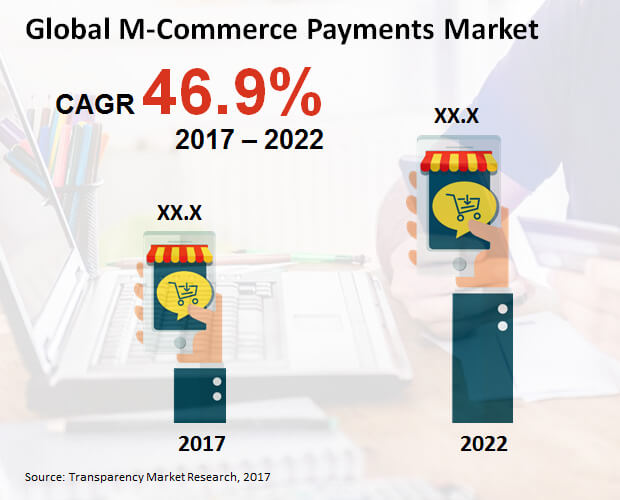

Owing to the growing ubiquity of smartphones, the prosperity of the m-commerce payments is almost certain, with the demand projected to increment at an exceptional CAGR of 46.9% during the forecast period of 2017 to 2024. Sheer ease of usability that m-commerce brings to the users is the most powerful driver of this market, although the slow adoptability has been a little hindrance. Nevertheless, a number of companies are now offering in-app payments, enhancing security of the transactions and personal details, and promoting sales via “buy button” on social media platforms. In addition to that, since m-commerce enables the merchants to analyze the buying habit of individual customer and make lucrative offers to increment sales, growing number of vendors of various fields are expected to adopt m-commerce payment methods. In terms of valuation, the revenue in the global m-commerce payments market is estimated to reach US$7.55 bn by 2024, exponentially up from its evaluated worth of merely US$1.11 bn in 2017.

Peer-to-Peer Most Preferred Mode of Payment Segment

On the basis of mode of payment, the global m-commerce payments market has been segmented into peer-to-peer transfer payments, near field communication m-commerce payments, and barcode m-commerce payments. In 2017, the peer-to-peer transfer payments segment accounted for US$2.68 bn or 45.1% of the overall demand, and by 2024, the figures are projected to reach US$4.97 bn or 46.2%, respectively. The demand for P2P transfer payments is anticipated to expand at a CAGR of 40.0%, and this absolute growth is larger than that of any other segment.

Based on end-use industry, the global m-commerce payments market has been bifurcated into retail m-commerce, hospitality and tourism, IT and telecommunication, banking, financial services and insurance (BFSI), media and entertainment, healthcare, airline, and others. Device-wise, the market for m-commerce payments has been categorized into smart devices, feature phones, and other electronic devices. On the basis of transaction, the market for m-commerce payments has been classified into mobile retailing, mobile booking or ticketing, mobile banking, mobile billing, and other modes of transactions.

Asia Pacific Projected for Most Robust Growth Rate

Geographically, the report takes stock of the potential of m-commerce payments market in the country of Japan as well as in the regions of North America, Latin America, Europe, Asia Pacific except Japan (APEJ), and the Middle East and Africa (MEA). Among these, North America constitutes the most profitable regional market for the vendors operating in the m-commerce payments market, expanding the demand at an above-average CAGR of 47.4% during the forecast period of 2017 to 2024. In terms of revenue, the North America m-commerce payments market is estimated to be worth US$2.47 bn by 2024. High adoptability of new technology, ubiquity of electronic devices, healthy e-commerce sector, and greater buying power of the citizens of developed countries such as the U.S. and Canada are some of the factors favoring the North America m-commerce payments market.

While Europe currently is the second most lucrative region in the m-commerce payments market, and is projected to increment the demand at a healthy CAGR of 44.0%, the APEJ region is anticipated to exhibit the most promising growth rate of 51.4% during the forecast period of 2017 to 2024. India and China are two of the world’s most populous countries and governments in both these countries are pushing for cashless transactions in order to maintain parity. Various merchants in these APEJ countries are adopting new technology and are experiencing increased sales. The m-commerce payments market valuation of this region is estimated to reach US$ 189,506.4 mn by 2024.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=30728

Apple Inc., Alphabet Inc., Mastercard Incorporated, ACI Worldwide, Inc., DH Corporation, Fidelity National Information Services, Inc., Fiserv, Inc., Paypal Holdings, Inc., Square, Inc., Visa, Inc., Jack Henry & Associates Inc., and Samsung Electronics Company Limited are some of the key companies currently operating in the global m-commerce payments market.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

Read Our Latest Press Release:

- https://www.prnewswire.com/news-releases/rapid-adoption-of-cloud-based-platforms-to-benefit-companies-in-the-global-tax-software-market-whilst-outbreak-of-covid-19-to-accelerate-use-of-digital-platforms-for-tax-filing-processes-tmr-301249303.html

- https://www.prnewswire.com/news-releases/advantages-of-precise-allocation-of-energy-costs-for-commercial-residential-establishments-spurs-growth-in-electric-sub-meter-market-digital-metering-solutions-witness-substantial-uptick-in-demand—tmr-301243186.html

- https://www.prnewswire.com/news-releases/scrap-metal-recycling-market-to-emerge-robust-from-headwinds-of-covid-19-market-projected-to-expand-at-notable-6-cagr-from-2020—2030-301239593.html