Explosion of use of digital technologies for business communication and everyday functioning is expanding avenues in the mobile virtual network operator market. Vendors in mobile virtual network operator (MVNO) market are capitalizing on changing practices of business functioning for internal and external communication. Conceptualized to provide cellular services on the existing infrastructure of other mobile network operators (MNO), this allows vendors in the MVNO market to provide low cost services to consumers. This attracts investments and participation of cellular service providers of all sizes to provide service on the MVNO model, collectively translating into growth in the mobile virtual network operator market.

Advancements in cellular infrastructure and support extended by MNOs serves to expand vistas in the MVNO market. For example, in Europe, government regulations mandate cellular service providers to support MVNOs by means of increased telecommunication spectrum for use. Additional bandwidth of the 3G telecommunication spectrum has helped MVNOs to better serve their customers. For example, this has allowed network operators to provide categorized services to niche business segments. MVNOs have been able to provide cheap rates for international calling that has been well-received by people to stay connected with family and friends at a low cost.

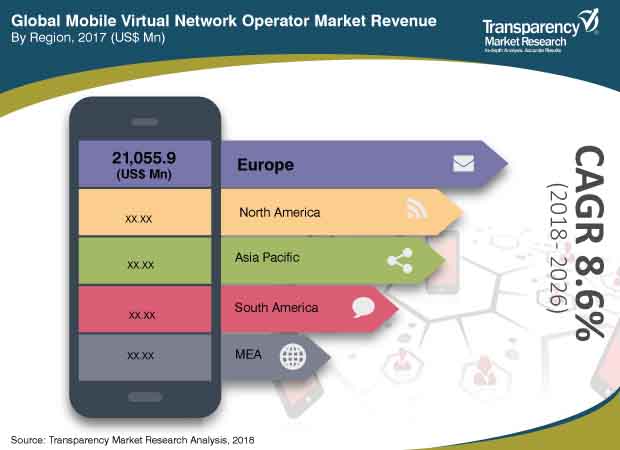

The MVNO market is segmented on the basis of operational model, subscriber, type, and geography. Europe led the MVNO market in the recent past and is expected to continue to remain at the forefront in the coming years. Key factor behind supremacy of the region is government rules and regulations. Product launches and business partnerships between cellular network service providers further strengthens the MVNO market in the region.

Asia Pacific is pacing as a key region in the MVNO market. Rapid advancements in cellular network services along with deployment of a number of service models in emerging economies is fuelling the MVNO market in the region.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=3261

Mobile Virtual Network Operator Market – Snapshot

Mobile virtual network operator (MVNO) is an entity which provides cellular services by using the existing infrastructure of any other mobile network operator (MNO). MVNO has its own data and voice plans, cost structure, and customer handling system. MVNOs provide low cost services to consumers. In addition, operators earn money through the rented spectrum used by MVNOs. Governing bodies are encouraging MVNOs to reduce the expenditure on household communications and promote efficient usage of the full spectrum. MVNOs provide customized services to consumers which are tailor-made to the requirements of consumers. The number of MVNOs is rising globally due to the support of governments and increased competition in the mobile network market. The global MVNO market was valued at US$ 47,090.1 Mn in 2017 and is forecast to grow at a CAGR of 8.6% from 2018 to 2026 reaching a value of US$ 98,438.4 Mn by 2026.

MNOs are supporting MVNOs to earn extra money through rent and also to deal with the competition from other network operators. In regions such as Europe, government rules and regulations have made it compulsory for operators to support MVNOs with increased spectrum available for usage. Additional bandwidth from the 3G spectrum has helped MVNOs to provide quality services to their customers. Network operators are able to provide categorized services to niche segments in the market. Cheap calling rates internationally have helped people from the same ethnicity to stay in touch with their family and friends at a low cost.

Customers using the services of MVNOs are indirectly utilizing the operator’s network. Customer acquisition has become easier and cheaper for network operators as promotional costs have reduced with the help of MVNOs. MVNOs have their own customer service system helping in building a strong relationship with the customers.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=3261

The global mobile virtual network operator market has been segmented on the basis of operational model, type, subscriber, and geography. On the basis of operational model, the market is segmented into reseller MVNO, service operator MVNO, and full MVNO. Mature markets in the mobile phone service segment are likely to experience a decline in terms of number of MVNOs launched. In contrast, fast developing markets are trying to accommodate MVNOs much earlier into their mobile network system which will result in increased number of MVNOs launched.

Based on type, the market is classified into discount, telecom, migrant, M2M, business, retail, media, and roaming. Discount was the largest segment of the MVNO market in 2017. Customers are trying to gain low cost calling services provided by the discount MVNOs. Migrant MVNOs are gaining popularity through customized services provided to communities from the same ethnicity. M2M is considered the most promising type of MVNO due to high traction being gained by connectivity of machines and devices.

In terms of region, Europe led the MVNO market in 2017 and is expected to remain dominant throughout the forecast period from 2018 to 2026. The primary driver for the MVNO market in Europe is the government rules and regulations. Asia Pacific and South America are anticipated to experience promising growth in the MVNO market in the coming years. In an interesting development, the mature MVNO markets in the Asia Pacific region such as Korea, Japan, Hong Kong, Malaysia, and Australia have now been overtaken by newcomer, China. The China MVNO market has developed into the largest and most promising one. There are also three Asia Pacific countries to keep an eye on: Vietnam, Indonesia, and Philippines.

The global mobile virtual network operator market is largely driven by product launches and partnerships. For instance, in January 2017, Virgin Mobile renewed its five-year deal with BT’s EE Limited to provide wholesale mobile services. Under this partnership, EE Limited is projected to offer wholesale mobile network services to Virgin Mobile for an unrevealed price. In December 2017, Virgin Mobile announced the launch of ‘Recommend’ in Dubai to help customers get more value from their mobile plans.

Key players profiled in the report include AT&T Inc., Lycamobile Group, Sprint Corporation, T-Mobile AG, Verizon Communications Inc., CITIC Telecom International Holding Limited, Telefonica S.A., Tracfone Wireless, Inc., Truphone Limited, and Virgin Mobile.

TMR Latest News Publication: