The imminent explosion of cross-border e-commerce websites will cause a stir in the global e-commerce logistics market, predicts TMR in a new study. The market will also receive a boost from the availability of low-cost cargo. Already, the spread of B2C and C2C e-commerce websites has resulted in an increase in the demand for both domestic and international e-commerce logistics.

Sellers are now expecting a greater degree of transparency and efficiency in their chosen e-commerce logistics providers. This will also pave the way for higher customization in e-commerce logistics services. At the same time, companies providing these services are trying for look for practical ways to reduce costs – especially those associated with reverse logistics. Among the key services that e-commerce logistics companies provide are warehousing and transportation along with some other types of niche services.

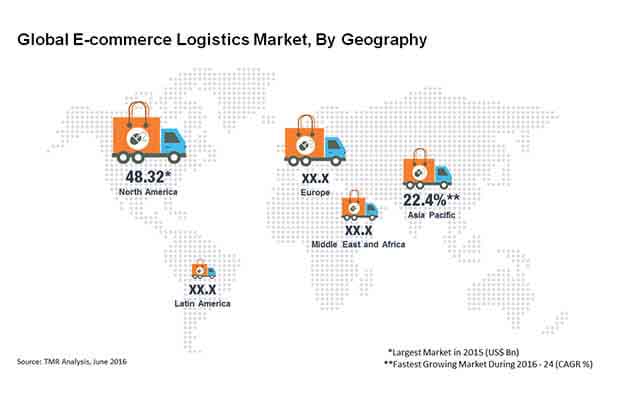

The global e-commerce logistics market is expected to surpass US$781 bn in 2024, up from its valuation of US$122.2 bn in 2014. The estimated CAGR of the market between 2016 and 2024 is 20.6%.

Request for a sample:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=12806

Transportation Segment to Lead in Terms of Revenue Given its Pivotal Role in Delivery Process

TMR finds that in 2015, the transportation segment was larger than the warehousing segment of the global e-commerce logistics market by service type. This is explained by the fact that transportation is important all through the e-commerce logistics process and will gain even more importance as all large and small companies target last-mile delivery.

The transportation segment has been split further into air/express delivery, trucking/over road, freight/rail, and maritime. Of these, the trucking and over road segment accounts for the larger share because it is the most prevalent transportation method. The preference for trucking and over road transportation is further elevated with the logistical difficulties and costs associated with rail and air transport.

Asia Pacific E-commerce Logistics Market Teeming with Opportunities

The sheer population growth in the Asia Pacific region has created multi-billion dollar opportunities for companies in the e-commerce logistics market. About 60% of the world’s population resides in Asia Pacific, the World Population Review 2015 has revealed. Add to this the stupendous rise in sales of smartphones and in internet connectivity and it is easy to see why companies are looking a massive opportunity in the face.

Ask for brochure:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=12806

Although several countries in Asia Pacific are still in the development phase, their burgeoning middle-income families represent a ripe target market for e-commerce companies. Moreover, e-commerce companies in Asia Pacific are expected to widen their reach in line with road and infrastructure development projects. Thanks to these dynamics at play, the Asia Pacific e-commerce logistics market will log a CAGR of 22.4% between 2016 and 2024.

However, in terms of revenue, North America will not budge from its dominant position through the forecasting horizon, TMR expects. The excellent digital infrastructure in the region and the healthy B2C sales will continue to create a conducive climate for the growth of the e-commerce logistics market in North America, which stood at US$48.32 bn in 2015.

However, with the U.K.’s exit from the European Union, the e-commerce logistics market in Europe could run into a rough patch. The regulations are poised to become more complex and compliance will pose a challenge.

The top companies in the e-commerce logistics market are FedEx Corporation and DHL International GmbH with over 50% of the market. Other notable players are Gati Limited, Clipper Logistics Plc., Aramex International, XPO Logistics, Inc., Kenco Group, Inc., United Parcel Service, Inc., and others.

Read Our Latest Press Release: