3D Polycarbonate Face Shields Protect Healthcare Workers Against COVID-19

Medical polycarbonates and other plastic-intensive products are acquiring increased importance amidst the ongoing COVID-19 (coronavirus) pandemic. This stems from an increased demand for polycarbonate syringes and intravenous (IV) components. As such, the revenue of fluid delivery and IV connection components is slated for aggressive growth in the medical polycarbonate market.

Innovative products such as one-piece plastic face shields are being introduced for coronavirus medics. For instance, the research team at the Massachusetts Institute of Technology (MIT), U.S., is increasing efforts to design disposable face shields and are urging manufacturers in the medical polycarbonate market to mass produce the same. This trend is particularly important since the U.S. healthcare facilities are being severely compromised on basic personal protective equipment (PPE) such as face masks, protective gowns, and gloves. Thus, companies in the market for medical polycarbonates can boost their credibility in the global market landscape by innovating in three-dimensional (3D) face shields that hold promising potential in fighting off the coronavirus infection.

To gauge the scope of customization in our reports Ask for a Sample

Glass-filled Medical Polycarbonates Gain Prominence in Laparoscopic Surgical Tools

Increasing number of patients are utilizing auoinjectors and injection pens to self-monitor therapeutics with convenience of staying at their homes. This has led to companies in the medical polycarbonate market to innovate in low-friction components that ensure injections are reliable and smooth. For instance, in January 2024, global leader of transparent polycarbonate plastics Covestro, announced the launch of three new medical polycarbonates, Makrolon® M204 LF, Makrolon® M402 LF and Makrolon® M404 LF that are associated with reduced coefficients of friction in devices.

Get an idea about the offerings of our report from Report Brochure

Companies are increasing R&D activities to innovate in glass-filled polycarbonates for developing laparoscopic surgical tools. Glass-filled polycarbonates are being highly publicized for surgical and drug delivery applications that require stiffness and strength in load-bearing internal components for laparoscopic surgical tools. Such innovations are bolstering revenue of the medical polycarbonate market, which is projected to reach a a value of US$ 1.5 Bn by the end of 2030.

Implant Packaging Applications Mandate Compliance with International Standards

Value-grab opportunities in implant packaging are grabbing the attention of manufacturers in the medical polycarbonate market. Since breast implants are sensitive products and need to be arrived undamaged at healthcare facilities, manufacturers are increasing their focus in new medical polycarbonate films. Companies are experimenting with highly transparent polycarbonate films that help physicians to visually inspect the implants before unpacking them. This explains why the medical polycarbonate market is estimated to reach a production of ~187,400 tons by the end of 2030.

There is a growing demand for medical polycarbonate films that offer stable protection of products. This demand has fueled innovations in high tear and impact resistance polycarbonate films. Such films can be easily thermoformed and are fully compatible in challenging applications such as autoclave sterilization processes, whilst withstanding extreme high temperatures. Manufacturers are increasing efforts to comply with the ISO (International Organization for Standardization) and other quality management standards such as the ASTM (American Society for Testing and Materials) standard for acquiring the implantable breast prosthesis certification.

Injection Molding Technologies Offer Cost-efficient Manufacturing of Portable Medical Devices

High-flow medical polycarbonates are increasingly gaining prominence in on-body drug delivery or monitoring applications. However, identifying the best processing technology for thermoplastic materials poses a challenge for companies in the medical polycarbonate market. This explains why the market is growing at a sluggish volume CAGR of ~3% during the forecast period. Hence, manufacturers are tapping into opportunities in injection molding technologies, owing to their economic advantages of high-speed and high-volume production.

Global leader in thermoplastics SABIC is increasing awareness about optimal plastic processing methods that align with demanding needs of healthcare providers. This has led to the popularity of injection molding technologies and is anticipated to register exponential revenue growth in the medical polycarbonate market. The advantages of injection molding technologies are associated with improved patient outcomes, thus boosting the credibility credentials of both companies in the market for medical polycarbonates as well as healthcare facilities. Likewise, injection molded designs are serving as cost-efficient manufacturing solutions for companies. Moreover, thin-wall injection molding techniques play an instrumental role in developing lightweight portable medical devices.

Looking for Regional Analysis or Competitive Landscape in Medical Polycarbonate Market , ask for a customized report

Analysts’ Viewpoint

One-piece 3D face shields are a novel introduction for frontline healthcare workers that are facing shortage of basic PPE amidst the debilitating COVID-19 crisis. High-flow polycarbonates play an instrumental role in the development of unobtrusive and lightweight medical devices.

Injection molding technologies have become the gold standard for manufacturing devices with dimensional accuracy and versatility. However, investing in injection molding equipment is relatively expensive for manufacturers. As such, manufacturers should take the leap in injection molded designs, since investment costs are offset by economic advantages of high-speed and high-volume production, whilst increasing the availability of products with long tool life.

Medical Polycarbonate Market: Overview

- Polycarbonate offers strong UV protection. It manufactured by polymerization of a monomer containing hydroxyl end groups and phosgene. Led by its high transparency, polycarbonate is employed in the production of eyewear lenses and is often considered a better alternative to glass. Furthermore, polycarbonate is almost four times stronger than fiberglass and has high tensile strength of 70 Mpa.

- Excellent clarity and strength make polycarbonate the resin of choice in the production of devices such as hemodialysis filter membranes, surgical instrument handles, and housings of oxygenator devices. Its other applications include needle-free injection systems, perfusion equipment, blood centrifuge bowls, and stopcocks.

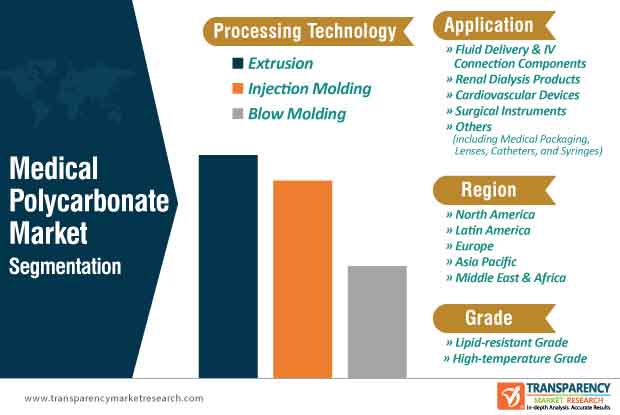

- Based on grade, the global medical polycarbonate market can be bifurcated into lipid-resistant and high-temperature grade. The lipid-resistant grade segment dominated the global medical polycarbonate market in 2019. Leading share of the segment can be ascribed to the excellent ability of lipid-resistant grade polycarbonate to deliver non-water-soluble drugs in IV connector components. Use of this grade also helps in reducing stress cracking of female luer fittings when exposed to lipid emulsions. The cost of high-temperature grade is higher than that of lipid-resistant grade polycarbonate. This is expected to hamper the growth of the segment in near future. However, this grade is extensively used in the production of surgical instruments, clinical lab wares, etc. owing to its ability to withstand flash autoclaving cycles.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/clean-and-safe-cooking-fuels-demand-to-support-the-growth-of-global-propane-market-to-reach-valuation-us-109-bn-from-2019-to-2027-finds-tmr-301030246.html

Key Growth Drivers of Medical Polycarbonate Market

- Properties of medical polycarbonate such as its excellent clarity, biocompatibility, high impact resistance, and strength make medical polycarbonate an ideal material for the formulation of fluid delivery & IV connection components, renal dialysis products, cardiovascular devices, surgical instruments, and medical packaging, lenses, catheters, syringes, etc. Additionally, medical polycarbonate can replace glass or metal in many products, owing to its broad range of physical properties. This helps in prevention of potentially life-threatening material failures.

- Increase in geriatric population and rise in number of diseases across the globe are anticipated to drive the demand for intravenous components, including stopcocks, y-injection sites, cannulas, check valves, filter housings, male and female luer fittings, and needle-free injection systems in the near future. In turn, this is projected to drive the demand for fluid delivery & IV connection components, thereby boosting the medical polycarbonate market in the near future.

Lucrative Opportunities in Medical Polycarbonate Market

- Established players can invest in R&D activities to develop innovative solutions in order to lower the cost of production of medical polycarbonate

- Manufacturers such as Teijin Ltd, Idemitsu Kosan, LG Chemicals, RTP Company, and Lotte Chemical are engaged in the production of polycarbonate. These are established players in the global polycarbonate market. They can obtain the certification and technology required to enter the medical polycarbonate market.

North America to Dominate Medical Polycarbonate Market

- The medical polycarbonate market in North America is dominated by manufacturers such as Trinseo S.A. and GOEX Corporation. These manufacturers are extensively engaged in new product launches to increase their share in the global medical polycarbonate market. For instance, on February 3, 2024, Trinseo S.A. launched a new wear resistant, high lubricity polycarbonate for medical devices at Pharmapack and MD&M West, the largest medical design & manufacturing events in the world.

- According to the National Kidney Foundation, chronic kidney disease affects an estimated 37 million people in the U.S. About 15% of the adult population and one in three adults in the U.S. is at risk for this disease. Furthermore, according to the U.S. Department of Health & Human Services, heart disease is the leading cause of death for people of most racial and ethnic groups across the country, and one person dies every 37 seconds in the U.S. from cardiovascular disease. These factors are expected to drive the demand for fluid delivery & IV connections components, renal dialysis products, cardiovascular devices and surgical instruments, etc. In turn, this is anticipated to boost the medical polycarbonate market in the near future.

- The medical polycarbonate market in Asia Pacific is anticipated to expand at a faster pace than that in other regions in the near future. Rise in support from governments of various countries such as China and India and growth in foreign direct investments in the medical industry are the prominent factors projected to drive the medical polycarbonate market in these countries. Manufacturers of medical polycarbonate in Asia Pacific are expanding their production facilities to meet the rising demand for medical polycarbonate in the medical sector across the region. This is also likely to propel the medical polycarbonate market in Asia Pacific.

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=72423

Leading Players in Medical Polycarbonate Market

- Major players operating in the global medical polycarbonate market include

- Covestro AG

- Mitsubishi Engineering-Plastics Corporations

- SABIC

- Trinseo S.A.

- Lotte Chemical Corporation

- GOEX Corporation

- Chi Mei Corp

- Covestro AG accounted for major share of the global medical polycarbonate market in 2019. The company is the largest producer of polycarbonate in the world. It also offers a wide range of product offerings for the medical polycarbonate market. Furthermore, Covestro AG is extensively engaged in new product launch and capacity expansion in order to increase its presence across the medical industry. On January 30, 2024, the company announced it had launched three medical-grade polycarbonates for drug delivery and surgical devices. The product lines of polycarbonate are Makrolon M204 LF, Makrolon M402 LF, and Makrolon M404 LF.