Introduction and Need of the Product:

Globally, the plastic punnets are prominently used packaging solutions for the packaging of the fresh produce, food, and vegetable products. This type of packaging format has gained significant attention in the last few years due to the substantial increase in the demand for lightweight packaging solutions across the globe to reduce overall waste generated due to high consumption of the materials in conventional packaging formats. The plastics punnets are also used for the packaging of some agricultural, food, and dairy products. It provides optimum transit protection and shelf life to the products stored in it. Due to increase in demand for the efficient and cost-friendly packaging solution in the food industry, plastic punnets have become the first choice for most of the food processors for packaging of their products. Also, plastics punnets are substantially replacing the paper-based packaging products in the food packaging market due to its cheaper cost and better characteristics.

Planning to lay down future strategy? Perfect your plan with our report sample here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=40622

Market Dynamics:

The demand for plastics punnets is expected to increase at a CAGR value of 4%-5% during the next five years. Some of the key players in the plastics punnets market are engaged in the research and development of this product to further reduce cost factor and increase profitability margin.

- In August 2012, Italy-based packaging manufacturer ILIP entered into a joint project with the Department of Fruit Trees and Woody Plant Sciences at the University of Bologna to find out the role played by the packaging product in the preservation of the fresh produce.

- Also, some of the companies such as LC Packaging International BV, are offering plastics punnets made up of the 100% recycled synthetic material. This not only differentiates their product offerings from other players but also creates a better brand image in the market. However, this trend is expected to be followed by other packaging companies too due to increasing rules and regulations over the use of conventional plastic materials, primarily in Europe.

- Recently, Holfeld Plastics, a manufacturer of rigid plastic packaging products, has extended its existing production line by introducing new product portfolio for packaging of soft fruits. The expansion is primarily driven by the increasing customer demand for family-sized and promotional packs along with the need for innovation in the existing product line. The pack is also suitable for top sealing and auto de-nesting which improves the air flow and reduces the condensation when punnets are stacked.

It has been analyzed that almost half of the packaged fresh-cut fruits available in the market are packaged in the plastics punnets. Moreover, the demand will further increase due to high growth in the packaged fresh-cut fruits market which is estimated to grow at approximately 15% annually. The plastics punnets market is highly fragmented with the strong presence of small manufacturers in the domestic market.

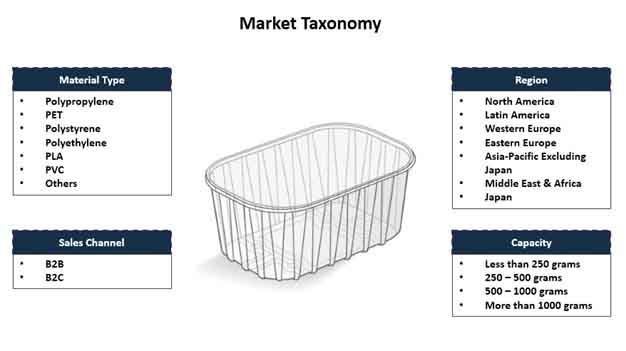

Market Taxonomy:

By Material Type

- Polypropylene

- PET

- Polystyrene

- Polyethylene

- PLA

- PVC

- Others

Looking for exclusive market insights from business experts? Request a Custom Report here https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=40622

PET and Polypropylene are the most prominent materials used for the production of the plastics punnets globally.

- INFIA Srl, a leading manufacturer of the fruit packaging products, offers wide range of plastic punnets made up of the recycled PET and Polypropylene material. The company is headquartered in Bertinoro, Italy and distributes more than 3 billion trays in South America, North America, Africa, Australia, Asia, and Europe through its strong sales network located globally. The company generated approximately US$ 80 million in sales in 2016.

Growing concerns over the use of PET material in most of the countries is expected to decline its growth in the next few years. However, few countries have recently established domestic PET recycling plants in order to cope with this problem. For eg. – In Aug. 2017, Flight Group Ltd. started a first PET recycling plant in New Zealand with an investment of US$ 12 million.