilitates utility companies to minimize loss of energy during electricity generation and electricity distribution, thereby optimizing operational efficiency. Due to incessant energy consumption along with challenges in energy production, utility providers are increasingly shifting towards power system analysis software to analyze data collected from smart power systems.

The increasing investment in smart power technologies is the primary factor boosting the global power system analysis software market. Apart from this, advancements in Big Data analytics and Internet of Things is also a major factor boosting the demand for power system analysis software. Furthermore, energy conservancy property of the software is gathering the attention of governments across the world for long-term energy security, which is another factor fuelling the market’s growth.

The power system analysis software market is highly fragmented with the presence of several local players. However, a handful of companies, namely General Electric Company, ABB Ltd., and Siemens AG have established themselves via mergers and acquisitions and strategic alliances with domestic players. For example, in 2016, General Electric Company acquired Alstom and has been making huge investments in India to build smart cities, mission critical facilities, process industries, and government operations.

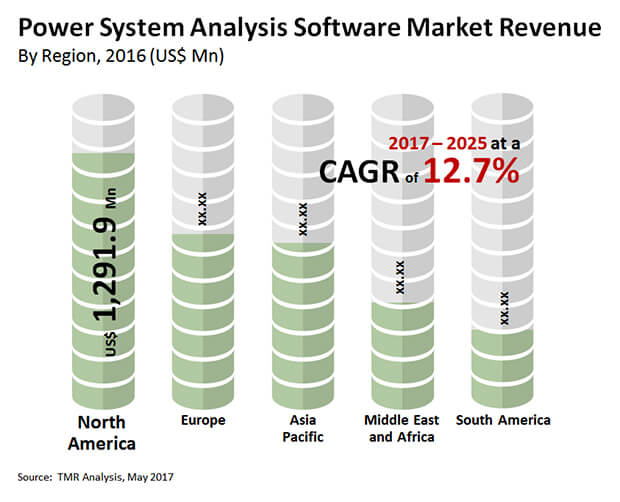

The global power system analysis software market stood at a valuation of US$3,540.4 mn in 2015 and is expected to be worth US$10,245.6 mn by 2024 rising at a CAGR of 12.6% between 2016 and 2024.

Cloud-based Implementation to Gain Prominence in Near Future

In terms of implementation, the global market for power system analysis software is divided into on-premise and cloud-based models. Of the two, on-premise led the market in 2015 accounting for almost 82% revenue of the overall power system analysis software market. The on-premise implementation segment is expected to rise at a CAGR of 12.3% between 2016 and 2024. The on-premise model offers better system uptime as servers are owned and maintained at the power utilities’ buildings, which is one of the key factors for the lead position of the segment.

However, cloud-based implementation segment is also expected to rise steadily due to the far-reach capabilities of the Internet.

On the basis of application, distribution and transmission are the segments into which the power system analysis software market is divided. In 2015, distribution held 62% of the overall market and is expected to display leading demand through the forecast period.

Asia Pacific to Emerge as Significant Market

Region-wise, North America is the leading contributor to the power system analysis software market. The region held almost 33.0% of the revenue in the global market in 2015. This is mainly due to massive investments in smart grid systems. Furthermore, ongoing efforts in Canada to upgrade its electricity infrastructure with the objective to minimize energy loss during production and transmission is expected to have a positive impact on the power system analysis software market in the coming years.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=7502

However, rapid urbanization in emerging economies of Asia Pacific is expected to bode well for the growth of this regional market. In Asia Pacific, countries such as China, India, Japan, South Korea, and Australia are the leading domestic markets with large populations and high unmet energy needs.

Key companies operating in the power system analysis software market include ABB Ltd., General Electric Company, ETAP/Operation Technology Inc., PSI AG, Unicorn Systems, Electricity Coordinating Center Ltd., Open Systems International Inc., Electrocon International Inc., Eaton Corporation plc, Siemens AG, Schneider Electric DMS NS, Atos SE, Artleys SA, Energy Exemplar, PowerWorld Corporation, Nexant Inc., Pöyry, Neplan AG, and DIgSILENT GmbH

Read Our Latest Press Release: