Moisture-resistant Pouches Gain Prominence in F&B Industry

Flexible packaging is one of the fastest-growing sectors in the FMCG manufacturing industry. Hence, companies in the moisture barrier bags market are innovating in flexible packaging solutions for the food industry. The versatility of bags is increasingly gaining the attention of packaging manufacturers. Hence, manufacturers in the moisture barrier bags market are introducing novel moisture-resistant bags that cater to the convenience of consumers.

Since users are always challenged with space-constrained storage in household environment, manufacturers in the moisture barrier bags market are developing multi-layer pouches that provide resistance to moisture, puncture, pests, and air, among others. Thus, bags are generating incremental opportunities, due to their high demand in commercial and domestic settings. Aluminum foils are gaining popularity in the market for moisture barrier bags. Though aluminum foils do not hold a significant share in terms of value and volume as compared to plastic, they are gaining prominence in confectionary packaging for dairy items.

Request a sample to get extensive insights into the Moisture Barrier Bags Market

Recyclable PE Solutions Cater to Unmet Needs of Food Manufacturers

Growing environmental concerns associated with plastic has led to the introduction of recyclable coextruded polyethylene (PE) pouches. As such, plastic material segment dominates the moisture barrier bags market, in terms of value and volume, which is expected to reach an output of ~373,300 tons by the end of 2027.

In order to provide resistance toward vapor, odor, and light, manufacturers in the market for moisture barrier bags are undertaking extensive R&D activities to develop five and nine layer PE pouches. On the other hand, they are increasing production capacities to develop PE laminates of up to two to three layers to provide efficacious resistance against quality-degrading elements.

Companies in the moisture barrier bags market are increasing the availability of PE pouches that can be surface-printed and manufactured with coextruded films. As such, PE pouches are witnessing rise in demand from manufacturers in various end markets, since they can be designed with barrier properties on the basis of specific shelf-life requirements. Thus, recyclable PE bags are becoming increasingly mainstream in food packaging applications for dry and frozen foods.

Heat-sealable and Puncture-resistant Bags Prevent Degradation of PCB

Growing consumer dissatisfaction toward damaged and mangled electronic products has driven the demand for moisture barrier bags. As such, moisture is one of the main causes of degradation of PCB (Printed Circuit Board). Hence, manufacturers in the moisture barrier bags market are increasing their efficacy in moisture-proof packaging solutions to prevent degradation of PCB.

To understand how our report can bring difference to your business strategy, Ask for a brochure

Outdoor and shipment applications of PCB are creating growth opportunities for manufacturers. As such, electrical & electronics end use segment of the moisture barrier bags market is estimated to reach an output of ~133,400 tons by 2027. Hence, manufacturers are tapping opportunities in shipment applications such as sea freight.

Companies in the market for moisture barrier bags are exploring opportunities to cater end user needs when PCB is being transported via long-distance travel through regions with humid climate. Moreover, growing awareness about moisture-proof packaging among consumers is boosting the uptake of moisture barrier bags. Thus, there is a growth in demand for heat-sealable and puncture-resistant bags for electricals and electronics.

Extensive R&D to Help Fine-tune Compostable Packaging of Food Products

Growing environmental footprint, owing to plastic packaging solutions has compelled market players to innovate in compostable packaging. Though compostable packaging constitute only a fraction of the global packaging market, companies in the moisture barrier bags market are increasingly focusing on food packaging. As such, food & beverages end use segment of the moisture barrier bags market is estimated to reach an output of ~145,700 tons by 2021. Hence, manufacturers are increasing their efficacy in compostable food packaging to reduce environmental impact.

Innovations in compostable food packaging are bolstering the credibility credentials of companies in the market for moisture barrier bags. However, manufacturers face limitations to comply with existing food industry requirements depending on the type of food. Hence, manufacturers are increasing research to fine-tune compostable packaging that matches oxygen and water vapor transmission rates.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Moisture Barrier Bags Market

Moisture Barrier Bags Market: Overview

- According to Transparency Market Research’s latest market report on the moisture barrier bags market for the historical period of 2014-2018 and forecast period of 2019-2027, demand for printing and packaging is anticipated to boost moisture barrier bags services

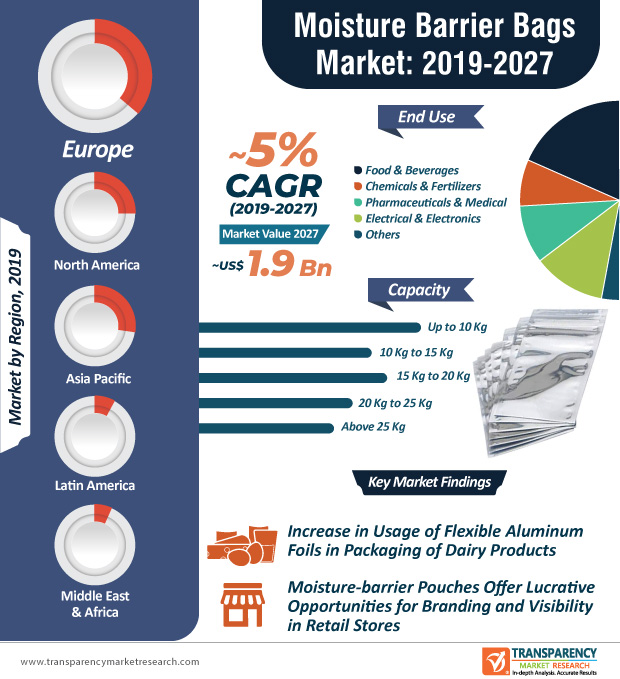

- Globally, the moisture barrier bags market was valued at ~US$ 1.2 Bn in 2018 and is anticipated to grow at a CAGR of ~5% during the forecast period

Increasing Demand for Moisture Barrier Bags to Extend Shelf Life of Products

- Moisture barrier bags offer moisture-resistant properties to dry products during their transition and throughout the complete supply chain. The increasing consumption of packaged foods across the globe will create a high demand for barrier bags resulting into long shelf life and high barrier properties in packaging. This is a crucial factor, which is expected to drive the moisture barrier bags market.

- Change in food consumption patterns of consumers, which is inclined toward ready-to-eat meals, is expected to fuel the demand for moisture barrier bags among consumers

- Moisture barrier bags are ideally suited for different foods items, such as liquid foods, food ingredients, and pet food that are mostly needed to increase the shelf life of these food products, as they are perishable

- There no single route toward sustainability and this has greatly proven by one of the leading packaging companies, Mondi PLC. As a manufacturer of paper and flexible packaging, Mondi positioned itself for most sustainable and suitable packaging solutions.

- Mondi in its offerings give sustainable paper and packaging options required to make moisture barrier bags options, such as Advantage MF EcoComp, Advantage Smooth White Strong, and Barrier Pack Recyclable

Lucrative Opportunities in Chemicals & Fertilizers for Moisture Barrier Bags Manufacturers

- Most chemicals and fertilizers that packed in moisture barrier bags are made of plastics, such as polyethylene, polyester, and others, which account for more than 60% market share. These materials offer excellent barrier properties for air and moisture that are needed for moisture barrier bags, but are not biodegradable.

- Moisture barrier bags manufacturers can enter untapped geographies to provide sustainable packaging. Besides this, manufactures can also target growing demand from eco-conscious customers and provide green packaging solutions. Different fertilizers, industrial salt, calcium carbonate, charcoal & minerals are some the categories that are packed in moisture barrier bags made of paper.

- The global provider of paper and flexible packaging, Mondi PLC, has launched an innovative product named SLASHBAG, which is a moisture barrier bag that offers excellent mechanical properties in wet environment to prevent rupture. It provides rain resistance for up to 6 hours.

Technological Advancements in North America Packaging Industry

- North America is anticipated to account for ~25% of the global moisture barrier bags market in 2019, attributable to increasing technological developments in the packaging industry in this region. The manufacturers in this region are involved in innovating and supplying new products such as static and anti-static moisture barrier bags for takeout and pharmaceutical purposes.

- Europe is expected to lead the moisture barrier bags market, in terms of market share

- China, India, and other ASEAN countries of Asia Pacific account for second-largest market share in 2019, owing to increasing population that interprets into strong demand for flexible packaging

- The moisture barrier bags market in MEA is anticipated to witness growth during the forecast period

Moisture Barrier Bags Market: Key Research Findings

- Shifting preference toward flexible packaging solutions attributable to enhanced consumer experience, low cost of end products, carriage & storage conveniences is anticipated to fuel the growth of the moisture barrier bags market during the forecast period

- In terms of package type, the gusseted bags segment is expected to dominate the moisture barrier bags market, accounting for over 75% of the market share. They are often used in food packaging, gardening soil, fertilizer packaging, and other dry bulk chemicals.

- The moisture barrier bags market in Asia Pacific region is projected to grow at an impressive CAGR, owing to increased per capita packaged food consumption. However, mature countries of the European region are expected to hold a significant share of the moisture barrier bags market, in terms of value as well as volume.

Moisture Barrier Bags Market: Competition Landscape

- The market for moisture barrier bags is highly fragmented. Service providers in the moisture barrier bags market are adopting the strategy of acquisitions & merger to expand their presence across the globe.

- Some key players operating in the moisture barrier bags market are

- Mondi Plc.

- Sonoco Products Company

- Amcor Plc

- Flexopack SA

- 3M

- SCG Packaging Public Company Limited

- Protective Packaging Corporation Inc

- ProAmpac LLC

- Ahlstrom-Munksjo Oyj

- Pacific Packaging (Far East) Pte Ltd

- Nordic Paper Holdings AB

- Twin Rivers Paper Company LLC & Billerudkorsnäs Ab