Anti-viral Coatings Hold Promising Potentials in Inhibiting Coronavirus Pathogen Activity on Surfaces

Anti-viral surfaces are helping to control the spread of the novel coronavirus (COVID-19). Leading coating specialists in the electrical appliance coatings market are increasing efforts to virtually gather at the Royal Society of Chemistry to discuss ways of innovations in special surface technologies that help to contain coronavirus. Other stakeholders such as technical industry specialists and representatives of the healthcare industry should set their collaboration wheels in motion to innovate in electrical appliance coatings that deploy anti-viral properties.

Webinars are becoming a great source of information for companies in the electrical appliance coatings market who are identifying the challenges associated with the production of coatings induced with anti-viral properties. As such, anti-viral coatings are gaining popularity for inhibiting the growth of microorganisms on surfaces of regular use electrical appliances.

To gauge the scope of customization in our reports Ask for a Sample

Leading-edge Electrical Appliance Coatings Engineered to Enhance Product Durability

High-performance electrical appliance coatings help to protect and enhance the durability of products. Hence, manufacturers are adopting leading-edge coating technologies to improve application efficiencies in products. For instance, PPG Industries – a U.S. supplier of paints, coatings, and specialty materials, has acquired proficiency to engineer high-performance electrical appliance coatings that heighten the user experience and increase product value. Companies in the electrical appliance coatings market are increasing efforts to enhance the color, durability, design, and functionality of devices.

Get an idea about the offerings of our report from Report Brochure

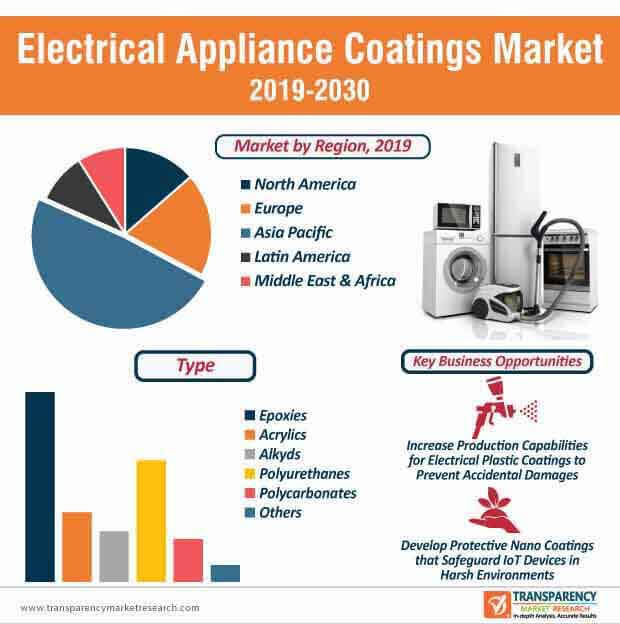

Industry leading technical innovations are bringing about a significant change in the electrical appliance coatings market, due to increasing consumer demand for cutting-edge color styling in appliances. Manufacturers are broadening their revenue streams with the help of increasing production for transparent functional coatings, decorative coatings, and conductive coatings & inks. Key developments are helping to mature the market at a rate of ~6% throughout the forecast period.

UV Coatings Acquire Prominence in Cardiovascular and Neurovascular Devices

Apart from domestic appliances, companies in the electrical appliance coatings market are keen on expanding their business in medical devices. Specialty manufacturers of hydrophilic coatings for medical devices, Biocoat Inc., has announced the launch of HYDAK® UV, an innovative UV (Ultraviolet) coating fit for the development of cutting edge medical devices. Manufacturers are developing improved versions of their previous product offerings to expand their portfolio in electrical appliance coatings. They are increasing the availability of coatings that can be cured using UV light in order to deploy flexible integration with medical devices.

The coronavirus scare continues to haunt healthcare facilities worldwide and in countries such as the U.S., Russia, India, and Brazil. Hence, companies in the electrical appliance coatings market are capitalizing on this situation, as hospitals are scurrying toward stocking essential medical devices such as ventilators and ECG (Electrocardiogram) machines, which play an important role in treating COVID-19 patients.

Specialty Coating Technology Overcomes Obstacles in Extending Asset Lifecycle

Companies in the electrical appliance coatings market are developing sustainable products by lowering VOC (Volatile Organic Compound) content during production, which helps to control environmental footprint. However, long-term sustainability of electrical appliance coatings is also becoming a major concern for stakeholders in the value chain. Apart from sustainability, long-term performance of electrical appliances is also important. Hence, manufacturers are increasing their research spending to develop specialty electrical appliance coatings that reduce the rate of applied coating failure.

Moreover, increasing the intervals between repainting has led to cost-efficiency goals for both manufacturers as well as consumers of electronic appliances. This is being made possible, since manufacturers in the electrical appliance coatings market are increasing their production capacities for specialty coatings. The specialty coating technology is being highly publicized to extend the lifetime of assets. Manufacturers are partnering with ingredient suppliers to innovate in specialty coatings.

Electrical Plastic Coatings Prevent Accidental Damages at Power Sources

Electrical plastic coatings are generating revenue opportunities for companies in the electrical appliance coatings market. Powder coating service provider in Connecticut, Precision Dip Coating, has an extensive product portfolio in electrical plastic coatings and bus bar plastic coatings that help to deploy electrical current safety. Frequent incidences of damage to electric circuits can be prevented with the help of electrical plastic coatings. Hence, manufacturers are increasing their focus in new business potentials that boost revenue growth of the market to US$ 10.2 Bn by the end of 2030.

Protecting power sources is important to prevent serious incidents pertaining to static, fire, and electrocution. Thus, companies in the electrical appliance coatings market are tapping into business potentials in electrical plastic coatings to broaden their revenue streams. Moreover, protecting electrical devices from liquids, dust, and accidental contact is important to extend the lifetime of devices.

Nano Coatings Instrumental in Water-resistant Electrical Appliances

Protective nano coatings are being used to safeguard electronics from the most demanding environments. For instance, HZO- a provider of protective nano coatings is increasing its product portfolio in conformal coatings with parylene to protect sensitive circuitry of electrical appliances from water, salt, dust, and the likes. Emerging players in the electrical appliance coatings market are collaborating established players to work from design through production to increase the availability of waterproof and water-resistant devices. Manufacturers are increasing their research efforts to innovate in plasma-applied nano coatings and hybrid coating solutions.

Companies are offering personalized services to clients, depending on the intensity of protection required for appliances at a budget-friendly cost. On the other hand, companies are increasing their production capabilities in atomic layer deposition coatings that help to protect IoT (Internet of Things) devices from a wide variety of harsh environmental conditions.

Looking for Regional Analysis or Competitive Landscape in Electrical Appliance Coatings Market, ask for a customized report

Analysts’ Viewpoint

The gradual increase in real estate property sales holds promising potentials for companies in the electrical appliance coatings market in the second half of 2020 post the peak of COVID-19. The ever-increasing healthcare landscape has created incremental opportunities for manufacturers dealing in UV electrical appliance coatings for ophthalmic devices. However, issues of repainting tend to arise in electrical appliances. Hence, manufacturers should develop specialty coatings that are ISO-(International Organization for Standardization) certified to extend the lifecycle of electrical appliances. They should innovate in nano coatings that prevent damage from water and dust for IoT devices in harsh environments.

Electrical Appliance Coatings Market: Overview

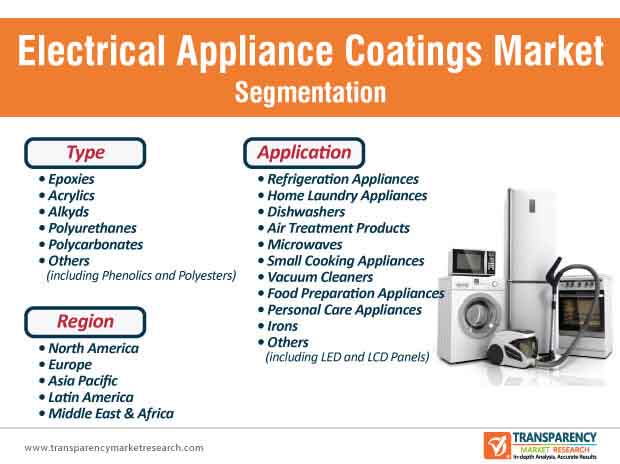

- Electrical appliance coatings are used to coat electrical appliances. Electrical appliance coatings combine durability with unique esthetic finishes. Electrical appliance coatings are developed to protect and enhance the design of appliances such as refrigerators, washing machines, dryers, dishwashers, and ovens.

Key Growth Drivers of Electrical Appliance Coatings Market

- Global population has been increasing steadily over the last decade. According to statistics from the UN, population growth is especially high in urban areas. Rise in spending habits, improvement in availability of electricity, technology advancements, and evolving lifestyles are driving the demand for consumer appliances across the world. This is driving the global electrical appliance coatings market.

- Consumers are exposed to new technologies through advertisements and promotions. Increase in spending capacity for luxury items (such as air treatment products and personal care appliances) is another major factor driving the global electrical appliances market. This, in turn, is boosting the global electrical appliance coatings market.

- Busy lifestyles have prompted customers to automate many household chores. For instance, use of vacuum cleaners and microwaves has been increasing over the last few years. Usage of coffee makers and toasters in developed countries is very high compared to developing countries. The trend is gradually shifting toward rise in usage of luxury appliances. This, in turn, is driving the electrical appliance coatings market.

- According to a report by Elara Capital, a leading investment bank based in the U.K., the share of the online channel in the home appliance segment surged two times to 7% to 8% in 2018 compared to 3% in 2017. The consumer electronics and household appliances market size, currently at US$ 12.3 Bn, is estimated to post an 8% CAGR and reach US$ 26.7 Bn by 2030.

- Increase in demand for electrical appliances leads to rise in production of these appliances. This boosts the consumption of electrical appliance coatings and films.

More Trending Reports by Transparency Market Research – https://www.prnewswire.com/news-releases/flame-retardant-masterbatches-market-players-strive-to-offer-plastics-customized-to-meet-regulatory-norms-for-end-use-industries-revenue-to-reach–us-3-5-bn-by-2027-tmr-301219735.html

Major Challenges for Electrical Appliance Coatings Market

- Several countries do not have an established waste collection and sorting system for solid waste. For instance, only 10% of the total waste produced in Africa is channeled into the collection system. The remaining 90% lies unaccounted for and usually ends up in oceans and river streams. Furthermore, more than 8 million tons of plastic waste is estimated to end up in oceans. Collection and sorting of plastic waste is the first and crucial step in plastic recycling.

- Manufacturers of plastic products usually add several additives, pigments, modifiers, and fillers to induce properties such as high density, elasticity, rigidity, and color in products. However, these fillers, additives, and pigments create issues, while recycling and ultimately result in poor quality of recycled plastics.

- Some plastics are harder to recycle compared to others. For instance, LDPE films are difficult to recycle, sort, and collect. Due to low density, LDPE bales are uneconomical to transport. Recycling of LDPE or other flexible plastics is highly difficult. They cannot be used for the same application again. Hence, down-cycling is the only option available. These films are usually converted into garbage bags or plastic timber, after which they become useless and need to be incinerated or landfilled. Furthermore, flexible plastics create operational issues by clogging recycling and washing equipment and machines in processing plants. They are also expensive in terms of decontamination and sorting.

- Prices of oil and gas directly affect the cost of plastic manufacturing. Volatility in prices of oil and gas affects the raw material cost of virgin plastic. For instance, decline in prices of oil and gas can result in substantial decrease in prices of virgin polymers. As a result, demand for recycled plastics decreases, since prices of virgin plastics are low. Thus, volatility in prices of virgin plastics creates fluctuations in demand for recycled plastics.

- Most plastics are non-biodegradable and remain in the environment for decades. Therefore, various regulations have been imposed on the manufacture of plastics as well as their usage in different end-use industries in order to regulate the production of plastics and plastic waste. For instance, the usage of polycarbonate is prohibited in applications with food contact in the U.S.

- Thus, these regulations and environmental concerns are estimated to negatively impact the electrical appliance coatings market

R&D Activities and Long Term Partnerships with Regional Manufacturers

- Companies such as Daikin Industries Ltd. primarily focus on the marketing strategy of products in order to enhance its market share. Furthermore, manufacturers have the opportunity to increase their sales force by expanding and strengthening their distribution networks.

- Existing companies as well as new entrants are focusing on competitive pricing, since players operating in the market such as Axalta coating Systems, CEKO Inc., Koninklijke DSM N.V., and Henkel AG & Co. KGaA have integrated operations

- Existing players focus on R&D investments to enhance properties of different polymer and coating resins in order to better fit into requirements of electrical appliances

- Manufacturers also focusing on the development and manufacture of bio-degradable and environment-friendly plastics, which would create less waste

- These activities of manufacturers provide lucrative opportunities for the global electrical appliance coatings market

Request for covid19 Impact Analysis – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=44628

Asia Pacific Dominates Electrical Appliance Coatings Market

- Asia Pacific is the leading consumer of electrical appliance coatings across the globe. In terms of volume and value, the region is estimated to dominate the global electrical appliance coatings market during the forecast period. Rapid growth of the electrical appliance industry is boosting the demand for electrical appliance coatings in Asia Pacific.

- High consumption of electrical appliance coatings in refrigerators is projected to drive the demand for electrical appliance coatings in Asia Pacific during the forecast period

- Increase in consumption of electrical appliance coatings in ASEAN, India, and China make Asia Pacific a lucrative region of the global electrical appliance coatings market

Leading Players in Electrical Appliance Coatings Market

- Major global manufacturers of electrical appliance coatings include

- Koninklijke DSM N.V. (Royal DSM)

- Henkel AG & Co. KGaA

- Elantas GmbH

- Evonik Industries AG

- Nippon Electric Glass Co., Ltd.

- Erie Powder Coatings

- Other players operating in the global electrical appliance coatings market include

- GMM Development Limited

- Axalta Coating Systems Ltd.

- AGC Chemicals Europe Ltd.

- CEKO Inc.

- Rust-Oleum Corporation

- Daikin Industries, Ltd.