Feed additives are now one of the coherent parts of the worldwide rising meat production industry. For improvising the overall growth of the animals, feed additives are mixed with the basic feed mix. Feed additives acts as a catalyst in improving rate of weight gain, prevention of diseases in animals, prevents vitamin deficiencies and improves feed digestion and conversion, thereby improving the quality of meat production. Feed additives are normally used in small quantities for e.g. in injectable, pellets, liquids and powder form. The dosage of the feed additives differs from animal to animal.

Processed meat consumption is rising

With rising consumer awareness regarding quality and safety of meat due to recent livestock disease outbreaks combined with increasing meat consumption, the demand for animal feed additives has spiraled substantially. In emerging nations, rising disposable income and improving lifestyle have led to evolving dietary patterns which in turn are resulting in higher consumption of processed meat products.

In 2018, Brazil, India, and China collectively held 23% of the global animal feed additives market and will likely contribute 39% in 2026. On the other hand, factors such as high raw material prices and regulations imposed by various governments to maintain feed quality restrain the growth of the market.

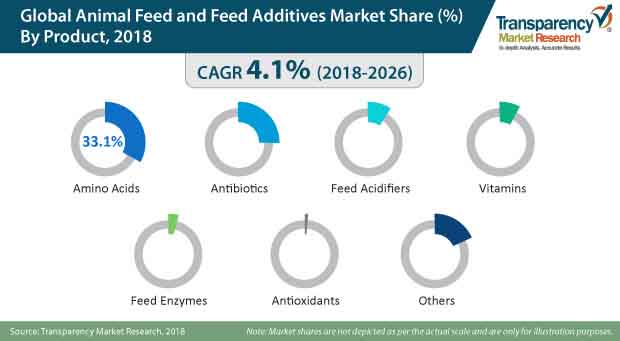

The global animal feed and feed additives market was worth US$17.5 billion in 2018 and will reach US$24.1 billion in 2026, growing moderately at a CAGR of 4.1% between 2018 and 2026.

Request A Sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=480

Animal feed additives are classified into two major types –

Nutritional feed additives such as amino acids, minerals and vitamins: It helps in providing effective nutrients in optimum proportion thereby helping the animals gain lean meat and higher muscle mass at a quicker rate than before.

Non-nutritional feed additives such as antibiotics, enzymes and acidifiers: It acts as armor against diseases, improving the digestive system, aiding in reproduction and reducing phosphate content in the livestock waste.

Request for Covid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=480

Meat commercialization to remain significant market driver

Animal diagnostics, animal biological, packaged pharmaceuticals and feed additives fall under the global animal health sector. Animal feed additives account for more than 42% share of the overall animal health industry and this is because of the accessibility to a broad range of products having wide benefits. The multiple driving factors like industrialization in meat production, increasing demand for protein enriched meat products, and rising awareness towards the quality of meat are the fuelling factors in the segment of feed additives such as amino acids, vitamins and acidifiers.

In the global animal health industry, packaged pharmaceuticals represent the second largest segment with 35% of overall market share and mainly consists of reproduction hormones, antibiotics and anti-parasitic products for treatment and preservation of animal health. Other segments in the animal health industry are animal biological (vaccines) with 15% market share and animal diagnostics (reagents and reproductive support) with 7.3% market share.

Different participants exist, like pre-mixers, feed mills and distributors, who manufacture and distribute the feed additives in the market. The feed additives either reaches the consumers directly through the industry participants by their own brands or through integrated feed producers.

Explore Transparency Market Research’S Award-Winning Coverage of the Global Food and Beverages Industry @ https://www.prnewswire.co.uk/news-releases/increasing-demand-for-superior-quality-surfactants-to-drive-valuation-of-global-sodium-lauryl-sulfate-market-to-us-11-0-bn-by-2027-notes-tmr-890273424.html

For livestock growth, the integrated feed producers mix the animal feed with the additives generating multi nutrient products. The livestock producers use these animal feed additives in micro quantities/doses to animals for improving their health, prevention from diseases, to improvise their overall body weight and for reduction in the pollutant ratio in animal waste. On maturing, these livestock are used for meat and dairy products. These products then reach the consumers through retailers and food service providers for e.g. hotels and restaurants who purchase it from the national or international market. Thus feed additives are important key players maintaining the health and helping improve the quality of meat production.