Ethylene Propylene Diene Monomer (EPDM) Market: A Shift towards Bio-based Materials to Create Promising Opportunities

The use of synthetic rubber across a number of applications is a common practice, wherein, ethylene propylene diene monomer (EPDM) has captured significant attention of consumers. The rising dominance of synthetic rubbers in the global rubber market is closely attributed to several interconnected factors, including the highly volatile prices of natural rubber and regional production polarization. These aspects have compelled rubber consumers to make a paradigm shift from natural rubber to synthetic rubber.

Substantial mechanical strength and application over wide temperature changes have positioned ethylene propylene diene monomer as the ideal rubber for use across a number of end-use segments. With very inert chemical properties that provide exceptional weathering resistance and considerable performance, EPDM continues to gain popularity, thereby favoring the growth of the ethylene propylene diene monomer market.

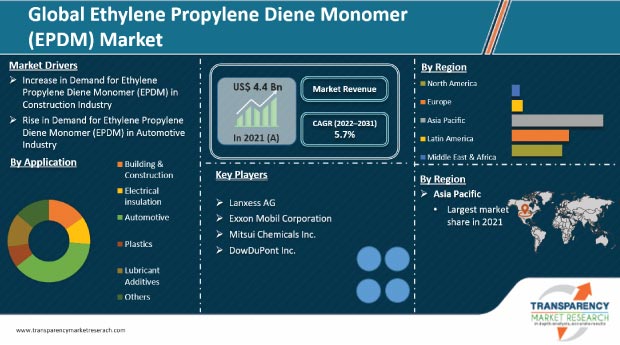

Continual growth projected by end-use industries, including the automotive and building & construction sectors, has propelled the requirements for EPDM. Transparency Market Research (TMR) recently published an extensive report on the ethylene propylene diene monomer market, with a positive overview of the market. The study unveils the key elements driving growth, while elaborating the developments made by EPDM market competitors.

Are you a start-up willing to make it big in the business? Grab an exclusive PDF sample of this report here

Ethylene Propylene Diene Monomer Market: Tracing the Timeline of the Industry’s Progress

The increasing utilization of bicycles, their pneumatic tires in particular, commenced in the 1890s. This created an increased demand for rubber. In 1909, a team led by Fritz Hofmann, functioning at the Bayer laboratory in Elberfeld-Germany, prospered in polymerizing isoprene – the first synthetic rubber. Moreover, by 1925, the cost of natural rubber had hiked considerably, incentivizing companies to explore methods of producing synthetic rubber. EPDM and hypalon synthetic rubbers were first introduced in the U.S. around the 1960s.

Continual transformations in application sectors have created the need for effective and improved materials that could withstand temperature changes and offer considerable efficiency. Synthetic rubbers such as ethylene propylene diene monomer, owing to its advantages, including cost-effectiveness and ability to reduce energy consumption, have both, specialty and general-purpose applications. The ethylene propylene diene monomer market is expected to generate a revenue of ~ US$ 3.9 Bn in 2019 and is expected to grow at a CAGR of ~ 6% throughout the period of forecast.

Key Trends Influencing the Ethylene Propylene Diene Monomer Market

Rapid Expansion of Automotive Sector Creating Demand

The automotive sector has witnessed significant growth over the past couple of years, with a constant rise in the sales volumes and increasing number of vehicle owners. The automotive industry is one of the largest end users of ethylene propylene diene monomer. With excellent resistance to ozone or UV rays, and brake liquids with glycol, ethylene propylene diene monomer is an ideal choice in the automotive sector.

Growing Application of Thermoplastic Vulcanizates (TPV)

When the thermoplastic elastomers industry was far less developed in early 1980, than it is currently, thermoplastic vulcanizates (TPVs) presented a new crease. These materials directly aimed at cross-linked rubber materials by the amalgamation of a cross-linked ethylene propylene diene monomer into a polypropylene structured matrix. The growing applicability of TPVs across the automotive sector, on account of its attributes such as high resistance to weather and chemical conditions, and superior ozone and UV resistance, is consequently creating higher demand for EPDM.

Although key industry trends are shaping the growth of the ethylene propylene diene monomer market, certain factors are likely to hamper its progress. EPDM shows poor compatibility with most oils, kerosene, gasoline, aromatic and aliphatic hydrocarbons, and halogenated solvent concentrated acids. Moreover, the inert nature of the material also creates difficulties in achieving success with the material during the process of in-mold vulcanized bonding to a substrate, creating further limitations.

Stuck in a neck-to-neck competition with other brands? Request a custom report on competition on “Ethylene Propylene Diene Monomer (EPDM) Market” here

Strategies Breaking Ground for EPDM Manufacturers

Expanding Production Capacity

Companies operating in the ethylene propylene diene monomer market are growing their global presence by installing production facilities in developing regions to capture untapped markets. The latest trend in the EPDM market is to increase the production of bio-based EPDM, particularly in Asia. For instance, a joint venture between Saudi Aramco and Sumitomo Chemical-Petro Rabigh commenced the production of EPDM grades at its new plant in Saudi Arabia.

Shifting Focus Towards Bio-based EPDM

Sustainability continues to influence businesses, making it significant for companies to discover bio-based variants. Similar approaches are witnessed across the EPDM industry in order to attain reduced carbon footprint. Moreover, in order to differentiate themselves from competitors, manufacturers are focusing on the production of bio-based EPDM with enhanced properties, including temperature flexibility, weather changes, high tensile strength, adhesion to metals, and solvent and oil resistance. Conventional EPDM rubbers are produced from petroleum products. Hence, manufacturers are likely to face internal competition from environment-friendly bio-based EPDM in the coming years.

Capturing Opportunities in Asia Pacific

The Asia Pacific market for ethylene propylene diene monomer is not just the leading region, but is also expected to remain a high-growth market over the forecast period. Robust growth in the automotive sector coupled with a multi-fold expansion of the building and construction industry, particularly in India and China, is likely to create major opportunities. Production and commercialization of bio-based EPDM is expected to further drive the Asia Pacific EPDM market during the forecast period. Such factors have led companies to consider business expansion in Asia. In an attempt to attain this stance, companies are considering strategies such as acquisitions and manufacturing capacity expansion.

Scrutinizing the Competitive Background

In 2018, Johns Manville (JM), an industry-leading manufacturer of commercial roofing products, announced the availability of a new reinforced EPDM membrane sheet, incorporating tape-to-tape technology. This next-generation offering, which is designed to work on a single ply waterproofing membrane, is tested and verified to speed up installation by up to four fold, resulting in lower labor costs.

In 2018, Versalis (Eni) opened a new EPDM rubber production plant in Ferrara, aiming to strengthen supply to the automotive industry. This investment would strengthen Versalis’ presence in the geography, further facilitated by functioning closely with local institutions.

The EPDM market is consolidated in nature, wherein, the leading six manufacturers held ~ 70% share in 2018. Key players are firming up their distribution channels to expand market share. Mergers and acquisitions are likely to alter the market shares of companies during the forecast period, as they continue to concentrate on business proliferation. The number of local players expanding into the global ethylene propylene diene monomer market is expected to intensify competition and affect the global dynamics of the EPDM market. The level of consolidation in the EPDM industry is expected to reduce during the forecast period, on account of the lucrativeness of the market and broadened scope of EPDM applications across various end-user industries. Companies are considering R&D investments to further bolster their business and get closer to meeting consumer needs.

Analysts’ Market Perception

Applicable in electrical cable joints and roofing membranes, as it does not pollute runoff rainwater, EPDM enhances the efficiency of rainwater harvesting. Similarly, its aesthetic finish continues to add value to automobiles. Owing to the aforementioned factors, TMR’s analysts have a positive perspective regarding the ethylene propylene diene monomer market. Based on historical trends and present automotive industry dynamics, developing regions such as Asia Pacific and Latin America are likely to contribute significantly to the expansion of the automotive industry, as such, driving the demand for EPDM at a significant rate in these regions. Moreover, although EPDM demand is high across Asian economies, most of the Asia’s EPDM demand is met through imports. New entrants in the EPDM market could consider this as an opportunity to set up new production facilities across developing countries in order to bridge the gap between demand and supply.

Ethylene Propylene Diene Monomer (EPDM) Market: Description

- Ethylene propylene diene monomer (EPDM), a type of synthetic rubber, is primarily used in automotive, roofing, and plastic modification applications. Ethylene propylene diene monomer is utilized in the manufacture of thermoplastic vulcanizates (TPVs), a highly important type of thermoplastic elastomer. TPVs are polymeric compounds that demonstrate elastomeric properties over a wide temperature range and thermoplastic behavior at melting temperature.

- The ethylene propylene diene monomer market in Asia Pacific is anticipated to expand significantly in the near future, owing to rapid growth of the automotive and building & construction industries, led by increasing industrialization and urbanization in the region.

- The automotive industry is certainly the largest end-user of EPDM, with its applications ranging from solid and foam-rubber-like body seals to under-the-hood applications such as coolant hoses and seals. Ethylene propylene diene monomer is one of the most widely used synthetic rubber, with both, specialty and general-purpose applications.

Key Growth Drivers of the EPDM Market

- The increasing usage of ethylene propylene diene monomer in the automotive industry is expected to act as a major driving factor for the market in the next few years. Apart from steel, aluminum, and other synthetic rubbers, EPDM is a key raw material used in the production of various automotive components.

- Ethylene propylene diene monomer is primarily utilized in the manufacture of rear-lamp gaskets, hoses, tire sidewalls, inner tire tubes, front and rear bumpers, braking systems, belt drives, door seals, and interior panels of cars. Diverse applications in the automotive industry are expected to boost the demand for ethylene propylene diene monomer in the next few years.

- Furthermore, plastic plays a vital role in various end-user industries. Ethylene propylene diene monomer is a major raw material used in plastic modification. EPDM is primarily employed in the polymer modification process for olefinic thermoplastic elastomers such as thermoplastic olefin (TPO) and other thermoplastic elastomers such as thermoplastic vulcanizates (TPVs).

- The unique properties of ethylene propylene diene monomer have resulted in an increase in its demand in industrial, automotive, and building & construction applications. In terms of volume, the automotive industry is a major consumer of ethylene propylene diene monomer.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/sales-in-advanced-materials-market-to-touch-28-kilo-tons-by-2027-manufacturing-end-use-industry-to-benefit-from-high-performance-structural-materials-tmr-301105755.html

Major Challenges for the EPDM Market

- The availability of substitutes for ethylene propylene diene monomer, such as other synthetic rubbers, is expected to act as a major restraining factor for the global Ethylene propylene diene monomer market during the forecast period.

- The disadvantages of EPDM, such as unsatisfactory compatibility with most oils, kerosene, gasoline, aromatic and aliphatic hydrocarbons, concentrated acids, and halogenated solvents, have led to an increase in the usage of other elastomers such as NBR, polyurethane-based, and HNBR elastomers.

- Furthermore, the oversupply of ethylene propylene diene monomer led by an increase in production capacities acts as another restraining factor for players operating in the global EPDM market.

Lucrative Opportunities for the EPDM Market

- The manufacture of conventional EPDM results in high carbon footprint. Rising awareness about the environment has prompted end-use consumers and automotive manufacturers to opt for bio-based ethylene propylene diene monomer.

- LANXESS AG first introduced bio-based EPDM in 2013. Raw materials employed in the manufacture of this ethylene propylene diene monomer were obtained from sugarcane and other bio-based products.

- Bio-based EPDM is likely to offer several advantages over conventional EPDM. These benefits include reduced dependence on fossil fuel, lower carbon footprint (as the product is bio-based), and the same or less cost as compared to conventional EPDM, after commercialization.

- Capacity expansion, joint ventures, and acquisitions can create opportunities for established players to further expand their businesses and new players to enter the ethylene propylene diene monomer market.

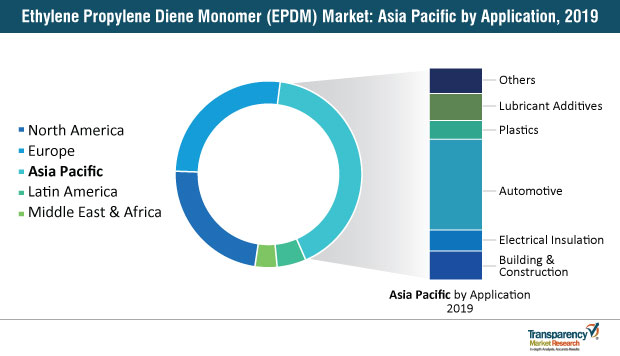

Asia Pacific a Prominent EPDM Market

- In terms of volume, Asia Pacific dominated the global ethylene propylene diene monomer market in 2018. The region is expected to continue its dominance during the forecast period, due to the increasing demand for EPDM in various applications and allied end-user industries in the region.

- Rise in the number of domestic producers and increase in production capacities of global manufacturers are anticipated to boost the market in China during the forecast period.

- Asia Pacific is estimated to be a highly lucrative market for ethylene propylene diene monomer during the forecast period, owing to the growth of automotive and rubber industries in the region. Countries such as India, Thailand, and Indonesia are projected to lead the market in the region, in terms of consumption, from 2019 to 2027.

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=1285

Europe to be a Moderately Attractive EPDM Market

- The EPDM market in Europe is likely to be moderately attractive during the forecast period, due to stagnant growth of downstream industries in the region. However, the demand for rubber goods and automotive components is high in a few countries in the region, such as France and Germany. Hence, these countries are expected to be moderately lucrative markets for ethylene propylene diene monomer in Europe during the forecast period.

- Currently, the North America ethylene propylene diene monomer market is dominated by the U.S. Growth of the automotive industry and increasing demand for EPDM in roofing applications in the U.S. are estimated to boost the market in the country during the next few years.

Automotive Industry to Account for a Prominent Share

- In terms of volume, the automotive segment dominated the global ethylene propylene diene monomer market in 2018. The automotive segment of the market in developing regions such as Latin America and Asia Pacific is anticipated to witness strong growth in the next few years, due to the growth of the automotive sector in these regions. The automotive segment of the market in Asia Pacific is likely to expand significantly during the forecast period.

- The building & construction segment is projected to be highly attractive during the forecast period, owing to the rising demand for better roofing systems (EPDM roofs) in developed regions such as North America and Europe.

- The plastics (plastics modification) segment is also likely to be attractive during the forecast period, owing to the increasing demand for TPO and TPV in automotive and roofing applications.

Leading Players Actively Engage in Joint Ventures and R&D Activities

- Key players operating in the global ethylene propylene diene monomer market are

- Lanxess AG

- Exxon Mobil Corporation

- Mitsui Chemicals Inc.

- DowDuPont Inc.

- Lion Elastomers

- Kumho Polychem (a JSR Group Company)

- Sumitomo Chemical Co. Ltd.

- Jilin Xingyun Chemical Co., Ltd.

- Versalis S.p.A.

- Johns Manville

- PJSC “Nizhnekamskneftekhim”

- SK Global Chemical Co. Ltd

- These companies are engaged in capacity expansion, mergers & acquisitions, and new product launches in order increase their share in the global EPDM market.

- In May 2017, Dow Elastomers, a business unit of Dow, introduced three new NORDEL EPDM products that enable automotive part manufacturers to produce high-performing weather-strip parts and meet consumer demand in terms of light weight, safety, and aesthetics.