Companies Prefer Biomass over Conventional Resources to Produce Fuel

Ongoing depletion of fossil fuels and lack of alternatives to replace compounds produced by oil has fueled the demand for levulinic acid. Meanwhile, there is a growing awareness about biomass being used for the production of alternative fuels and several chemicals, such as bioethanol and levulinic acid, which are pervasively diminishing reliance on oil. Hence, manufacturers in the levulinic acid market are leveraging opportunities in countries of Asia Pacific and Latin America, since agribusiness is one of the key sources of revenue in these countries. Thus, abundance of biomass in these regions, especially Asia Pacific, has led to exponential growth of the region, as the levulinic acid market matures in the coming decade.

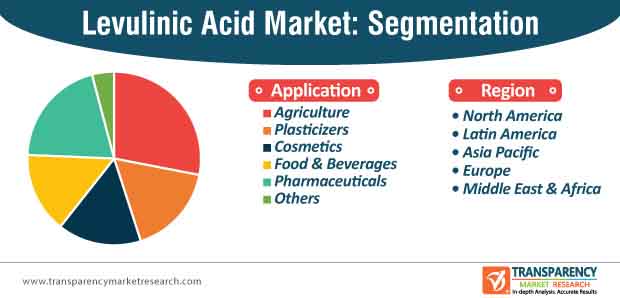

In terms of application, the agriculture segment of the levulinic acid market is estimated to reach a production of ~1,300 tons by the end of 2022. Apart from agriculture, manufacturers are tapping into opportunities to manufacture chemical compounds used in the development of additives of fluids, oils, plastics, fragrances, etc.

Request a sample to get extensive insights into the Levulinic Acid Market

Advantages of Microalgae Support Production of Pharmaceutical Products

Different types of microalgae are being commercially used for the production of phycocolloids, and have potential for the production of nutraceuticals and pharmaceutical products. Sustainable use of macroalgal biomass for the production of cosmetics and thickening agents in food are bolstering credibility credentials of companies in the global landscape. Thus, the environment-friendly way of energetic valorization of food wastes has helped to increase the production of levulinic acid.

Awareness about the advantages of microalgae has created a stir in the pharmaceutical landscape. As such, the pharmaceuticals application segment of the in the levulinic acid market is projected for aggressive growth during the forecast period. The segment is anticipated to account for the second-highest revenue of ~US$ 8.6 Mn by 2027. On the other hand, manufacturers in the levulinic acid market are using the novel compound for the production of organic matter and materials such as soil fertilizers and pet food formulations. Regulatory support has been instrumental for the emergence of efficacious drug formulations involving levulinic acid.

Eco-conscious Cosmetics Formulators Benefit from Natural Preservatives

Levulinic acid is gaining prominence in the personal care & cosmetics industry. Moreover, cosmetics application segment is anticipated for exponential growth during the forecast period and is creating revenue opportunities for companies in the levulinic acid market. For instance, Troy Corporation – a manufacturer of performance materials, announced the launch of TroyCare™ LSB1 – an innovative preservative used in personal care and cosmetic products.

To understand how our report can bring difference to your business strategy, Ask for a brochure

In order to gain credibility in the global market landscape, personal care companies are increasing R&D to streamline their production activities so that their products gain the approval of regulatory authorities. They are increasing their production efficacy to develop preservatives that are based on natural ingredients to cater to specific needs of environmental-conscious consumers. Since more number of companies are becoming eco-conscious formulators, the trend of natural preservatives is gaining much appreciation by personal care companies.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=6260

Future Possibilities in Potential Derivatives Propel Levulinic Acid Market

Levulinic acid is growing popular as promising bio-based building blocks for the chemical industry. However, lack of technological development according to the market demand has emerged as a challenge for manufacturers in the levulinic acid market. For instance, there is a need for technological innovation for low-cost direct production of levulinic acid from biomass.

Excellent versatility and high potential for low-cost production of levulinic acid from biomass has gained the attention of manufacturers. Hence, manufacturers in the levulinic acid market are becoming aware about this technological gap and are thus, are increasing their efficacy in production-related technological innovations. In order to meet the expectations of end users in fuel and chemical industries, companies are adopting novel production techniques by using furfuryl alcohol for direct production of levulinic acid from biomass.

Ongoing developments are surfacing to reduce production costs, which will eventually help to create increased demand for levulinic acid in the coming years. Potential derivatives such as levulinic esters and oligomers for transport fuels are likely to trigger market growth.

Analysts’ Viewpoint

The levulinic acid market is consolidated with five leading players accounting for more than 70% of the market share. This poses as a challenge for emerging players who are increasing efforts to innovate in biomass for the production of levulinic acid. Thus, companies should increase research to advance in the technological front to reduce costs associated with the production of levulinic acid using furfuryl alcohol.

Companies are focusing on establishing economically and environmentally sustainable systems for conversion of biomass to increase availability of alternatives to fossil fuels. They should adopt cost-effective extraction and purification of levulinic acid through one-stage conversion using microwave radiation of softwood and hardwood waste.

Levulinic Acid Market: Overview

- Levulinic acid, also known as 4-oxopentanoic acid, is an organic compound. Its color ranges from pale yellow to brown. It is a crystalline solid with mild odor. This acid is generally classified as a keto acid. It is soluble in water and polar organic solvents such as ethanol and diethyl ether. It is derived from degradation of cellulose and is a potential precursor to biofuels.

- Delta-amino levulinic acid (DALA), a levulinic acid derivative, is widely used in herbicides that are primarily used on lawns and certain grain crops. Thus, growth of the global agrochemical industry drives the levulinic acid market.

Key Drivers of Levulinic Acid Market

- According to the IQVIA Institute for Human Data Science, global spending on medicines reached US$ 1.2 Trn in 2018, increasing from US$ 1.1 Trn in 2017. It is expected reach US$ 1.5 Trn, increasing at a CAGR of 4%–5% from 2019 to 2023.

- Increase in the medicine spending is primarily attributable to adoption of new and innovative products by developed countries such as the U.S. and Japan

- Levulinic acid is used in anti-inflammatory medications, anti-allergic agents, mineral supplements, and transdermal patches. It is used in drugs such as indomethacin and calcium levulinate.

- Several manufacturers are constantly working on developing new, bio-based medicines, which is expected to augment the global pharmaceutical industry in the near future. This, in turn, is anticipated to drive the levulinic acid market during the forecast period.

Major Challenges for Levulinic Acid Market

- Levulinic acid is a type of renewable chemical, and its demand is primarily affected by its high production cost and complex production technology. Manufacturers of levulinic acid are facing difficulties to match the target prices close to US$ 1 per kilogram so as to penetrate downstream applications. Thus, high price of levulinic acid is likely to hamper the levulinic acid market during the forecast period.

Lucrative Opportunities for Levulinic Acid Market

- Levulinic acid is an organic compound, which is constantly replacing petroleum-based products in different sectors such as biofuel and chemical. The acid is also employed in cigarettes to enhance their nicotine content. Increasing spending on research and development of the manufacturing technology for levulinic acid is anticipated to open new growth avenues for the levulinic acid market during the forecast period.

Asia Pacific to Dominate Levulinic Acid Market

- The levulinic acid market in North America is primarily driven by expansion of pharmaceutical and food & beverages industries in the region. Personal care & cosmetics is a leading end-use industry in North America, which witnesses high demand for levulinic acid.

- Rapid growth of population in Asia Pacific is expected to significantly boost the food & beverages industry in the region, thereby propelling the levulinic acid market in the region. Levulinic acid is utilized as a flavoring agent in food and beverages.

- According to a report published by Infinitus, in 2018, the cosmetics industry in Latin America is projected to reach value of US$ 68.92 Bn by 2020. Growth of this industry is driving the levulinic acid market in the region.

High Demand for Levulinic Acid in Agriculture

- In terms of volume, the agriculture application segment held a major share of the levulinic acid market in 2018. Levulinic acid is a bio-based additive, and it can be utilized in herbicides and insecticides or agricultural products, owing to its ability to enhance crop production and prevent pest infestation. Demand for levulinic acid is anticipated to rise worldwide in the near future, due to increased preference for bio-based products in the global agriculture sector.

- Levulinic acid-based ketal plasticizers are extensively utilized in phthalate-based plasticizers, as they exhibit excellent compatibility with hydrophilic biopolymers, such as polylactic acid

Joint Ventures and R&D Activities to Remain Key Strategies

- The levulinic acid market was highly consolidated in 2018, with top five manufacturers i.e.

- GFBiochemicals Ltd.

- Biofine Technology LLC

- Tokyo Chemical Industry Co., Ltd.

- Godavari Biorefineries Ltd

- Aurochemicals accounting for more than 70% of the market share

- GFBiochemicals Ltd. held a leading share of the levulinic acid market in 2018. In February 2016, GFBiochemicals acquired Segetis. Situated at Golden Valley, Minnesota (the U.S.), Segetis is a leading producer of levulinic acid derivatives.

- Companies operating in the levulinic acid market are investing significantly in expanding their product portfolios and improving their distribution networks. They have adopted strategies, such as mergers and acquisitions, new product development, joint ventures, and expansion to cater to the increased demand for levulinic acid across the globe.

- Biofine Technology LLC was a major manufacturer of levulinic acid in 2018. It accounted for 3.4% share of the global market in the year. This can be primarily ascribed to the company’s constant efforts toward technological innovations, leading to low processing costs and development of high-quality products.