Coherent Optical Equipment Market – Snapshot

Coherent optical equipment refers to all the equipment in the optical network which supports 100G+ speed for data transmission. Significant growth in bandwidth requirements to reduce latency issues and provide smooth data transmission is estimated to fuel the growth of the coherent optical equipment market.

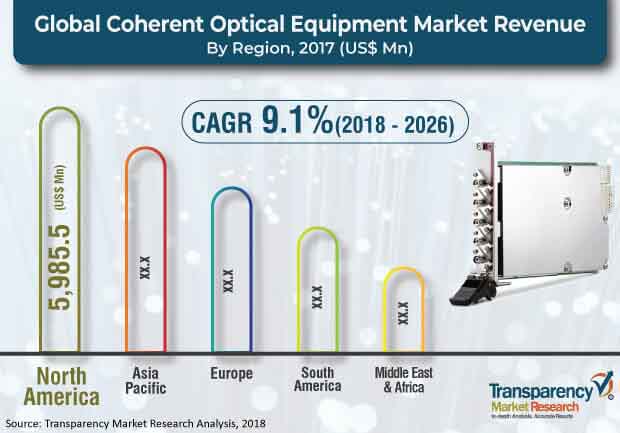

Many technological advancements have taken place in the optical network equipment market in recent years. Internet service providers, telecom service providers, public sector, and different industries are extensively using coherent optical equipment due to tremendous growth of internet penetration among the population, and increasing demand for high quality audio and visuals. Therefore, the coherent optical equipment market is expected to expand at a rapid pace in the coming years. Growing need to adopt new IT solutions with modern consumer trends across the world is driving the demand for coherent optical equipment. This is anticipated to propel the market over the forecast period. Moreover, increasing demand for high speed bandwidth from the telecom industry is expected to fuel the growth of the market in the near future. However, high initial investment is anticipated to hinder the growth of the market across the world. The coherent optical equipment market is likely to reach a value of US$ 34,599.0 Bn by 2026 from US$ 15,966.9 Mn in 2017, expanding at a CAGR of 9.1% during the forecast period.

Planning to lay down future strategy? Perfect your plan with our report brochure here https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=62211

Based on technology, the coherent optical equipment market has been segmented into 100G, 200G, 400G+, and 400G ZR. The 100G segment accounted for significant market share globally in 2017.This segment is projected to maintain considerable market share over the forecast period. Both residential and business customers are demanding high speed bandwidth. The adoption of 100G coherent technology has surged both in long haul networks and metro networks. Coherent optical fiber enables greater network programmability and flexibility by supporting different baud rates and modulation formats. This results in greater flexibility in line rates, with scalability from 100G to 400G and beyond per single signal carrier, delivering increased data transmission throughput at a lower cost per bit. 400G+ technology segment is estimated to expand at a rapid pace during the forecast period with growing demand from the public sector and industries end-use sectors.

Based on equipment, wavelength division multiplexer (WDM) accounted for leading market share in 2017 followed by optical switches, and is expected to retain its position over the forecast period. WDMs are used to increase capacity of communication in different applications such as access, enterprise communication, backhaul, long-haul, and metro networks. However, optical switches segment is expected to expand at a significant pace over the forecast period from 2018 to 2026. Moreover, test & measurement equipment segment is projected to gain market share in the coming years due to increasing demand for higher capacity communication networks from end-users as well as different industry verticals.

Based on application, networking application in coherent optical equipment accounted for leading market share in 2017 followed by original equipment manufacturers (OEMs), and is expected to retain its position over the forecast period. Networking is a form of optical communication which depends on optical amplifiers, LEDs, lasers, and WDM to transmit data through a channel (usually by optical fiber). It is capable of transmitting data with maximum possible bandwidth and minimum possible losses. However, data center application segment is expected to expand at a significant pace over the forecast period from 2018 to 2026 with increasing internet penetration and growing data traffic along with need for high speed transmission networks.

Based on end-user, the coherent optical equipment market can be categorized into service provider, public sector, and industries. The service provider sector is the prominent user of coherent optical equipment followed by the public sector, due to increasing demand for high speed bandwidth from internet service providers and telecom service providers. The industries sector is projected to expand at a rapid pace over the forecast period due to growing demand for high speed data transmission from different industries such as aviation and railways.

Looking for exclusive market insights from business experts? Request a Custom Report here https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=62211

The market in North America is anticipated to contribute significantly to revenue in the near future, followed by Asia Pacific, due to a large base of existing users in the region. North America and Europe are mature regions of the coherent optical equipment market in terms of technical awareness among users. This is likely to contribute to the decline in market share of these regions. Furthermore, the market in APAC and Middle East & Africa is likely to expand at a robust CAGR in the coming years.

Attracted by the increasingly expanding coherent optical equipment market, many small and large scale vendors are investing in coherent optical equipment in order to improve data transmission speed and reduce power consumption and cover a wider area in metros as well as in urban areas. Product innovation and upgrade of research and development are constantly taking place in the coherent optical equipment market. For instance, in January 2017, Infinera Corporation introduced the XTS-3300 and XTS-3600 meshponders for subsea networks, and upgraded its DTN-X XTC series to 12 terabits per second (Tb/s) of non-blocking optical transport network (OTN) switching with a new 1.2 Tb/s subsea line card.

Prominent players identified in the coherent optical equipment market and profiled in the study include Ciena Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Nokia Corporation, Infinera Corporation, Fujitsu Limited, ECI Telecom Ltd. and ZTE Corporation.