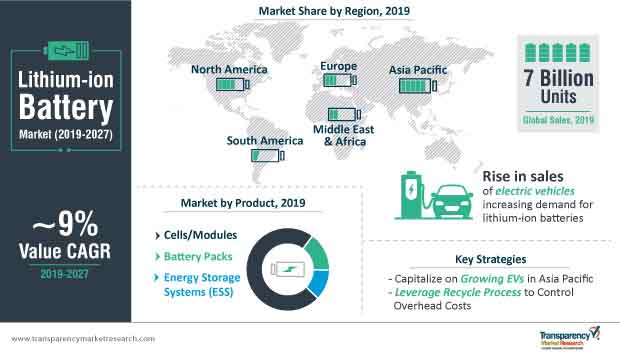

The lithium-ion battery market will grow over 2x between 2017 and 2027 – where will this spurt in growth come from? Unsurprisingly, consumer electronics will be at the forefront; however, it will witness massive uptake by the automobile industry that will catalyze revenue streams. As EV penetration grows rapidly, and the automotive industry looks to reduce its dependence on fossils, lithium-ion battery manufacturers will unlock access to opportunities that were unthinkable of a decade ago.

Growth will also be complemented by the growing focus on renewables. As government and private initiatives on harnessing solar and wind energy gain traction, the lithium-ion industry will play a central role. However, amidst the euphoria in the industry, the traditional challenges associated with supply/demand are also likely to crop up. Also, while a majority of the lithium-ion batteries manufactured currently satisfy the ‘cycle stability’ parameter, creating next-gen batteries that do not falter in terms of ‘overall age’ remains a challenge. Overall, these are exciting times to be in the lithium-ion battery landscape, as the highly-touted EV revolution grows stronger by the day.

Planning to lay down future strategy? Perfect your plan with our report brochure here

Disposal of Lithium-ion Batteries: Challenge or Opportunity?

The lithium-ion battery market does encounter a deadlock when it comes to environmental sustainability. With the exponentially rising need to integrate lithium-ion batteries in EVs, serious disposal concerns and their detrimental effects on the environment have inspired automakers to give a second thought to adopting them.

With polymer separators and plastic cases being used to manufacture lithium-ion batteries, the shift to electric energy from fossil-based energy for EVs makes no difference. This challenged manufacturers to rethink their product. However, innovation in the technological range engendered the recycling of lithium-ion batteries, which is likely to become a trend of the industry. With automation meeting recycling processes, the separation of different components have been easier, and, in that perspective, manufacturers can capitalize on the reduced overhead costs with low raw material requirements.

Since the reserves of lithium are highly concentrated in Chile, China, Argentina, and Australia, dependence on mining will reduce as industries optimize recycled materials and attribute a second-life to the batteries.

Want to know the obstructions to your company’s growth in future? Request a PDF sample here

Changing Industry Dynamics Indicate a Rising Tide of Lithium-ion Battery Market

Currently, lithium-ion batteries hold sway over the dual quest for portability and long operational life in consumer electronics. In the immediate future, the encapsulation of a large amount of energy into relatively small space and weight of a wearable’s tiny pocket will rely on a lithium-ion battery. And, in the pursuit of innovative gadgets, consumer electronics is anticipated to hold a strong uptake of lithium-ion batteries, like it did in the last decade. In the next decade, the sales of lithium-ion batteries for consumer electronic devices are likely to maintain a ratio of half the global sales. However, desired traction to the market will be received from the automotive industry.

Lithium-ion batteries feature high energy density, high discharge power, and low impact of time, which facilitates a remarkable advance in the growing application to EVs. Besides, increasing government spending plays a crucial role in fueling the adoption of electric vehicles. Leading regions in electric mobility leverage varied measures such as fuel economy standards and incentives for zero or low emission vehicles, which serve as economic instruments for the adoption of electric vehicles.

With the remodeling of EVs and customizable battery size, manufacturers look at the reduced cost of lithium-ion batteries, which further lays the foundation for the integration of lithium-ion batteries in autonomous vehicles (AVs). Collectively, the demand for lithium-ion batteries ascending from the automotive industry is likely to uptake at a compound annual growth rate of ~ 11% during the period 2019-2027.

Favorable Response from Private Sector to Escalate Momentum for Lithium-ion Battery Applications

Though the growth of the lithium-ion battery market is significantly stimulated by the governments of numerous countries, the private sector will follow the lead and push the bars of the industry. Volkswagen, a German automaker, announced its vision to electrify all its car models by the year 2030. Chinese automakers – Yutong and BYD – are actively involved in deploying electric bus in Latin America and Europe. For example, in June 2019, BYD Co. Ltd announced the deployment of 183 units of Pure Electric Buses to Chile.

With electric vehicles becoming the benchmark for the automotive industry, automakers following the traditional suit of fossil-based vehicles are seen entering into partnerships with lithium-ion battery manufacturers. For instance, in June 2019, LG Chem Ltd. formed a joint venture with Geely Automobile Holdings Ltd. for manufacturing lithium-ion batteries for EVs in China. Production of lithium-ion batteries is expected to begin in 2021, with 10 GWH of annual capacity.

Since the conceptualization of electric cars, the performance of Chinese EV automakers and favorable regulatory norms reflected a strong position of China in the global electric vehicle market. However, this lead has gone beyond the entire product, and moved towards the lithium-ion battery landscape as well. Currently, China accounts for ~ 60% of the total Asia Pacific lithium-ion battery market. The effect of EVs peeping into the automotive industry has also influenced the mature German lithium-ion battery market.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

In November 2018, the German government announced support worth US$ 1.12 billion for bringing in innovation into lithium-ion manufacturing firms. With an innovative-driven approach and established automotive players, Germany is likely to remain an attractive region as far as investment is concerned.

Read Our Latest Press Release:

- https://www.prnewswire.com/news-releases/affordability-and-beneficial-properties-to-serve-as-vital-growth-factors-for-construction-tape-market-during-forecast-period-of-2020-2030-tmr-301221294.html

- https://www.prnewswire.com/news-releases/global-higher-education-solutions-market-to-thrive-on-growing-popularity-of-cloud-computing-and-high-consumption-of-digital-content-tmr-301219732.html