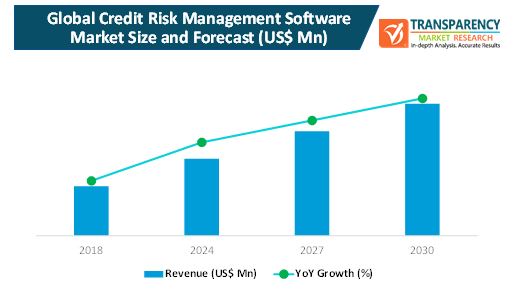

Credit Risk Management Software Market – Introduction

- Credit risk management software enables the automation of lending, analysis of credit risks and continuous risk monitoring, as well as decision-making processes. Tools and practices for credit risk management are essential for the long-term growth of financial services providers and banking organizations.

- The credit risk management platform uses in-depth risk assessment process to enable the credit monitoring and credit origination and also software helps in implementation of complex strategies for securing credit transaction.

- The credit risk management software helps to implementing framework or scoring model and internal rating and also used in spreading and capturing financial statement.

- Credit risk management allows financial institutions to use centralized applications with client & facility management and financial spreading. The credit risk platform helps to integrate with existing customer data for better synchronization with customers.

- Comprehensive & modular structure, centralized & standardized process, and simulation capability is expected to increase demand for credit risk management software among banking centers during the upcoming years.

Planning to lay down future strategy? Perfect your plan with our report sample here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77990

Key Drivers of the Credit Risk Management Software Market

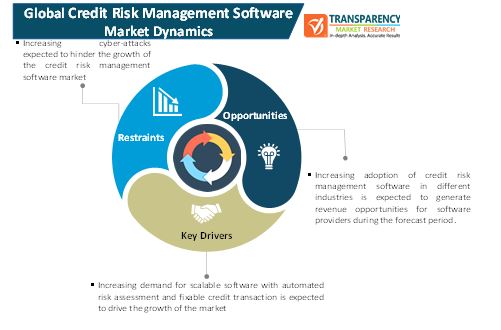

- Increasing demand for scalable software with automated risk assessment and fixable credit transaction is expected to drive the growth of the market. Increasing awareness about credit risk management software in banking sectors to maintain assess and process warning signals which identify unauthorized transaction is also expected to boost the growth of the market.

- Increasing adoption of credit risk management software in different industries is expected to generate revenue opportunities for software providers during the forecast period.

Increasing cyber-attacks expected to hinder the growth of the credit risk management software market

- Increasing advancement in credit risk management software also creates multiple ways for cyber-attacks on a company’s confidential customer information, financial records, and banking sales which may restrain the growth of the market.

- Advanced credit risk management platforms offered by several companies to increase their market penetration is also expected to hamper growth of the market.

Impact of COVID-19 on the Global Credit Risk Management Software Market

- Banks and financial institutes are expanding their geographical presence to capture more market share in Asia Pacific and Middle East & Africa due to increasing impact of COVID-19 on business growth. Banks and financial institutes are adopting new business strategies in sales and business leads which creates opportunities for solution providers of credit risk management software in different industries.

- Many banks now operate their businesses on online platforms due to the lockdown conditions; companies are adopting credit risk management software to secure the online platform for their customer database. Demand for credit risk management software solutions is increasing during COVID-19 and is also set to increase during the forecast period.

Looking for exclusive market insights from business experts? Buy Now Report here https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77990

North America to Hold Major Share of the Global Credit Risk Management Software Market

- North America holds prominent share of the credit risk management software market due to increasing adoption of risk management solutions by the banking and insurance service sector to expand the customer base and also due to presence of major solution providers in the region.

- The credit risk management software market in Asia Pacific and Europe is expected to expand the fastest during the forecast period due to increasing adoption of technologically advanced software platforms to manage operational risk, foreign exchange risk, credit risk, and market risk in the regions.

Key Players Operating in the Global Credit Risk Management Software Market

- Oracle CorporationOracle Corporation is a U.S. based information technology company providing applications, platforms, and IT infrastructure products and services. It has three business segments: Cloud and Licensing, Hardware, and Services. The Services segment offers consulting services, advanced customer support services, and education services. Oracle Corporation offers solutions in artificial intelligence, application integration, digital assistance, Internet of Things, enterprise communication, credit risk management, asset liability management, and mobile campaigns. The company provides services to different industries such as automotive, BFSI, communication, healthcare, public sector, and research.

- IBM CorporationIBM Corporation is a multinational company, manufacturing and marketing products including computer hardware, middleware, and software, besides providing hosting and IT consulting services. IBM Corporation operates under five business segments which include banking and finance; government; healthcare; gaming, media & entertainment; and retail and telecommunications. The company also offers various cognitive solutions in risk management, and artificial intelligence platforms such as analytics & data management platforms, Internet of Things, and cloud data services.

Other key players operating in the global credit risk management software market include SAP SE, SAS Institute Inc., ACTICO GmbH, Pegasystems Inc., Experian Information Solutions, Inc., Finastra (Turaz Global S.à r.l), Fiserv, Inc., and Resolver Inc.

Global Credit Risk Management Software Market: Research Scope

Global Credit Risk Management Software Market, by Deployment

- Cloud Based

- On-premises

Global Credit Risk Management Software Market, by Application

- Client & Facility Data Management

- Financial Spreading

- Credit Risk Rating

- Credit Bureau Gateway

- Others

Global Credit Risk Management Software Market, by Industry

- BFSI

- Automobile

- Healthcare

- Government

- Manufacturing

- IT & Telecom

- Others

Global Credit Risk Management Software Market Segmentation, by Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Russia

- Italy

- Spain

- Nordic

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- Malaysia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America

This study by TMR is all-encompassing framework of the dynamics of the market. It mainly comprises critical assessment of consumers’ or customers’ journeys, current and emerging avenues, and strategic framework to enable CXOs take effective decisions.