The global market for payment security software has been witnessing a significant rise over the last few years, thanks to the increasing trend of digitization. The advancements in electronic and online payment is leading to a tremendous rise in the number of transactions made over the Internet. With the escalating penetration of smartphones, the number of mobile payments has also increased. This, as a result, has increased the concerns over the security of these payments across the world, which is reflecting greatly on the worldwide payment security software market.

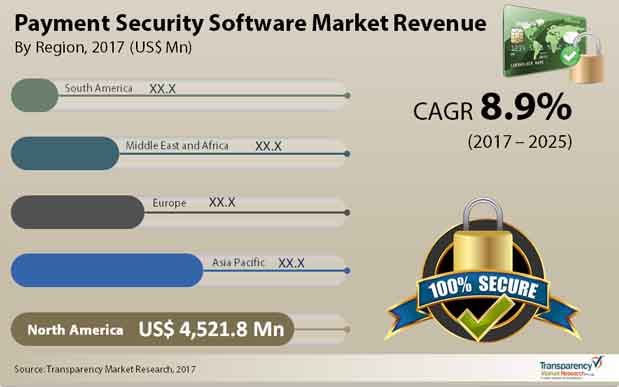

The ongoing shift towards cashless economy is also influencing the growth of this market substantially, as non-banking players are adopting various cashless transaction platforms, such as digital wallets, mobile money, and virtual currencies. Overall, the future of the global payment security software market looks bright. According to Transparency Market Research (TMR), the market is estimated to expand at a CAGR of 8.90% between 2017 and 2025 and reach a value of US$23.7 bn by the end of 2025.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30509

Increasing Investment in Payment Security Technology to Ensure North America’s Lead

In terms of the geography, the global market for payment security software reports its presence across Asia Pacific, South America, the Middle East and Africa, Europe, and North America. With nearly 40% shares, North America has emerged as the market leader. The high adoption rate of online medium of payments is the key factor behind the growth of this regional market. Apart from this, the presence of a large pool of payment security software providers in North America also supports this market considerably.

Over the forthcoming years, the investment in the online payment technology is likely to increase. Coupled with the rising partnership between software and hardware providers in this region, this factor is expected to boost the North America market for payment security software significantly in the near future. The introduction of innovative technologies in payment security, particularly in the U.S. is also projected to propel this regional market over the next few years.

Currently, Europe, which stood at the second position, is witnessing a slowdown in its payment security software market sue to stringent regulations and economic upheaval. Asia Pacific, on the other hand, is anticipated to provide the most promising opportunities for growth in the years to come, owing to the increasing awareness about technological advancements among people in this region. The markets in South America and the Middle East and Africa are still in the nascent stage and are predicted to gain momentum in the forthcoming years.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=30509

Security Information and Event Management Software to Continue Displaying Strong Demand

The worldwide payment security software market is broadly analyzed on three fronts: The solution, mode of payment, and the end user. Based on the solution, software and services are considered as the key segments of this market. Firewalls, security information and event management (SIEM), intrusion detection and prevention (IDS/IPS), anti-virus/anti malware, data encryption, multi-factor authentication, tokenization, and data loss prevention (DLP) are the main payment security software available across the world. Among these, the demand for security information and event management software is greater than other software and the trend is likely to remain so over the forthcoming years.

By the mode of payment, the market is classified into mobile payment security software, online payment security software, and point-of-sale (PoS) systems and security. Since mobile payments is widely utilized for transactions, this segment is expected to lead the market over the forecast period. The banking, financial services, and insurance (BFSI), healthcare, retail, and the government sectors have emerged as the prime end users of payment security software.

At the forefront of the global market for payment security software are Symantec Corp., Intel Corp., Cisco Systems Inc., Trend Micro, CA Inc., Gemalto, HCL Technologies, TNS Inc., Thales e-Security, and VASCO Data Security Int. Inc.

Read Our Latest Press Release: