Levulinic Acid Market: Introduction

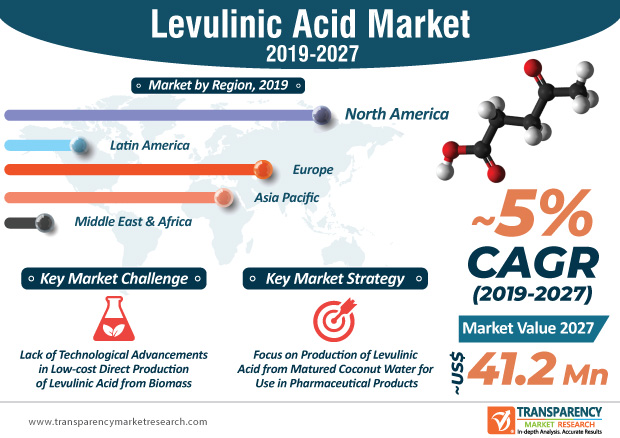

The levulinic acid market was valued at ~US$ 26.2 Mn in 2018 and is anticipated to expand at a CAGR of ~5% from 2019 to 2027. The Asia Pacific led the global agrochemical industry, accounting for approximately 30% share in 2018. Countries in Asia, such as South Korea, China, Japan, and Vietnam, are applying herbicides in large amounts onto short-term as well as perennial crops. Thus, growth of the agrochemical industry in Asia Pacific is driving the levulinic acid market in the region.

Key Drivers of Levulinic Acid Market

According to L’Oréal, a leading manufacturer of cosmetic products, the global cosmetics industry was valued at US$ 532 Bn in 2018 and is expected to expand at a CAGR of 5.5% from 2019 to 2020. The industry is primarily driven by rise in urbanization, continuous increase in online purchase of beauty products, and growth in the adoption of social media platforms.

Levulinic acid is primarily used in personal care products and cosmetics, as it enhances active concentration; enables high water loading for moisturizing formulations; raises solubility of ethanol; and reduces greasiness. Thus, the levulinic acid market is driven by the growth of the global cosmetics industry.

Request PDF brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=6260

Levulinic Acid Constantly Replacing Petroleum-based Products

Levulinic acid is generally produced from cellulose, biomass, manure, and brewery waste. It is the antecedent of biofuels. Levulinic acid is widely used in the manufacturing of polyvinyl chloride, which is a better alternative for phthalate plasticizers. Levulinic acid derivatives such as gammavalerolactone (GVL), methyl tetrahydrofuran (MeTHF), and methyl butanediol (MeBDO) are suitable for use as solvents in several applications.

High Prices of Levulinic Acid to Hamper Global Market

Levulinic acid prices range between US$ 5 per kilogram and US$ 8 per kilogram. High prices of levulinic acid are associated with the high initial cost incurred for its production as well as modifications such as alterations in the production process at the application end. Various countries in Asia Pacific have imposed anti-subsidy duties on levulinic acid, leading to increase in the product price. This, in turn, restrains the levulinic acid market in the region.

North America Dominates Levulinic Acid Market

In terms of volume, North America held a leading share of the levulinic acid market in 2018. The U.S.-based companies usually source levulinic acid at a low price from China-based manufacturers. For instance, Segetis is reported to source levulinic acid from China for its portfolio of L-ketal products. Middle East & Africa held a minimal share of the levulinic acid market in 2018; however, the market in the region is at a nascent stage currently. It is anticipated to expand in the near future, owing to the rising demand for levulinic acid for use in plasticizers and as a substitute for petroleum-based products.

Buy Now

https://www.transparencymarketresearch.com/checkout.php?rep_id=6260<ype=S

High Application of Levulinic Acid in Agriculture

Among applications, the agriculture segment held a major share of the levulinic acid market in 2018. Delta-amino levulinic acid (DALA), a levulinic acid derivative, is widely utilized as herbicide for lawns and certain grain crops. Levulinic acid is used in anti-inflammatory medications, anti-allergy agents, mineral supplements, and transdermal patches. Delta-amino levulinic acid (DALA) is utilized in the diagnosis and treatment of cancer (photodynamic therapy).

Levulinic Acid Market: Prominent Players

Prominent players operating in the levulinic acid market include GFBiochemicals Ltd., Biofine Technology LLC, Tokyo Chemical Industry Co., Ltd., Godavari Biorefineries Ltd, and Aurochemicals. In February 2016, GFBiochemicals acquired Segetis, a player based in Golden Valley, Minnesota (the U.S.). The latter is a leading producer of levulinic acid derivatives and it owns more than 50 patents. It has over 200 pending patent applications worldwide. GFBiochemicals has acquired Segetis’ pilot production plant located in Minnesota. With this acquisition, the company is planning to establish its direct presence in the U.S. market through opening commercial offices as GFBiochemicals Americas. Biofine Technology LLC is a technology holding company controlling patents for the levulinic acid technology, along with various license agreements for related derivatives.

Request Discount:

https://www.transparencymarketresearch.com/sample/sample.php?flag=D&rep_id=6260