The global industrial biomass boilers market presents a highly fragmented vendor landscape, with none of the large companies holding more than 10% of the overall market as of 2015, observes Transparency Market Research (TMR) in a recent report. A large network of biomass suppliers commands a strong hold on the market, collectively holding over 59% of the market in 2015. To thrive in the intensely competitive market, neatly formulated strategies to control supply chain from manufacturing to end sales and collaborations with influential vendors can prove to be beneficial for companies operating in the industrial biomass market.

Improvement in yielding capacity and proper selection of transformation and separation processes could also prove effective in quality improvement and cost reduction of products, allowing companies to have an upper hand over competitors. Suppliers of biomass in serving the industrial biomass boilers market could benefit from optimization of transportation to improve their profit margins, suggests TMR.

Request PDF Brochure –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=11666

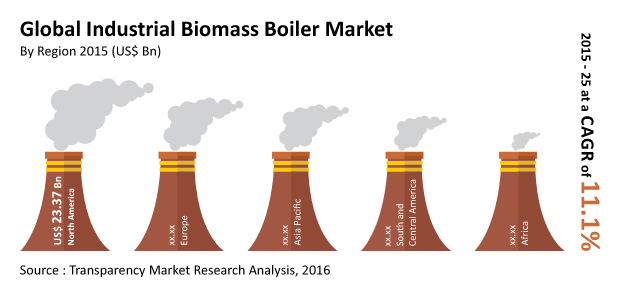

TMR estimates that the global industrial biomass boiler market, which held an opportunity of US$68.2 bn in 2015, will expand at an impressive 11.1% CAGR from 2016 to 2025, rising to a valuation of US$68.2 bn in 2015.

Europe Market for Industrial Biomass Boilers Market to Continue its Bullish Run

Of the key applications of industrial biomass boilers examined in the report, including pulp and paper industry, power generation, combined heat and power (CHP) production, and brewery industry, the segment CHP presently holds the maximum share in cumulative revenue of the global market. The segment accounted for a promising 24% of the overall market in 2015 and is likely to hold on to its top post, chiefly owing to its high energy efficiency level of as much as 80%.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=11666

In terms of geography, the market for industrial biomass boilers in Europe is overshadowing other the growth of the market in other prominent regions. The region, chiefly on account of its ambitious emission reduction plans, has instigated bullish rules and regulations aimed at curbing pollution-inducing operations and activities and encouraging the increased use of bio-based energy products at industrial level. Although North America beat the Europe industrial biomass boilers market in terms of installed biomass boilers capacity in 2015, the latter is expected to emerge as the most promising grounds for investment, charting an impressive 16.9% CAGR through 2015-2024 in terms of valuation.

Fiscal Incentives and Feed-in Tariffs by Governments Bolstering Adoption of Industrial Biomass Boilers

A number of factors are fusing together, forming veritable grounds for the promising development of the global industrial biomass boilers market. These include the high rate of economic and industrial development, especially in several developing regions, and the increased concern regarding the polluting nature of industrial boilers powered by fossil fuels. Such conventionally powered industrial boilers being a key propeller of environmentally harmful gases such as CO2, government bodies are increasingly encouraging the increases use of bio-based power sources to ramp up their environment-friendliness quotient.

Explore Transparency Market Research’s award-winning coverage of the global (Energy) Industry

Constant attempts in this regards, in the form of favorable regulations and policies supporting biomass-fed boilers, feed-in tariffs, and tax incentives, are encouraging the increased employment of biomass boilers at industrial level. Strict boiler standards and emission regulations are also supporting the increased adoption of biomass boilers across industries.

The information provided about the global industrial biomass boiler market is based on a Transparency Market Research report, titled “Industrial Biomass Boiler Market (Capacity Type – ~2-10 MW, ~10-25 MW, and ~25-50 MW; Application – Pulp & Paper Industry, Brewery Industry, Sawmill Industry, CHP, Production, and Power Generation; Feedstock – Wood Deliverable, Landfill Residues, and Agricultural Residues) – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 -2025.”