Integrating digital technology in personal protection equipment (PPE) including industrial protective footwear or safety footwear is a potential opportunity. For example, Germany based UVEX Group, a global industrial protective footwear manufacturer is in the process of integrating digital sensors and actuators in industrial protective footwear. Information relayed by the sensors and actuators can be analyzed and necessary actions can be taken by the safety footwear to avoid slipping or loss of control. In October 2017, the Group launched these smart PPE (Smart Insole – uvex 1 techware) at the A+A trade fair in Germany. Thus, integration of digital technologies in industrial protective footwear is expected to create good opportunity for market players.

An industrial accident is always an unexpected, undesirable and a sudden event in an industrial setup that causes interruptions in the orderly progress of any work. It might cause harm to people during the time of his or her employment. Technological progress together with the upgradation of safety regulations and standards is prophesized to drive the growth of the global industrial protective footwear market in the near future. Unwanted incidents like loss of fingers, broken bones, and crushed feet often take place in fishing, forestry, and construction sectors. On the other hand, cutting one’s feet, severed fingers, and lacerations often happens when one works in an environment where there is extensive use of scrap metal, blades, chainsaws or nails. To ensure safety of one’s feet and legs in such setups, it is necessary to wear protective footwear, which is likely to foster growth of the global industrial protective footwear market in the near future.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1472

Given the chances of such occurrences, manufacturers have realized and come up with various foot safety protection programs pertaining to machine maintenance, training, inspection, selection, and fit testing so as to protect workers from such foot injuries at various industrial setups. These foot-related safety programs mandate manufacturers to stick to the stringent safety norms as set out by the programs and thus save lives of workers and surplus expenses of the employers. It also reduces or does away with the loss of production time, medical expenditure, and compensations to workers arising out of such situations. These benefits are likely to widen the scope of growth of the global industrial protective footwear market in the near future.

There has been a trend of shifting production facilities from various developed nations to developing countries like India and China. Various favorable conditions, such as low cost of raw materials, labor, and less amount of capital investment than developed regions of Europe and North America have spelled boon for the countries like India and China. In addition to that, governments in these countries are offering financial incentives, such as preferential tax rates for setting up of various manufacturing sites, including protective footwear. Such flourishing business in the Asia Pacific region is likely to add to the growth of the global industrial protective footwear market in the years to come.

However, the ongoing global pandemic, Covid-19, has led to sever demand-supply gap in the market. China being one of the prominent manufacturers of such protective footwear has suffered a blow with worldwide lockdown and restrictions to contain the spread of coronavirus. The market is anticipated pick up after the arrival of a vaccine or a drug for the treatment of coronavirus

Asia Pacific countries also offer opportunities for global industrial protective footwear manufacturers. Presently in Asia Pacific, per capita footwear consumption is low and per capita safety footwear consumption is even lower compared to developed countries. Per capita footwear consumption in the U.S., U.K., China, and India are 7.2, 6.8, 2.3, and 2.1 pairs respectively.

Asia Pacific has the largest population in the world. It also has the largest number of labor and contract workers in the world. The number of work related deaths are also highest in the region. According to ILO and Workplace Safety and Health (WSH) Institute, Singapore, Asia Pacific has the largest (almost two-third) work related mortality in the world.All these factors are prompting governments in the region to implement laws related to the safety of their workers. In India, the Factories Act, 1948 protects the health and safety of workers. Rising awareness about occupational safety and increase in industrial safety regulations is increasing the demand for industrial protective footwear in the region. Asia Pacific offers significant opportunity for growth of the global industrial protective footwear market, thus increasing the demand for industrial protective footwear across the globe.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=1472

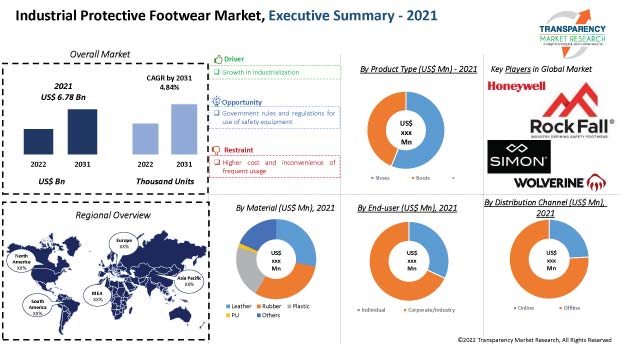

The study provides a conclusive view of the global industrial protective footwear market by segmenting it in terms of product type, density, material, gender, application, end-user, and distribution channel. In terms of product type, the market has been classified into shoes and boots. Based on density, the market has been segmented into single density and double density. In terms of material, the market is segmented into leather, rubber, plastic, and PU (polyurethane). Based on gender, the market has been segmented into male, female, and unisex. Based on application, the market has been segmented into construction, manufacturing, mining, oil & gas, chemicals, food, pharmaceuticals, and transportation. In terms of end-user, the global industrial protective footwear market is segmented into residential and commercial. Based on distribution channel, the market is segmented into online and offline.

Developed regions such as North America and Europe already have stringent health and safety regulations for safety of their workers. Safety footwear regulations in Europe must comply with the standard EN ISO 20345:2011. Toecap regulations of industrial protective footwear are SB, S1P, S3, and S5. Any industrial protective footwear that is classified as SB only has a protective toecap. Industrial protective footwear that is classified as S1P is anti-static and made with a protective toecap and midsole only. S3 styles are the most commonly specified standard for the industry. Any industrial protective footwear that is classified as S5 is polymer or rubber molded construction, making them water and leak proof.

Canadian Standards Association (CSA) is a global testing and certification organization, testing various products including personal protection equipment (PPE) which includes industrial protective footwear. CSA Group estimated that the average annual counterfeit market is worth US$ 500 billion of which share of footwear is 14.0%. CSA Group has alerted consumers about counterfeit industrial protective footwear brands such as Scorpion, Tiger, and TIG sold by Harron Trading Ltd, Markham, Ontario, Canada. These footwear bear the unauthorized CSA registered trademark and pose danger to users. Harron Trading Ltd in collaboration with CSA Group recalled 2,020 pairs of safety footwear of Scorpion safety footwear. Thus, rise in counterfeit industrial protective footwear across the globe is restraining the growth of the industrial protective footwear market.

The report highlights major companies operating in the global industrial protective footwear market including Honeywell International Inc., Dunlop Protective Footwear, VF Corporation, Bata Industrial, UVEX WINTER HOLDING GmbH & Co. KG, Elten GmbH, Rock Fall (UK) Ltd, Simon Corporation, Wolverine, and Rahman Industries Ltd.

Read TMR Research Methodology at: https://www.transparencymarketresearch.com/methodology.html

Read Our Latest Press Release:

- https://www.prnewswire.com/news-releases/affordability-and-beneficial-properties-to-serve-as-vital-growth-factors-for-construction-tape-market-during-forecast-period-of-2020-2030-tmr-301221294.html

- https://www.prnewswire.com/news-releases/global-higher-education-solutions-market-to-thrive-on-growing-popularity-of-cloud-computing-and-high-consumption-of-digital-content-tmr-301219732.html